China is set to issue 3 trillion yuan ($411 billion) in special treasury bonds next year, a dramatic increase from this year’s issuance. The funds will be directed toward several key areas: consumption subsidies, advanced manufacturing, and recapitalizing major state banks. This move is part of China’s strategy to boost its economy amid slowing growth and external pressures, including tariffs from the incoming Trump administration.

Out of the total bond issuance, approximately 1.3 trillion yuan will be used for consumption subsidies and infrastructure projects, with another 1 trillion yuan focusing on advanced sectors such as electric vehicles (EVs). The remaining funds will be used to strengthen large state-owned banks.

This fiscal approach signals a shift toward a more aggressive stimulus, as Beijing plans to expand its budget deficit to 4% of GDP—the widest since 1994. The finance ministry has committed to increasing public spending to support economic growth.

Key Takeaways from China’s National Fiscal Work Conference:

– Increased Fiscal Spending: The government will ramp up fiscal spending, with a focus on improving the livelihood of citizens and boosting consumption.

– Larger Government Bond Issuance: A greater volume of bonds will be issued to stabilize growth.

– Support for Local Governments: Efforts will be made to improve financial resources for local governments, strengthening their capacity to spend.

– Pension Increases: Basic pensions for retirees, as well as urban and rural residents, will see an increase.

– Support for Core Technologies: The government will focus on developing a modern industrial system and supporting technological breakthroughs.

– Encouraging Investment: The plan includes measures to expand effective investment, with government bonds used to leverage more social investment.

– Reform Initiatives: Fiscal and tax reforms will be deepened to address local government debt risks and improve tariff policies, including further cooperation with ‘Belt and Road’ countries.

Market Response:

The yield on China’s 30-year government bonds increased by 3.75 basis points to 1.995%, reflecting the market’s reaction to these upcoming fiscal plans.

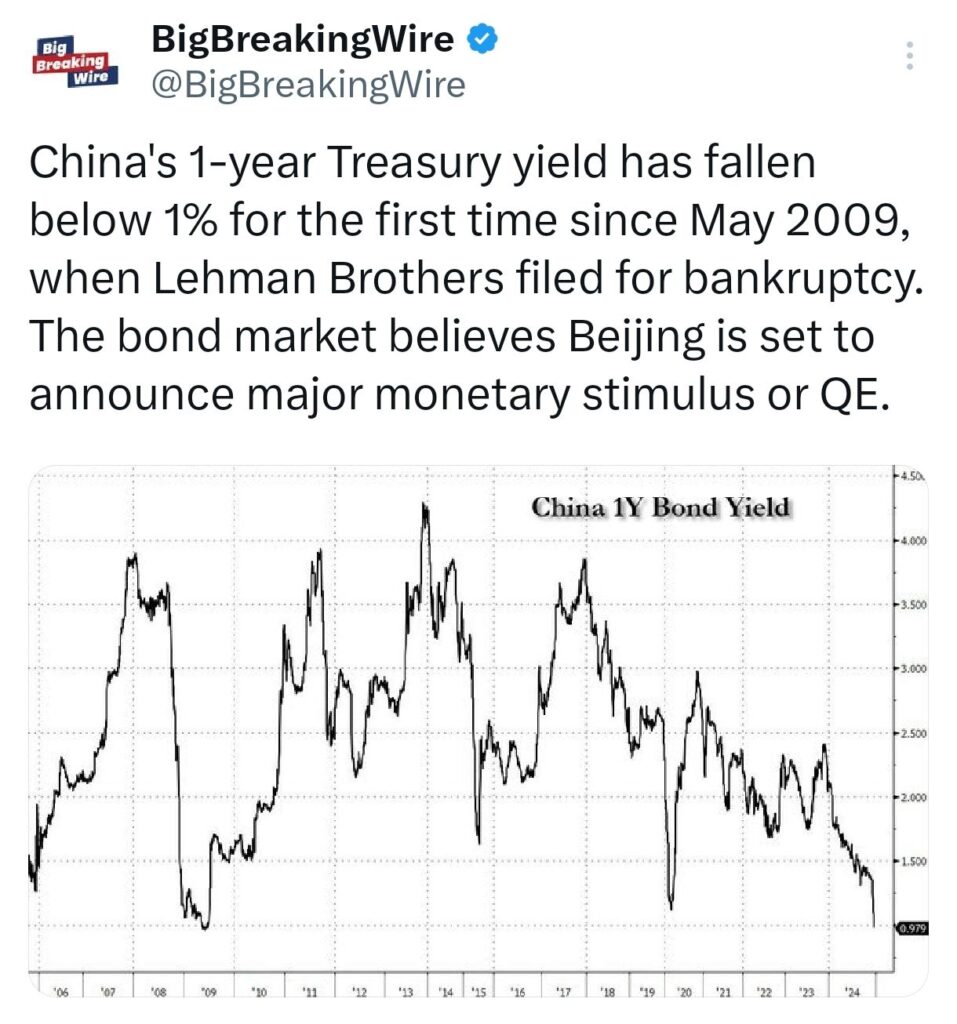

For the first time since May 2009, when Lehman Brothers filed for bankruptcy, China’s 1-year Treasury yield has dropped below 1%. This significant decline in yield signals that the bond market is anticipating a major announcement from Beijing regarding monetary stimulus or potentially even quantitative easing (QE). Investors expect the Chinese government to implement measures aimed at boosting economic growth and addressing ongoing financial challenges.

Overall, this bold fiscal strategy demonstrates China’s commitment to countering its economic challenges through increased spending, infrastructure development, and support for advanced industries.

World Bank Raises China’s Growth Forecast for 2024

The World Bank has updated its growth forecast for China’s economy, increasing its projection for 2024 by 0.1 percentage points to 4.9%, and for 2025 by 0.4 percentage points to 4.5%. While the 2024 forecast is close to Beijing’s growth target of around 5%, the economy recorded a growth of 4.8% during the first nine months of this year.

The growth forecast for 2025 has been revised to 4.5%, up from the previous estimate of 4.1%.

The World Bank also highlighted the importance of striking a balance between supporting short-term growth and implementing long-term structural reforms for sustainable development.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment