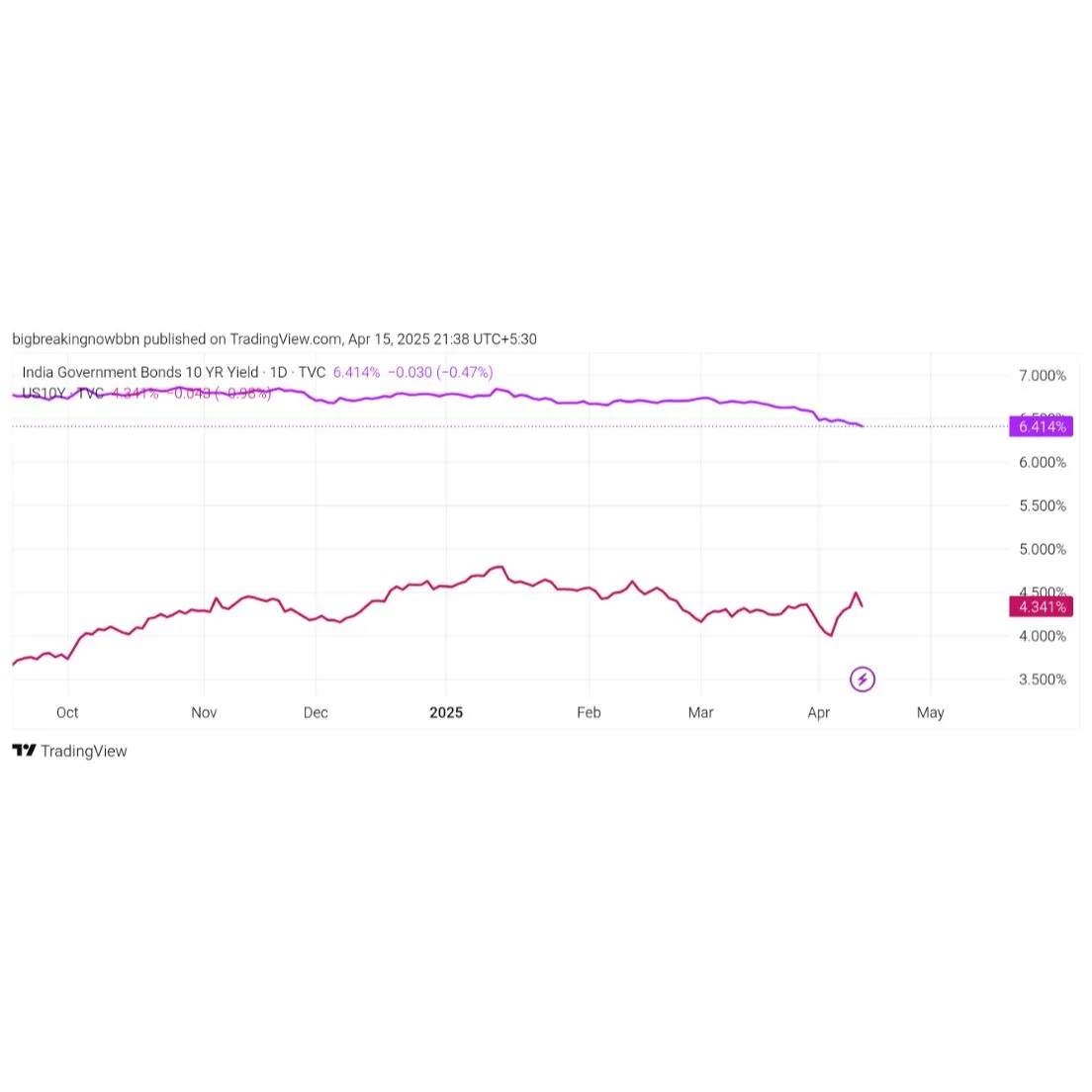

India’s bond market is showing resilience despite global headwinds caused by rising U.S. tariffs. Unlike many other countries facing a debt market selloff, Indian bonds are gaining strength. Citi expects this positive trend to continue, supported by falling inflation, the possibility of more interest rate cuts, and improved liquidity conditions in the domestic market.

The bank forecasts that the yield on India’s 10-year government bond, currently around 6.40%, could drop further to between 6.20% and 6.25%. This follows an 18-basis-point fall already recorded this month, indicating growing investor confidence and room for further upside in the bond space.

Be First to Comment