Overview

Trend-following hedge funds, also known as CTAs (Commodity Trading Advisors), are expected to continue buying US stock indices in the upcoming week. While big banks like Bank of America (BoA) are more positive about this, others like Goldman Sachs and UBS expect only light buying activity.

US Stock Market Outlook

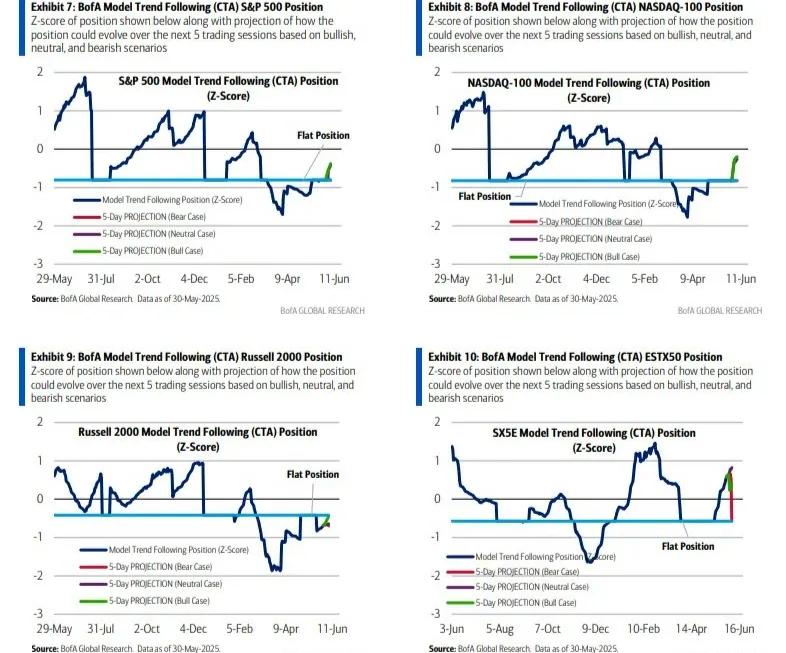

S&P 500 ($SPX)

Trend: Strong upward trend

Performance: +23% (up from +6% last week and -50% three weeks ago)

Outlook: CTAs that are already long are expected to increase their positions. Short positions by long-term traders are also falling.

NASDAQ-100

Trend: Very strong upward trend

Performance: +41% (up from +27% last week and -14% three weeks ago)

Outlook: Similar to the S&P 500, trend-followers are likely to keep buying more.

Russell 2000 ($RUT)

Trend: Still negative

Performance: -22% (improved from -32% last week and -49% three weeks ago)

Outlook: CTAs are less likely to buy this index as the overall trend remains weak.

Global Market Trends

Japan – Nikkei 225

Trend: Recovering

Performance: +22% (recovered from -7% last week and -32% three weeks ago)

Outlook: CTAs are expected to buy Japanese stocks as the price trend improves.

Europe – Euro Stoxx 50

Trend: Very strong

Performance: +85% (up from +65% last week)

Outlook: Since the trend is already very strong, CTAs might start selling or reducing their positions.

Summary

US Indices: S&P 500 and NASDAQ-100 are in strong uptrends; CTAs are likely to continue buying.

Russell 2000: Still weak; not much interest from trend-followers.

Japan: Buying interest is rising.

Europe: Might see some profit booking as trends peak.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment