China’s recent stock market surge is causing a shift in global investment, with many investors eager to join the rally.

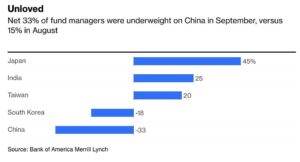

As a result, funds are moving away from other Asian markets. For instance, last week, investors withdrew money from stocks in South Korea, Indonesia, Malaysia, and Thailand. Additionally, over $20 billion was pulled from Japan’s stock market in the first three weeks of September, according to BNP Paribas SA.

MSCI China Index has increased more than 30% from its recent low after the government announced several measures to boost the economy. Trading volumes in both China and Hong Kong reached record highs on Monday.

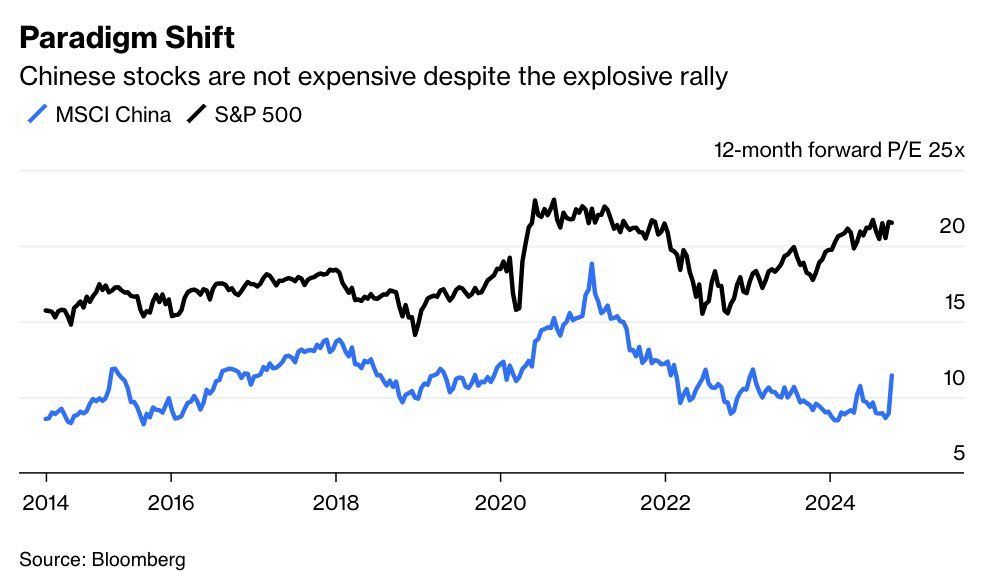

Attractive stock prices are also a factor. Even after the recent rise, the MSCI China index is still trading at 10.8 times future earnings, which is lower than its five-year average of 11.7 times.

In India, Foreign Portfolio Investors (FPIs) have been net sellers for the third consecutive day. In September, FPIs purchased stocks worth ₹15,423.4 crore, while domestic institutional investors (DIIs) were significantly more active, acquiring ₹31,860.3 crore.

On Tuesday, FPIs sold stocks totaling ₹5,579.4 crore, according to the National Stock Exchange (NSE). This follows a substantial sell-off on September 30, when FPIs sold stocks worth ₹9,791.9 crore, marking the largest single-day sale since June 4, when they offloaded ₹12,436.2 crore in stocks.

Currently, mutual funds worldwide have only a 5% investment in Chinese stocks, the lowest in ten years. This suggests that there is potential for these funds to increase their investments in China.

Chinese investment-grade companies plan to raise $10 billion to $15 billion in offshore bonds this quarter due to Beijing’s stimulus measures that reduce costs and boost borrower demand. Last week, they raised $5.9 billion, the busiest week in 2024.

Inputs from Bloomberg

Update

China’s largest money market exchange-traded funds (ETFs) have experienced significant outflows, totaling $4.1 billion, while ETFs focused on equities have gained $6 billion. This shift indicates that Beijing has successfully attracted investors back to its struggling stock market after implementing new stimulus measures.

The largest outflows came from the Yinhua Traded Money Market Fund, which lost $2.4 billion, and the Hwabao WP Cash Tianyi, which saw a decrease of $1.7 billion, with both funds losing over 10% of their assets. On the other hand, the Huatai-Pinebridge CSI 300 ETF led the inflows among equity funds, attracting $2.9 billion. This change occurred during the best week for mainland stocks since 2008.

Udpate

Global asset managers are facing tough choices as investors rethink their views on Chinese stocks. After missing the first rally, they are now considering whether these stocks might be ready for a new boost.

Update (October 7th, 2024)

Goldman Sachs Group has upgraded its view on Chinese stocks to “overweight,” joining others who are optimistic about the positive effects of Beijing’s stimulus efforts.

According to strategists, including Tim Moe, Chinese stock indexes could increase by 15%-20% if the government delivers on its policies. Current valuations are still below the historical average, company earnings could improve, and global investors haven’t heavily invested in these stocks yet.

The CSI 300 Index has already risen by 27% since its low in September. Traders are now waiting to see if this trend continues when China’s markets reopen after a holiday on Tuesday.

Goldman Sachs has also raised its targets for the MSCI China Index and the CSI 300 Index to 84 and 4,600, respectively, which suggests a potential total return of 15%-18% from current levels.

🚨 Global P/E Ratios by Country

Before investing, it’s important to check a country’s P/E ratio, which indicates how much investors pay for each dollar of earnings. A high P/E suggests optimism but may mean overvaluation; a low P/E could signal undervaluation or slow growth.

Update (October 8th, 2024)

Mainland China stocks opened significantly lower on Wednesday, threatening to end a 10-day winning streak after officials did not instill confidence in their stimulus plans aimed at revitalizing the economy. As of 0132 GMT, the Shanghai Composite index had dropped 4.6%, while the blue-chip CSI300 Index fell over 5%. The A-share market, which includes stocks listed in Shanghai, Shenzhen, and Beijing, experienced a turbulent session the previous day after returning from a week-long holiday, with turnover reaching a record 3.485 trillion yuan ($493.17 billion) on Tuesday.

Update (October 11, 2024)

China will hold a press conference on Monday, October 14, at 10:00 AM CST (2:00 AM GMT) to announce new measures to support businesses. The event will include speakers such as the Director of the State Administration for Market Regulation, Vice Ministers from the Ministry of Industry and Information Technology and the Ministry of Justice, and the Deputy Director of the National Financial Supervision and Administration.

China has released new guidelines to improve oversight, reduce risks, and encourage quality growth in the futures market. Here are the main points:

The China Securities Regulatory Commission (CSRC) is urging banks to better manage credit and stop companies from misusing loans for speculation in commodity futures.

The government will take strict measures against illegal activities in the futures market.

Stock index futures and options will be used to stabilize and energize the market, as well as to expand the variety of trading options.

Steps will be taken to limit excessive speculation.

The CSRC is considering allowing overseas investors to access stock index futures and treasury bond futures as part of its opening up efforts.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment