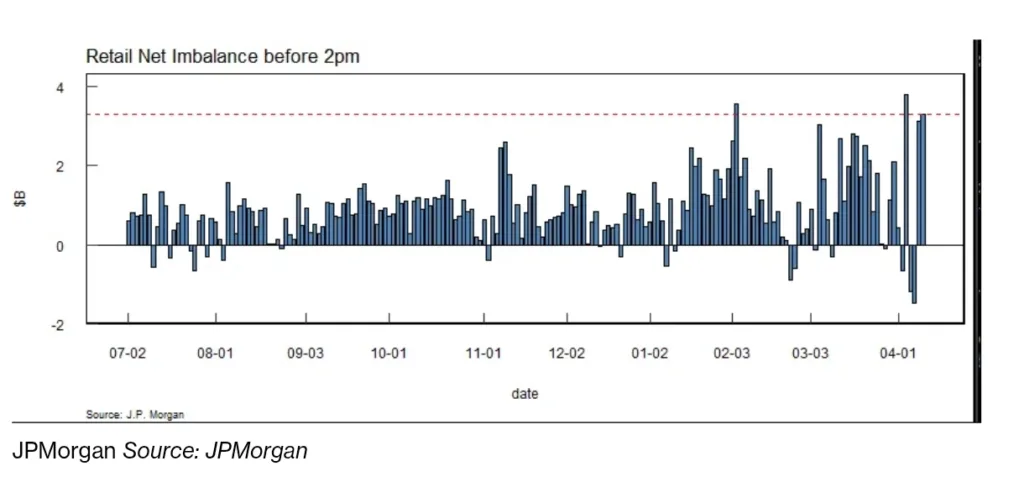

On Wednesday, retail traders were very active in the stock market. By 2 p.m., they had already bought $3.3 billion worth of shares, making it one of the biggest early-day purchases in U.S. market history.

JPMorgan warned that if stock prices continue to rise, hedge funds might have to close their short positions. This means they would need to buy back stocks they bet against, which could make the market go even higher.

Another reason for the market rally was heavy buying by leveraged ETFs. These funds use borrowed money to invest more and can increase market movements when they buy in large amounts.

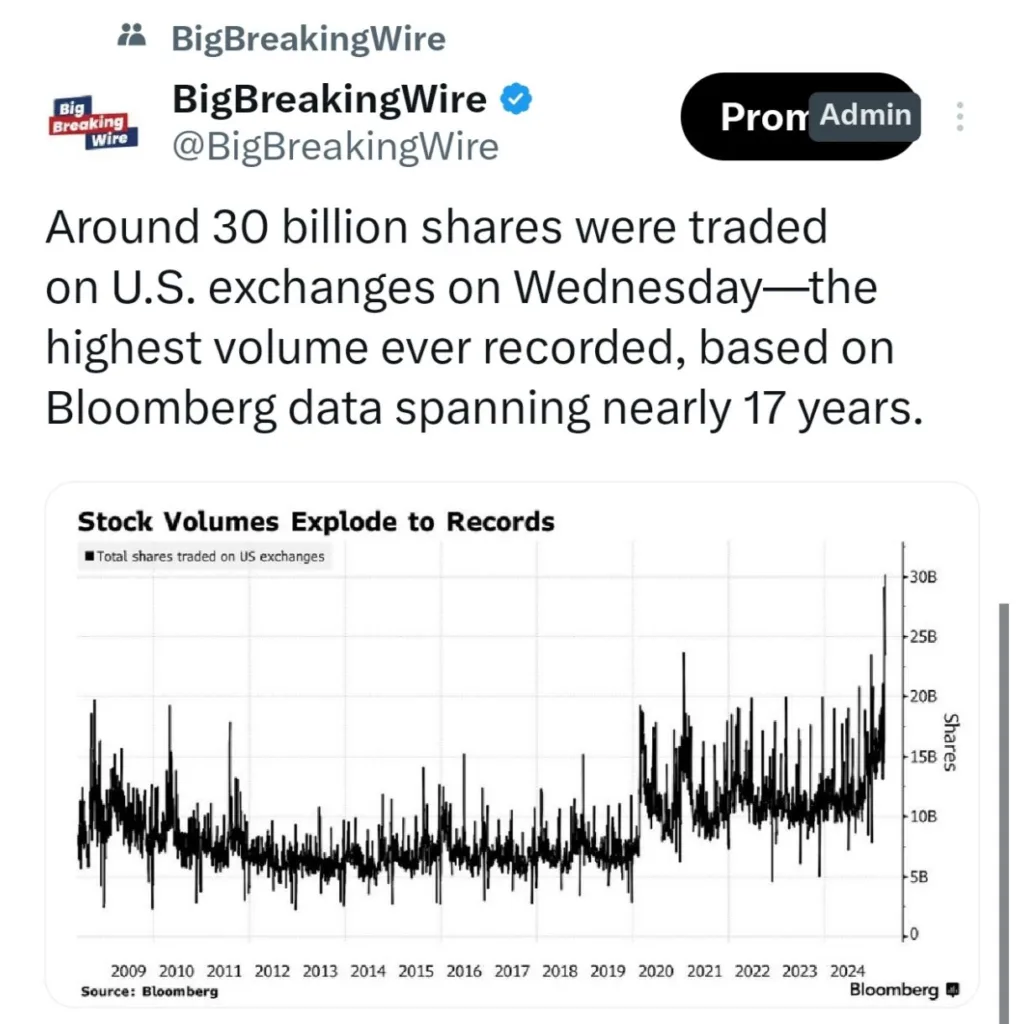

In total, around 30 billion shares were traded on U.S. stock exchanges on Wednesday—the highest single-day volume seen in nearly 17 years.

Foreign investors sold $6.5B in U.S. stocks over five days, per BofA. Meanwhile:

• $18.8B flowed into safe-haven U.S. Treasuries (record high)

• $21.3B pulled from active equity funds

• $15.9B exited high-yield bond funds (new record)

• Equity funds saw $48.9B inflows, but BofA says it’s likely due to ETF share creation during panic selling, like during Lehman collapse or Covid wave.

Be First to Comment