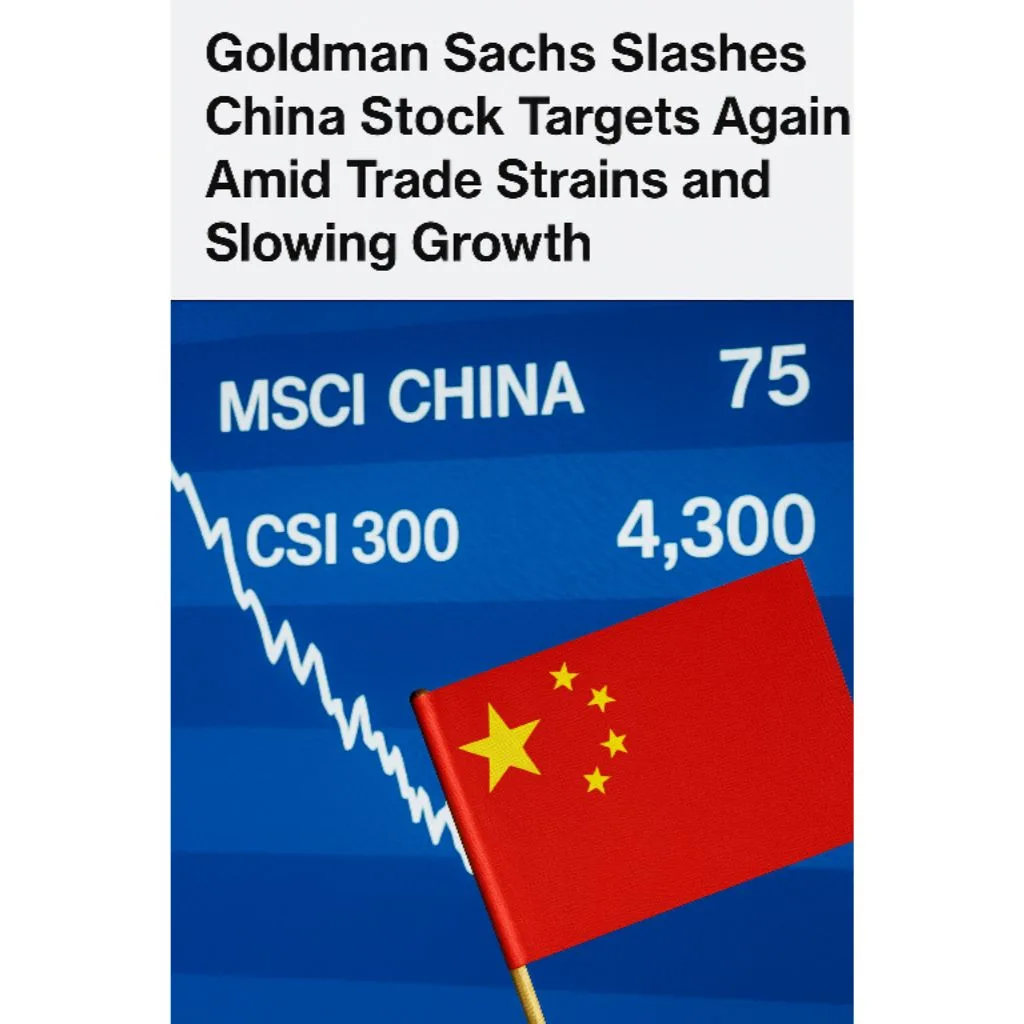

Goldman Sachs has lowered its expectations for Chinese stocks again this month, citing rising U.S. tariffs and slower economic growth. In its latest report, the bank cut its 12-month forecast for the MSCI China index from 81 to 75 and also reduced the CSI 300 target from 4,500 to 4,300. The analysts pointed to factors like only 4% GDP growth, high government spending levels, a weakening yuan, and mounting trade pressure from the U.S. as key reasons behind the downgrade.

To overcome these hurdles, the bank believes China must take bold action. This includes boosting the economy through large-scale government spending, easing rules in key industries, and making deeper reforms. Goldman also recommends that China reduce its reliance on U.S. trade by expanding business with other countries and shift more domestic investments into the stock market to keep it strong.

One Comment