This Is Not A Stimulus; It’s A Debt Swap!

China’s top legislative body has approved the State Council’s plan to raise local government debt limits by 6 trillion yuan, aiming to replace existing hidden debts, according to the Vice Chairman of the NPC Financial and Economic Affairs Committee.

China Launches $839 Billion Debt Swap Plan to Support Local Governments and Boost Economy

China has introduced a $839 billion (6 trillion yuan) debt swap plan to help local governments refinance their debt. This is part of Beijing’s efforts to support a slowing economy, which is facing new challenges due to Donald Trump’s reelection. The plan was approved by the Standing Committee of the National People’s Congress and was reported by Xinhua News Agency on Friday. While few details were shared, the move gives investors a clearer idea of China’s fiscal measures to restore confidence in the economy.

China’s Vice Chairman stated that the new debt quota will help replace existing debt and that the initiative to exchange hidden debt aims to reduce local debt risks. He also mentioned that the NPC has approved plans to raise the local debt limit and accelerate reforms of local government financing vehicles to control new debt.

The offshore yuan dropped below 7.18 against the USD, falling over 300 points during the day. China’s Finance Minister highlighted that allocating 6 trillion yuan in local government debt quotas to address hidden debt is a major policy shift. He also mentioned that 2 trillion yuan will be allocated annually for the debt swap.

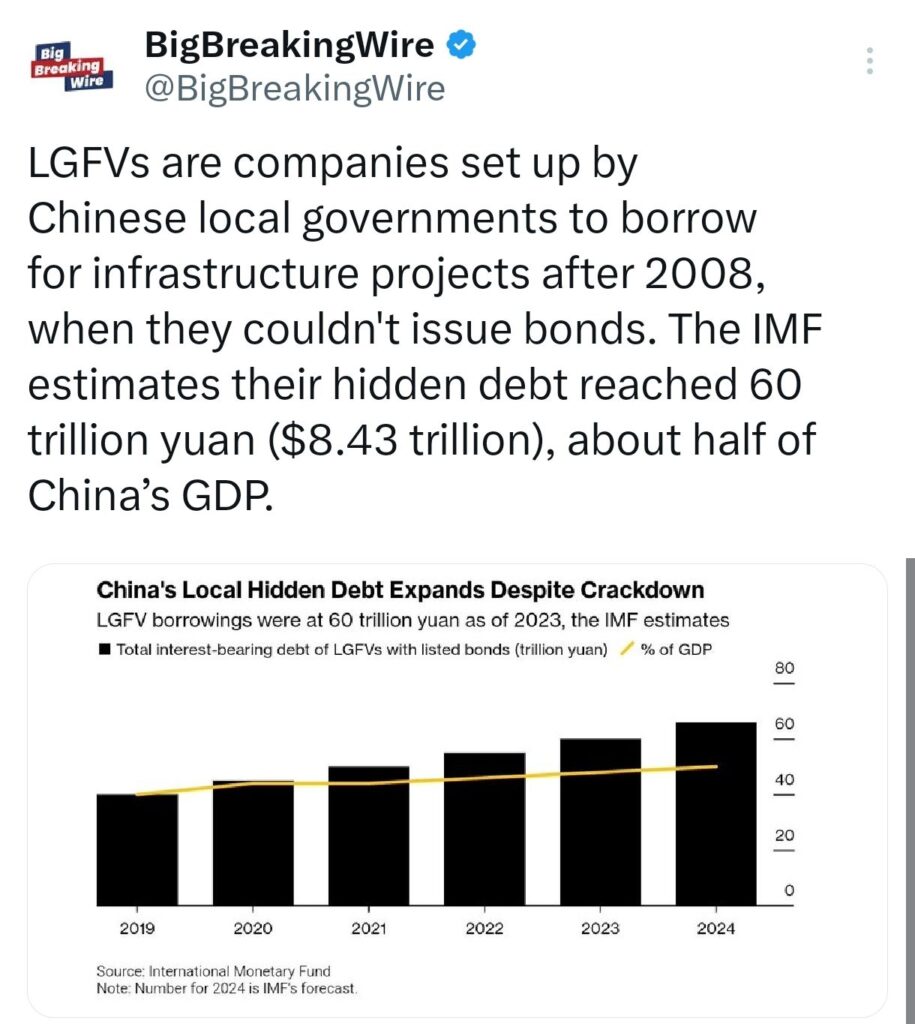

Local government financing vehicles (LGFVs) are companies set up by Chinese provinces and cities to borrow money for infrastructure projects like roads and airports. They emerged after China’s 2008 stimulus package, as local governments were not allowed to issue bonds. The IMF estimates LGFVs’ hidden debt surpassed 60 trillion yuan ($8.43 trillion) by last year, about half of China’s GDP.

By the end of 2024, the limit for local government special bonds is set to increase to 35.52 trillion yuan from 29.52 trillion yuan. The Finance Minister also revealed plans to reduce local government hidden debt from 14.3 trillion yuan to 2.3 trillion yuan by 2028, noting that the concealed local government debt reached 14.3 trillion yuan by the end of 2023.

The People’s Bank of China (PBOC) reports a 1% yearly increase in property loans by the end of Q3.

China’s Finance Minister emphasized the importance of reducing local government debt to stimulate economic growth. He also predicts that local governments will save 600 billion yuan in interest over the next five years.

The Finance Minister acknowledged that debt burdens in certain areas are significant and heavy, stressing the need to firmly control the growth of new “hidden” debt.

Additionally, he stated that local officials will be held accountable for any unlawful increases in debt.

Meanwhile, the FTSE China A50 Index futures have dropped by more than 5%.

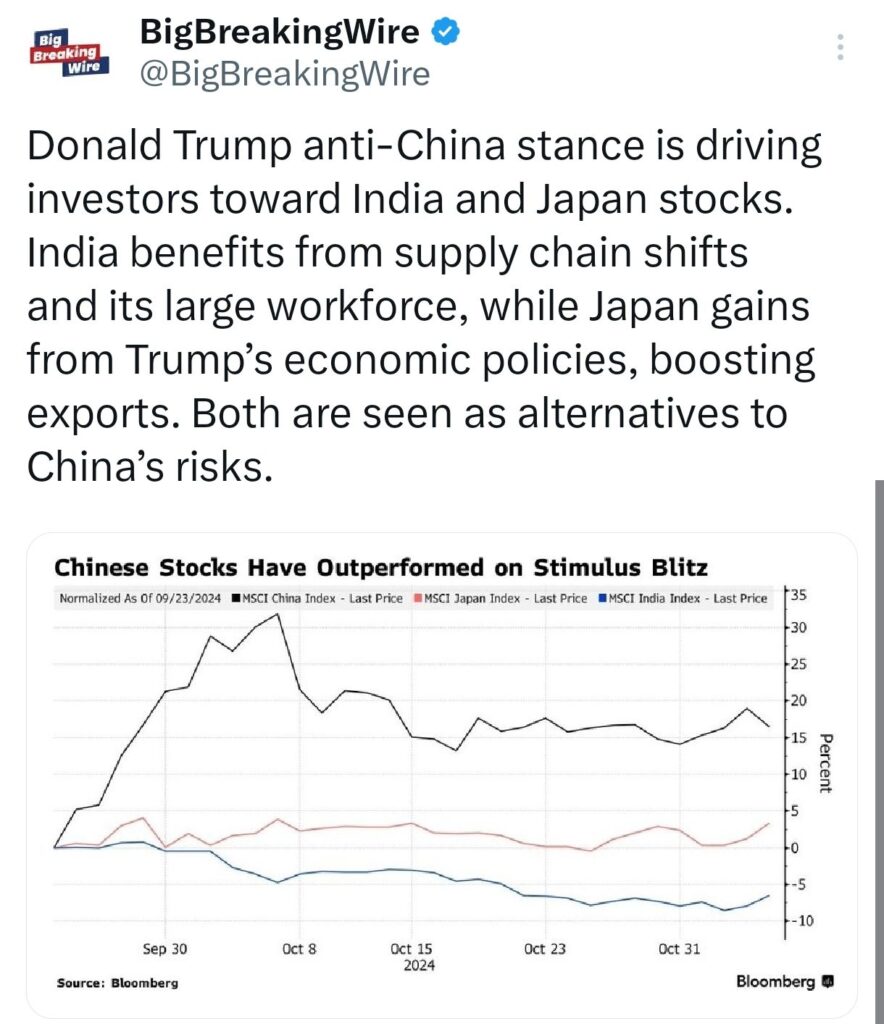

China’s economy grew by 4.6% in the third quarter, the slowest since March last year, raising doubts about reaching its 5% growth target. In response, the government introduced supportive measures like interest rate cuts and aid for the stock and real estate markets. This led to a major stock rally, prompting global banks, including Goldman Sachs, to raise their forecasts for China’s economy. However, with Trump’s election win, there are calls for China to strengthen policies to boost domestic demand, as his tariff threats could hurt exports.

China has allocated a total of 10 trillion yuan for addressing local government debt, according to Bloomberg. LAN, a key official, stated that China still possesses substantial capacity to increase borrowing, noting that the central government has significant room to raise additional debt. Furthermore, China’s finance minister highlighted that the country’s government debt burden remains relatively low, with considerable potential to further increase borrowing.

LAN announced plans to implement a forceful fiscal policy in 2025, including the issuance of ultra-long special treasury bonds. Additionally, China’s Finance Minister stated that the government will soon issue special sovereign bonds aimed at replenishing the capital of major state-owned banks.

China’s Finance Minister announces new policy measures to support the real estate market, including special local bonds for idle land and unsold apartments, and sovereign bonds to boost state banks’ capital. The fiscal press conference concludes in Beijing.

China New Stimulus Summary

China Approves 10 Trillion Yuan Program to Address Economic Slowdown and Hidden Debt

China has unveiled a 10 trillion yuan ($1.4 trillion) initiative to refinance local government debt in an effort to counteract the country’s economic slowdown, exacerbated by new risks from Donald Trump’s potential reelection. Key highlights include:

1. Increased Debt Ceiling: Local government debt limits will be raised to 35.52 trillion yuan, enabling the issuance of six trillion yuan in special bonds over three years to swap hidden debts.

2. Additional Bond Quota: A further 4 trillion yuan in special local bond quotas will be allocated over the next five years for the same purpose.

Next Steps:

China’s Finance Minister announced plans to issue special sovereign bonds soon to strengthen state banks.

New policies will be introduced to support the real estate market, including the release of special local bonds for acquiring idle land and unsold apartments.

In 2025, China plans to implement more aggressive fiscal measures, including expanded local government debt sales and ultra-long special treasury bonds.

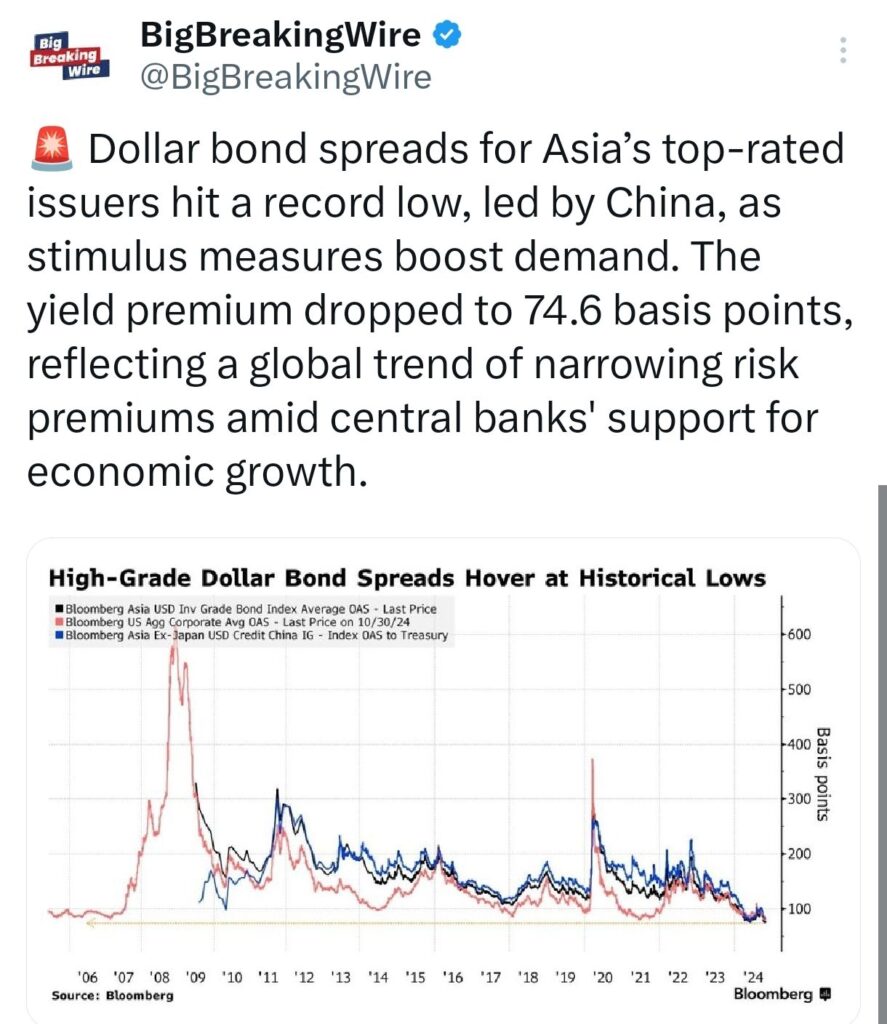

Dollar bond spreads for Asia’s highest-rated issuers, particularly China, have reached a record low, driven by increased demand following stimulus measures. The yield premium has fallen to 74.6 basis points, highlighting a broader global trend where risk premiums are narrowing. This decline is largely attributed to central banks’ ongoing efforts to support economic growth, which have helped lower borrowing costs and boost investor confidence in top-rated bonds.

Additionally, The People’s Bank of China (PBOC) released its third-quarter monetary policy report, emphasizing a flexible and targeted approach to monetary policy. It plans to enhance the role of the central bank’s policy rates, expand its monetary policy tools, and maintain an accommodative stance. Additionally, the PBOC aims to keep the yuan exchange rate stable and further improve its monetary policy framework.

China’s securities regulator, Wu Qing, called on asset managers and securities firms to better serve investment needs to ensure a stable capital market. Following recent meetings, Wu emphasized their key role in deepening capital market reforms. China’s equity market, recently uplifted by stimulus, now awaits further support amid a $1.4 trillion debt relief plan for local governments. The regulator also discussed improving tools like equity and debt financing, M&As, and restructuring, while an advisory body explored ways to boost foreign investment.

The table presents the current P/E ratios for the US, India, and China, along with their historical averages. The higher P/E ratios in the US and India signal elevated market valuations, whereas China’s lower P/E ratio points to potential undervaluation.

Update, 11th November 2024

Asian stocks fell after China’s economic support measures disappointed investors and data showed ongoing deflation. Bitcoin hit a record above $81,000. Stocks in Australia and South Korea dropped, and futures suggested a weak start in Hong Kong, while Japanese stocks were stable. US futures rose slightly after the S&P 500 gained 0.4% on Friday. China unveiled a 10 trillion yuan plan to address local government debt but did not introduce new fiscal stimulus. Foreign investment in China continued to decline, with a net outflow of $98.7 billion in the first three quarters.

Update, 12th November 2024

Chinese stocks and the yuan dropped amid rising fears of worsening Sino-US tensions after disappointing economic data. The Hang Seng China Enterprises Index fell over 3%, and the CSI 300 Index dropped 1.7%. The offshore yuan weakened to 7.25 per dollar. Investor sentiment worsened after reports that US President-elect Trump plans to appoint harsh critics of China, fueling concerns of escalating geopolitical tensions and the possibility of punitive tariffs on Chinese exports.

