Morgan Stanley India Strategy

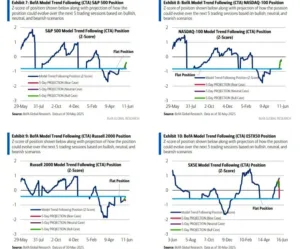

• Certain technical indicators are nearing the sell zone.

• Fundamentals are currently around mid-cycle, suggesting potential growth in upcoming quarters.

• Anticipate increased volatility; trading volumes have surged and might continue to do so.

• India continues to be a top choice in the macro market landscape.

• There’s a possibility that the macro trade might reach its peak in the forthcoming weeks.

• Preference for cyclicals over defensives and large-caps over small and midcaps.

• Bullish stance on financials, technology, consumer discretionary, and industrials sectors.

•Bearish outlook on all other sectors.

Nomura On Marico

• Neutral stance, target price set between Rs 600 to Rs 1,000.

• Sales fell slightly instead of the expected growth.

• Anticipate negative sales growth in India for the third straight quarter.

• Margin growth expected due to consistent low raw material prices.

Morgan Stanley On Marico

• Equal-weight recommendation, with a target price of Rs 553.

• Predictions of stagnant to minimal top-line growth.

• Profitability challenges persist in the FMCG general trade channel.

• Improved margins due to favorable raw material costs.

• Management optimistic about recovery in 2024.

CLSA On Godrej Consumer

• Recommendation to sell, with a target price of Rs 936.

• Sales weaker than expected; domestic volumes as anticipated.

• Consolidated organic sales impacted by overseas currency fluctuations.

Morgan Stanley On Godrej Consumer

• Overweight recommendation, target price set at Rs 1,072.

• Predicted slight decline in consolidated organic revenue.

• Expected mid-single-digit growth in India’s organic volume.

• International segment affected by currency devaluations.

• EBITDA margins (inclusive of forex) expected to grow YoY despite increased A&P expenditures.

HSBC On Titan

• Buy recommendation, revised target price of Rs 4,200 from Rs 3,900.

• Q3 saw a robust 23% YoY growth in jewellery sales.

• Positive performance across divisions, except for EyeCare.

• Strong results highlight Titan’s enduring appeal.

Morgan Stanley On Titan

• Equal-weight stance, target price of Rs 3,190.

• Noteworthy jewellery demand amidst broader discretionary demand slowdown.

• Projected 20%+ growth for the upcoming quarter.

• The gold exchange initiative is proving beneficial.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment