Billionaire hedge fund manager Paul Tudor Jones said on Tuesday that the stock market could fall even further — even if U.S. President Donald Trump reduces his tariffs on China.

> “For me, it’s pretty clear. You have Trump who’s locked in on tariffs. You have the Fed who’s locked in on not cutting rates. That’s not good for the stock market,” said Jones during an interview with CNBC’s Squawk Box.

Jones said that even if Trump reduces the China tariffs to 50% or even 40%, the impact would still be like a huge tax increase.

> “It’d be the largest tax increase since the 1960s,” he said.“So you can kind of take 2% or 3% off economic growth.”

Market Risks Are Still High

Jones explained that the overall macroeconomic environment is still weak. He doesn’t think the stock market has reached its lowest point yet.

He pointed out two key issues:

1. The Federal Reserve (U.S. central bank) is not cutting interest rates.

2. Trade tensions between the U.S. and China are still high.

The Federal Reserve has kept interest rates between 4.25% and 4.5% since December. Fed Chair Jerome Powell has said the central bank will wait for more clarity on trade policies before changing rates.

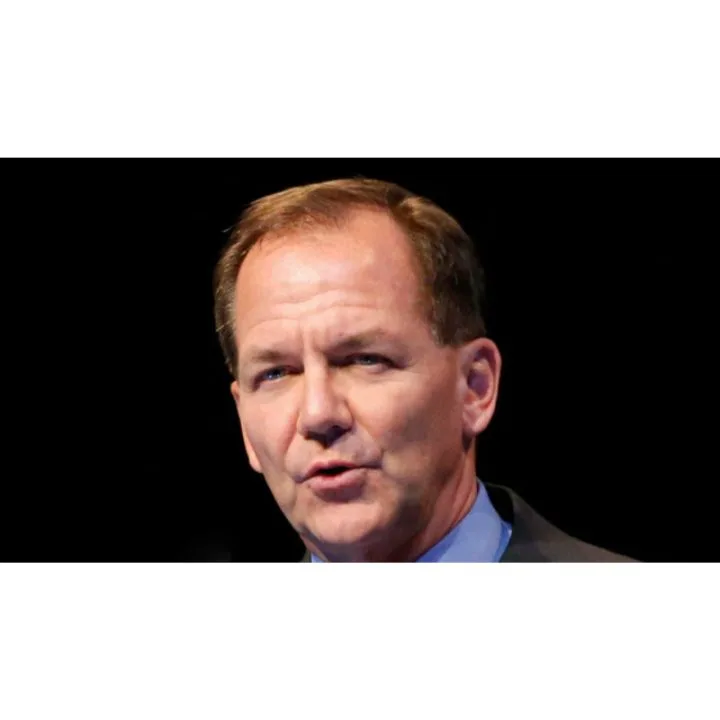

About Paul Tudor Jones

Paul Tudor Jones is the founder and chief investment officer of Tudor Investment Corporation. He became famous for correctly predicting the 1987 stock market crash, where he made large profits. He is also the chairman of Just Capital, a nonprofit that ranks U.S. companies based on how well they treat people and the planet.

Disclaimer: This article is based on CNBC “Squawk Box” interview with Paul Tudor Jones.

One Comment