Update November 13th, 2024

China’s household deposits dropped by 570 billion yuan ($78.8 billion) in October, as many savers shifted their funds from bank accounts to the stock market and mutual funds, according to a report by Shanghai Securities News on Wednesday.

October saw a notable decline in residents’ deposits, while the broad money (M2) growth rate increased. This shift occurred just after the introduction of a new set of policies, with the data showing a “one decrease and one increase” trend, indicating rising interest among residents in stocks, funds, and other asset management products.

Household deposits refer to residents’ savings. The central bank’s latest data reveals that household deposits rose by 11.28 trillion yuan in the first 10 months of 2024, down from 11.85 trillion yuan in the first nine months. This indicates that October alone accounted for a significant drop of 570 billion yuan in deposits.

Update November 15, 2024

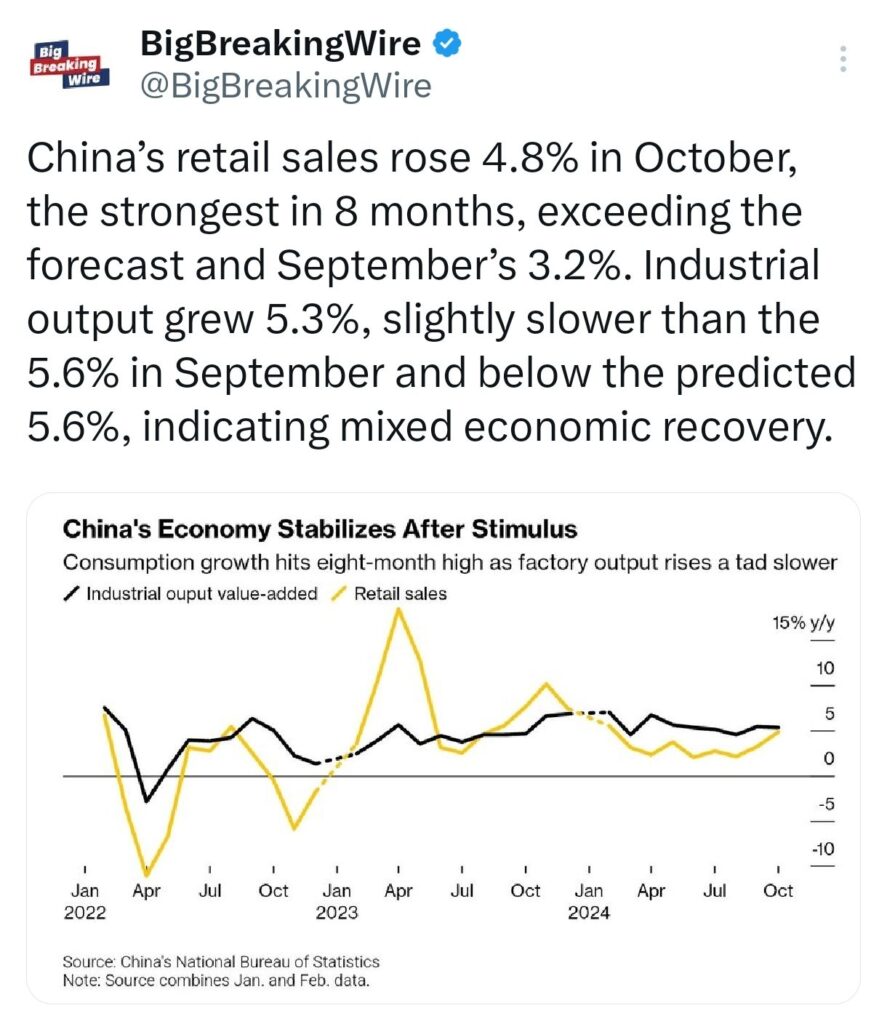

China’s economy showed positive signs as retail sales grew 4.8% in October, the strongest in eight months, driven by recent stimulus efforts. This growth surpassed expectations, up from 3.2% in September. Industrial output rose 5.3%, slightly below the prior month’s 5.6% increase, signaling mixed performance across sectors.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

5 Comments