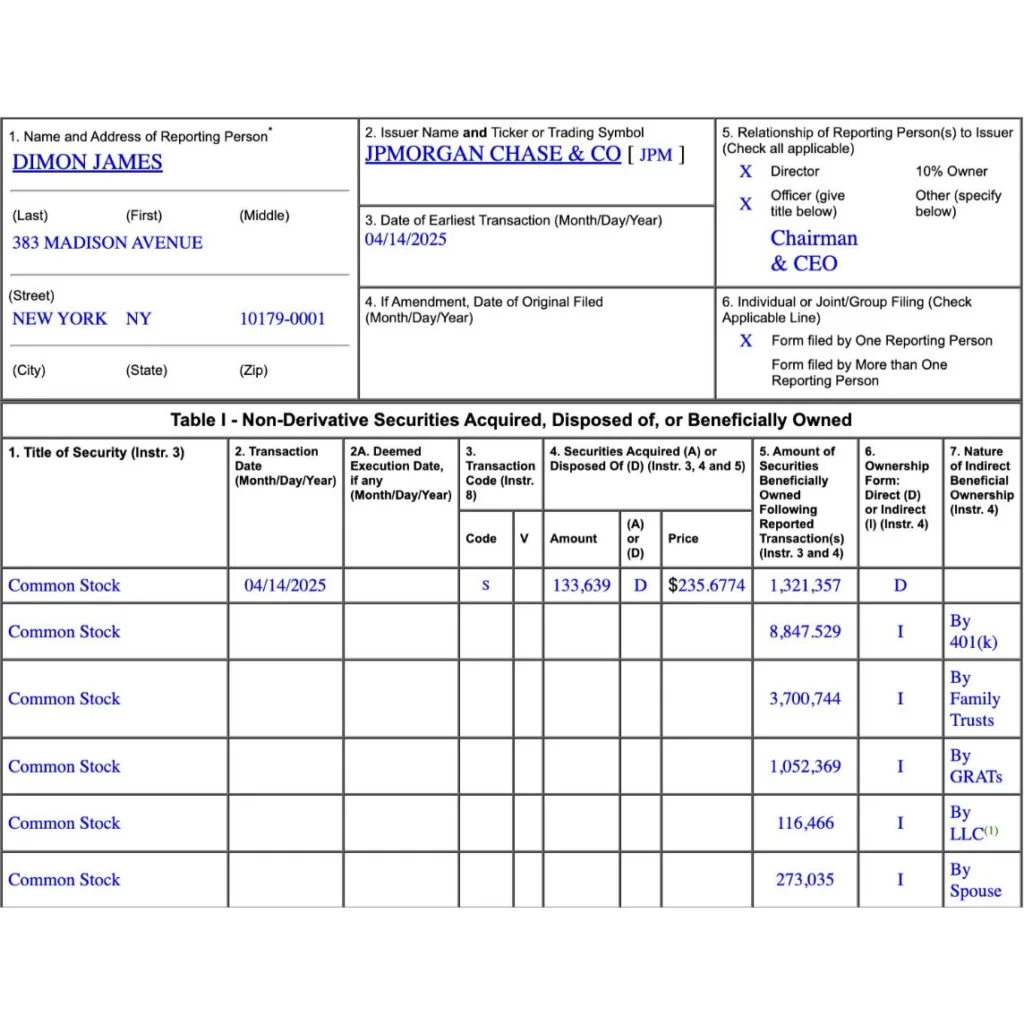

JPMorgan Chase CEO Jamie Dimon has offloaded another large batch of company stock, selling around 133,639 shares for a total of $31.5 million, according to a recent SEC filing. The shares were sold at an average price of roughly $235.70 each. This move comes just weeks after Dimon made a much bigger sale in February, when he sold over $233 million worth of JPMorgan stock.

While such insider sales often spark speculation, they don’t necessarily signal trouble for the company or the market. Executives frequently sell shares for personal financial reasons, tax planning, or portfolio diversification. Nonetheless, this back-to-back selling streak has caught the attention of investors.

2 Comments