Morgan Stanley on LTI Mindtree:

Rating: Overweight (OW), Target Price: Rs 7050

Analyst Day Takeaways:

1. Discretionary spending is still slow.

2. Sales momentum is showing good progress.

3. The company is shifting its delivery model to include Gen AI.

4. The company aims for a margin of 17-18% when it reaches $10 billion in revenue.

JP Morgan on LT Mindtree:

Rating: Overweight (OW), Target Price: Rs 6900

Analyst Day Takeaways:

1. Discretionary spending is still not showing up.

2. To increase margins to 17-18%, growth needs to speed up.

3. The company’s target is to hit $10 billion in revenue.

4. The AI strategy is to embed AI into the business.

5. The company has a strong pipeline of large deals.

6. They have launched Project North Star.

UBS on Siemens:

Rating: Neutral, Target Price: Rs 8000

Siemens showed 11% growth in revenue, 34% in EBITDA, and 45% in PAT year-on-year.

Revenue missed estimates by 6%, but EBITDA and PAT beat estimates by 1% and 18%, respectively.

The significant increase in PAT was driven by a 95% rise in other income.

New orders stood at Rs 61.6 billion, reflecting a 37% year-on-year growth.

Goldman Sachs on Aurobindo Pharma:

Rating: Buy, Target Price: Rs 1525

Key Takeaways from APAC Healthcare Corp day:

1. The US business grew 7% quarter-on-quarter with a 200 basis points improvement in margins.

2. Europe’s growth and margins are supported by increased material supply.

3. Aurobindo Pharma plans to launch 3 biosimilar products next year.

Macquarie on Telecom:

The telecom industry is seeing a tariff increase, which should support earnings, cash flow, and return growth.

Order of Preference:

Bharti Airtel (Outperform)

Hexacom (Outperform)

Reliance (Neutral)

Indus Towers (Neutral)

Vodafone Idea (Neutral)

Bernstein on IT Services:

Bernstein prefers large-cap stocks like Infosys and TCS, which have high exposure to the US (50-60%) and BFSI (30%). These companies have strong customer relationships and are more resilient to margin pressures.

Among mid-sized companies, Persistent (with 80% US revenue) is well-positioned to grow by high teens in the medium term.

JP Morgan on Persistent:

Rating: Overweight (OW), Target Price: Rs 6900

Persistent is the most expensive tech stock globally at 58x 1-year forward P/E. However, JPM believes its valuation will either hold or even increase.

They expect 20% revenue growth in FY26/27 and a higher P/E multiple of 50x, which would give it a fair value of Rs 7100.

Morgan Stanley on Prestige Estates:

Rating: Downgrade to Underweight (UW) from Overweight (OW), Target Price: Rs 1510

Prestige Estates saw 63% growth in pre-sales in FY24, but the FY25 pre-sales growth estimate is reduced to +9% YoY (earlier forecasted at +28%) because only 29% of the target was achieved in 1H FY25.

Goldman Sachs on M&M:

Rating: Buy, Target Price: Rs 3600

M&M has launched its first dedicated electric vehicle (EV) platform with BE 6e & XEV 9e models. The company believes these launches will help them capture more segments in the market.

M&M also plans to file PLI scheme applications for these vehicles in the coming months.

Morgan Stanley on Coal India:

Rating: Overweight, Target Price: Rs 5250

Coal India is expected to benefit from the ongoing uptrend in power demand.

A strong power demand outlook bodes well for coal consumption.

Volumes are expected to be the key driver of earnings in the medium term.

The company’s strong balance sheet will support future investments.

Morgan Stanley on OMCs:

India’s fuel prices are based on $75 per barrel of Brent crude.

The integrated margins for Oil Marketing Companies (OMCs) have increased with stable fuel prices.

Rising crude discounts and improving domestic demand are expected to continue supporting margins.

Preferred stocks: HPCL/BPCL.

JPMorgan on Hyundai:

Rating: Overweight, Target Price: Rs 2200

Hyundai is well-positioned as a key player in India’s passenger vehicle (PV) growth and the premiumization trend.

The recovery in the PV industry is expected to continue in H2 FY26.

Hyundai’s high SUV mix helps drive profitability per unit compared to its peers.

The company’s capex efficiency supports a higher Return on Capital Employed (ROCE).

Exports contribute 20%, providing a cushion against domestic market fluctuations.

Key triggers for growth include maintaining margins, ROCE, and market share gains.

Jefferies India Strategy:

Jefferies spoke with institutional investors about Maharashtra’s vision to double its GDP to $1 trillion by this decade.

Maharashtra currently contributes 13% to India’s GDP, and this ambitious target requires a 14% CAGR growth from the current $500 billion.

Achieving this would increase per capita GDP from $3,300 to $6,500, improving the state’s overall economic situation.

Key strategies to reach this goal include raising the manufacturing sector’s share and implementing power sector reforms.

The state will focus on improving infrastructure, particularly in Mumbai, and balancing fiscal policies with income transfer schemes.

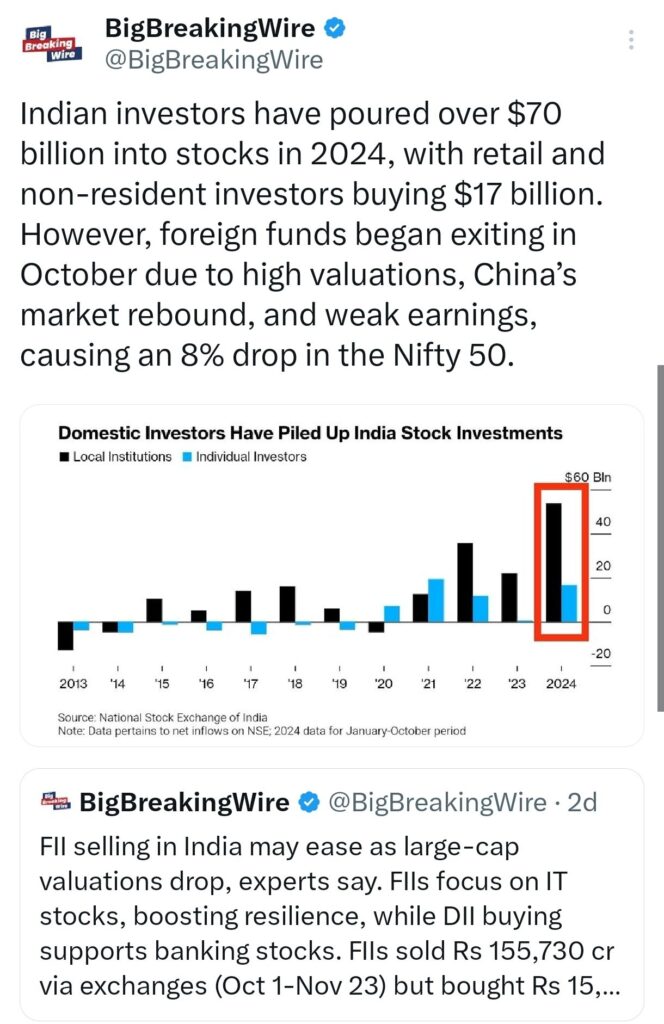

Indian Investors Pour $70B into Stocks; Foreign Funds Exit

In 2024, Indian investors have invested more than $70 billion into the stock market, with retail and non-resident investors contributing $17 billion of this total. However, in October, foreign funds started pulling out of the market. This shift was attributed to several factors: the market’s high valuations, the rebound of China’s stock market, and disappointing earnings reports. As a result, the Nifty 50 index saw a decline of 8%.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment