CLSA’s Shift in Strategy: Back to India Amid China’s Challenges

In a recent global equity strategy note titled “Pouncing Tiger, Prevaricating Dragon,” CLSA announced that it has reversed its earlier tactical allocation shift from India to China, a move it made in early October. This decision follows a turbulent period for Chinese equities and a broader reassessment of global market dynamics in light of Trump’s re-election in the United States.

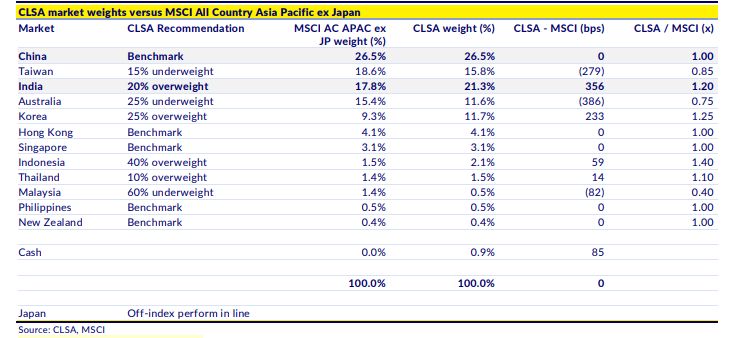

Foreign institutions have sold Rs 1.30 lakh crore worth of Indian stocks since October. CLSA mentioned that many global investors were waiting for a correction to increase their investment in India. In October 2023, CLSA upgraded India from being 40% underweight to 20% overweight, citing reasons like a favorable credit environment, lower energy costs due to discounted Russian oil, and strong GDP growth. However, by October 2024, CLSA revised its strategy, reducing India’s overweight to 10% and increasing its focus on China, as signs of a market recovery started to appear there.

From China Back to India: A Tactical Reversal

CLSA initially shifted funds from India to China in October, citing an opportunity to capitalize on China’s equity rally. However, the firm expressed skepticism about the rally’s sustainability from the start, viewing it as a “rent rather than buy” opportunity. Over the same period, both MSCI China and MSCI India have corrected by approximately 10% in US dollar terms, meaning CLSA’s allocation switch yielded no significant losses.

Now, CLSA has decided to reverse its stance, returning to a neutral position on China and reinstating a 20% overweight allocation to India.

Challenges Facing China

China’s economic landscape remains fraught with issues, making its equity markets less appealing. Key challenges include:

Persistent deflation and high real interest rates of 2.8% despite recent PBOC easing.

Falling property prices and stagnant real estate investment.

Rising youth unemployment and poor household confidence.

Retail sales growth at only half of pre-pandemic levels.

With China facing growing economic problems, CLSA has shifted its focus back to India. They highlight India’s stable currency, especially as the US dollar strengthens. India is also less affected by global trade tensions, particularly with possible policy changes in the US, making it an attractive safe investment in Asia. CLSA believes India’s stable currency and economic outlook position it to benefit in the current global trade situation.

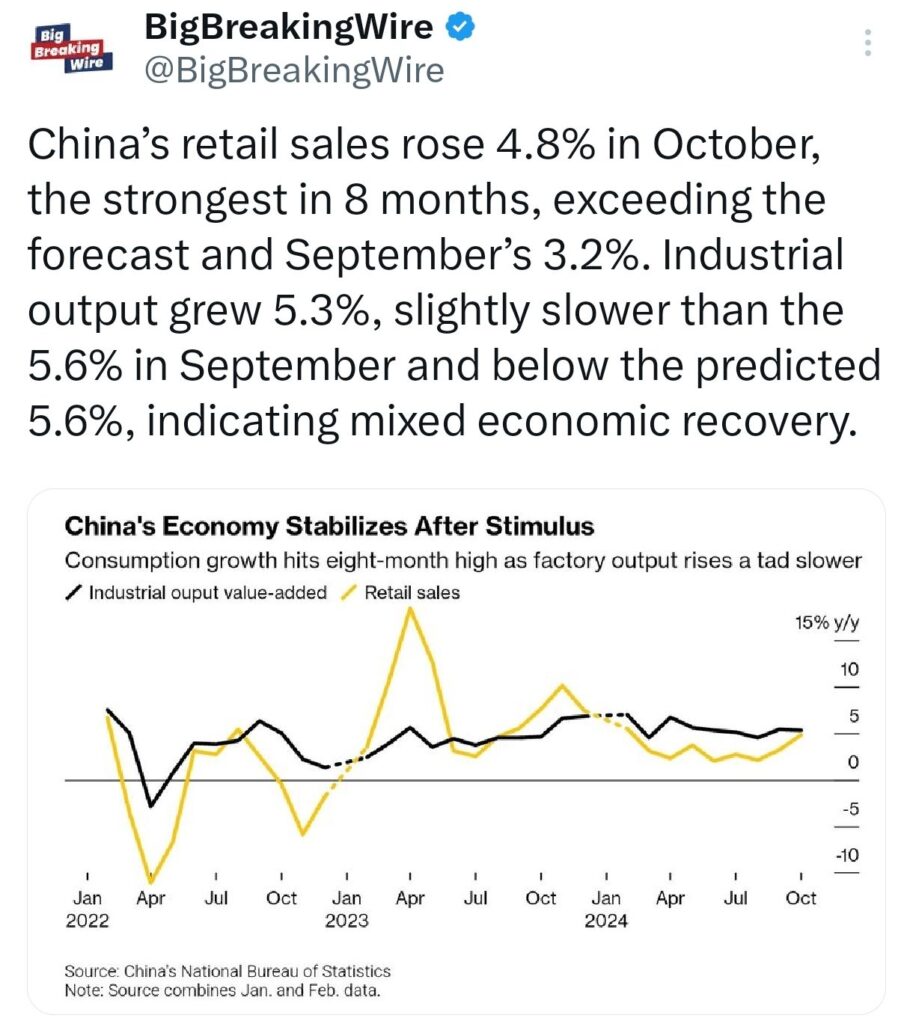

Meanwhile, China’s retail sales surged 4.8% in October, marking an 8-month high and surpassing forecasts and September’s 3.2%. Industrial output rose 5.3%, slightly below both September’s 5.6% and expectations, reflecting a mixed economic recovery.

The Chinese Finance Minister, Lan Fo’an, hinted at potential measures to address these issues, including recapitalizing banks, absorbing excess property inventory, and stimulating consumption. However, CLSA noted that these measures might come too late to regain investor confidence. Upcoming economic events, such as the December Economic Work Conference and March “Two Sessions,” may serve as key decision points, but CLSA is concerned that foreign investors could lose patience and reduce exposure before meaningful action is taken.

Additionally, Trump’s second term heralds a potential escalation in trade tensions, which could further strain China’s economy, particularly as exports have become the largest contributor to its growth.

China’s commercial banks purchased a net $18.2 billion of forex in October, down from $48.2 billion in September, according to the FX regulator. For the January-October period, banks sold a net $103.1 billion of forex. Meanwhile, foreign institutions held 4.25 trillion yuan worth of onshore bonds in China’s interbank market at the end of October, as reported by the central bank.

India: A Promising Alternative

In contrast, India appears well-positioned to weather global uncertainties. CLSA highlighted the following advantages:

Limited exposure to US-China trade hostilities.

Relative forex stability amid a strengthening US dollar, assuming energy prices remain stable.

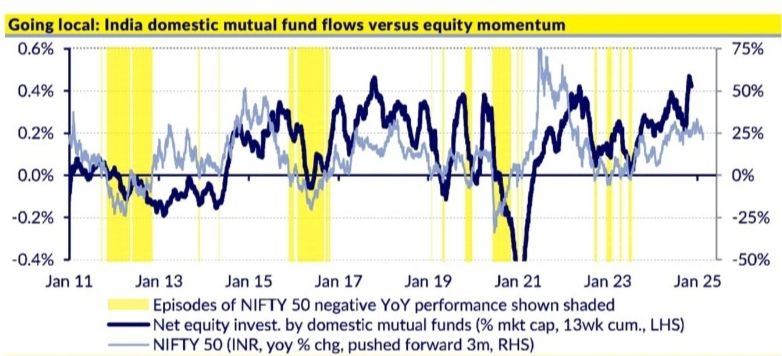

Strong domestic investor appetite, which offsets recent foreign investor selling since October.

Although Indian stock valuations are still high, CLSA believes they offer better long-term growth potential compared to Chinese stocks. In China, issues like deflation, weak property markets, and low real estate investment are still a concern. Luke Barrs, Global Head of Fundamental Equity at Goldman Sachs Asset Management, mentioned this week that the recent high earnings multiples of 22-23x in Indian markets have led to some profit-taking.

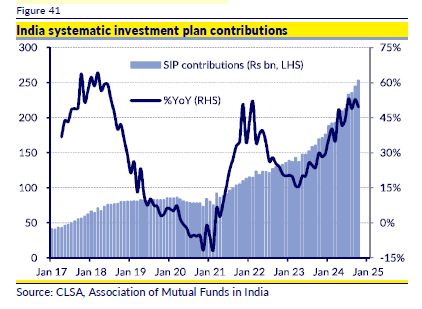

Despite foreign investor outflows totaling $14.2 billion since October, domestic mutual fund inflows have surged, with Systematic Investment Plans (SIPs) reaching a record $3.0 billion in October, reflecting strong local demand that counters foreign market concerns.

The report also pointed out the strong demand for Indian stocks within the country, which has helped balance out concerns about high valuations and acted as a safeguard against possible foreign outflows. Domestic institutions have bought a net total of Rs 1.10 lakh crore worth of Indian equities since October.

AMFI’s October data reveals a 21.7% MoM increase in equity inflows, totaling Rs. 41,887 Cr. AUM stands at Rs. 68.5 Lakh Cr. Inflows by segment include large-cap at Rs. 3,452 Cr, mid-cap at Rs. 4,683 Cr, small-cap at Rs. 3,772 Cr, debt funds at Rs. 1.57 Lakh Cr, and passive funds at Rs. 23,428 Cr.

In October 2024, active equity funds accumulated a record Rs 1.47 lakh crore in cash (4.91% of AUM), reflecting a cautious approach amid market weakness. SIP investments surged, and funds shifted focus towards sectors such as banking, tech, and cement, while reducing exposure to others.

Risks to India

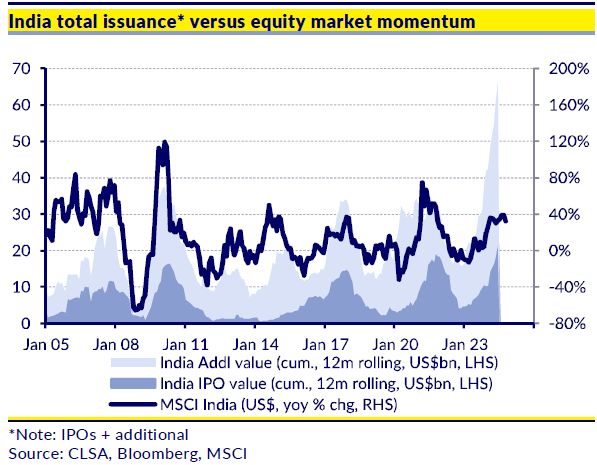

The primary risk to Indian equities is the potential oversupply of new issuances swamping the market. Over the past 12 months, issuance has reached 1.5% of market capitalization, a level CLSA considers a tipping point.

Indian equities continue to appear costly, with a CAPE of 33.5x, although valuations have become somewhat more reasonable. A major risk lies in the flood of new issuances, which could saturate the market and weaken secondary momentum.

CLSA’s move to restore China to a benchmark weight while increasing India’s overweight position signals a strategic shift. As China grapples with challenges and policy uncertainty, India’s structural growth prospects seem more promising for 2025.

Recently, CLSA’s Laurence Balanco states that India’s relative underperformance could continue, possibly extending into the first quarter of 2025. Identifying any consistent pattern may take between 6 to 12 months.

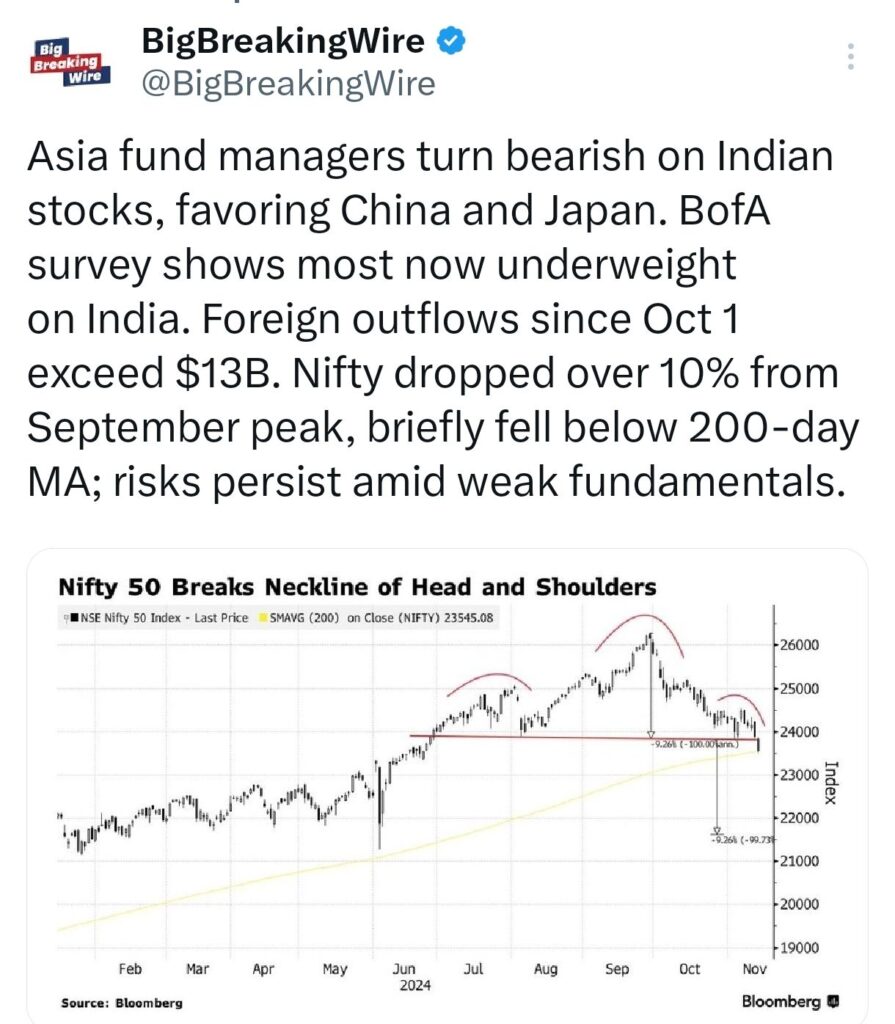

In terms of market outlook, the Nifty index appears to have downside support at around 22,800, but substantial upside potential seems limited. There are no major signs of a breakout at present, so caution is advised until clear investment opportunities emerge.

On the global front, Bitcoin could present a good buying opportunity on any dips, with the overall financial landscape showing promise. Crude oil is expected to remain range-bound, with strong support around $70.

In the banking sector, private banks may see a recovery, with HDFC Bank appearing particularly interesting. However, sectors like autos, consumer goods, and real estate are currently undergoing a correction, and this trend is likely to persist in the near future.

CLSA and CITI Disagree on Indian Equities

CLSA and Citi are taking opposite views on Indian stocks. CLSA has increased its investment in India, seeing the country as less affected by potential US trade tariffs under Donald Trump’s presidency. The firm also highlighted that India has stable foreign exchange rates and that recent drops in stock prices have made them more affordable. In contrast, Citi has downgraded Indian equities, expressing concerns about slower growth in corporate earnings.

Local Funds Maintain Cash Despite Market Selloff

Since October, foreign investors have sold over $13 billion worth of Indian stocks. However, local institutional investors have stepped in, buying heavily to offset the selloff. Despite this activity, local mutual funds have largely maintained their cash reserves. According to Elara Capital, mutual fund cash levels dropped only slightly, from 1.69 trillion rupees to 1.68 trillion rupees in October, a month that marked the worst performance for Indian stocks in four years. This stability is due to a surge of cash inflows into ETFs and index funds, as investors took advantage of lower stock prices to “buy the dip.”

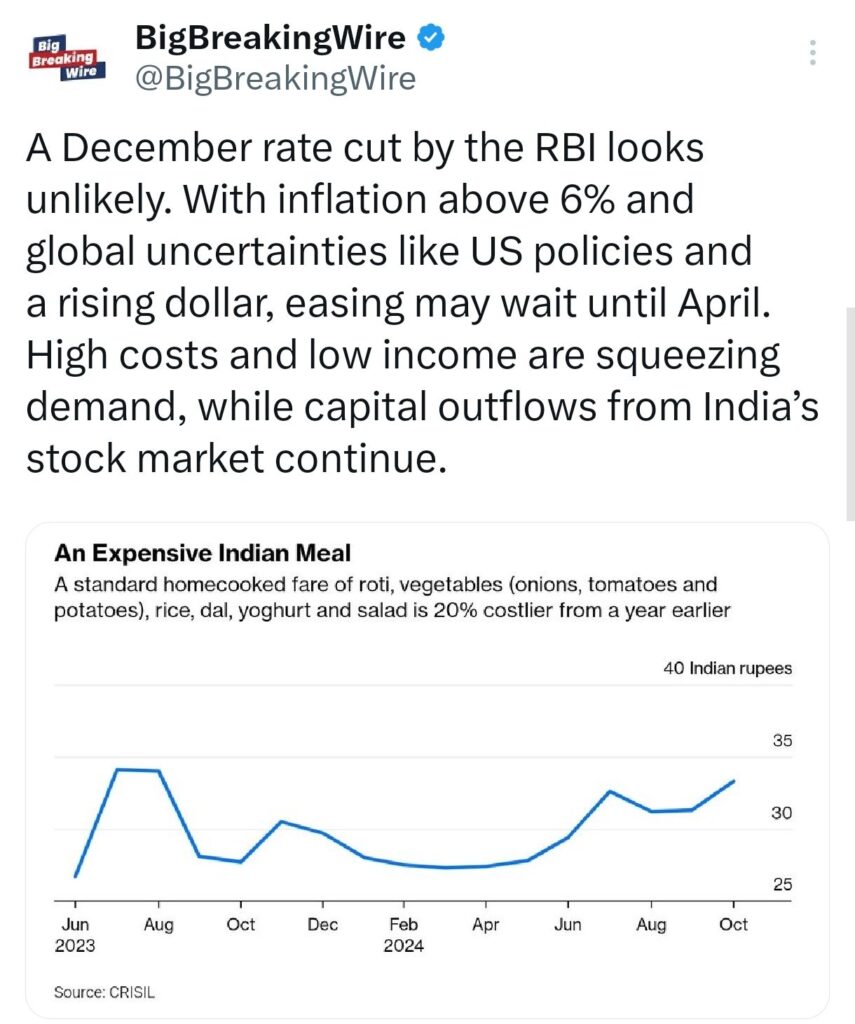

Meanwhile, the December rate cut by the RBI appears improbable due to persistent inflation exceeding 6% and global headwinds such as US monetary policies and a strengthening dollar. These challenges are compounded by domestic factors, including rising costs and subdued income growth, which are dampening consumer demand. Additionally, capital outflows from India’s stock markets continue to exert pressure, making it likely that any monetary easing will be deferred until at least April 2024.

Asian fund managers have shifted their sentiment, turning bearish on Indian equities while showing increased preference for Chinese and Japanese markets. According to a Bank of America survey, a significant number of fund managers now hold an underweight position on India. Since October 1, foreign investors have withdrawn over $13 billion from Indian markets. The Nifty index has declined more than 10% from its peak in September and briefly dropped below its 200-day moving average, signaling continued market vulnerabilities amid weak economic fundamentals.

Additionally, India’s central bank may allow the rupee to weaken alongside the Chinese yuan following Trump’s election win, as a weaker yuan could increase India’s trade deficit with China, says Bloomberg. The RBI plans to use its $680 billion reserves to manage the rupee’s fall. Experts predict the rupee could reach 85 per USD within a year.

Download the full report from here 👇

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

3 Comments