Investors Show Optimism for US Dollar and Stocks

According to the latest survey by Bank of America (BOFA), investors remain optimistic about the US dollar and stock markets. However, sentiment toward other assets appears largely negative, with a preference for riskier investments.

Risk-On Allocations, Bonds Least Popular Since 2022

The survey reveals that fund managers are maintaining a “risk-on” approach. Bond allocations are at their lowest levels since October 2022, and cash holdings have dropped to just 3.9%, reflecting a willingness to take on more risk.

European Equities Make a Comeback

European stocks have seen the second-largest increase in allocation in the past 25 years. Fund managers are turning to lagging European assets as they aim to capitalize on potential catch-up opportunities.

Popular Trades: Magnificent 7, US Dollar, and Crypto

The survey highlights the most crowded trades among fund managers. Leading the pack is the “Magnificent 7” tech stocks, with 53% of managers favoring these assets. Long positions in the US dollar (27%) and cryptocurrencies (13%) are also among the top trades.

Shift to Large-Cap Stocks, Value Investing Loses Appeal

Investors are moving back to large-cap stocks, reducing their interest in smaller companies. Additionally, fewer fund managers believe value stocks will outperform growth stocks, signaling a shift in market sentiment.

India Off Radar as Japan Leads Investor Picks

According to BofA Securities’ latest fund manager survey, global investors still favor Japan as their top pick, while India is not among the top three preferred Asian markets. Most participants believe India’s equity markets will decline further, keeping it off investors’ radar.

In China, optimism about economic growth has dropped significantly, with only 10% expecting improvement compared to 61% in October. Many investors are bearish on China’s economy, and stock market returns are expected to be under 5% in the next year. Cash hoarding by Chinese households remains high, and few are willing to increase investments despite signs of economic easing.

Japan remains the most favored market, with 20% expecting double-digit returns in the next 12 months. Taiwan ranks second, followed by Korea, which has seen a rebound in investor interest due to political stability and a better outlook for semiconductors.

This survey underscores the growing investor confidence in equities and riskier assets, while bonds and other safe-haven investments continue to lose favor.

Udpate

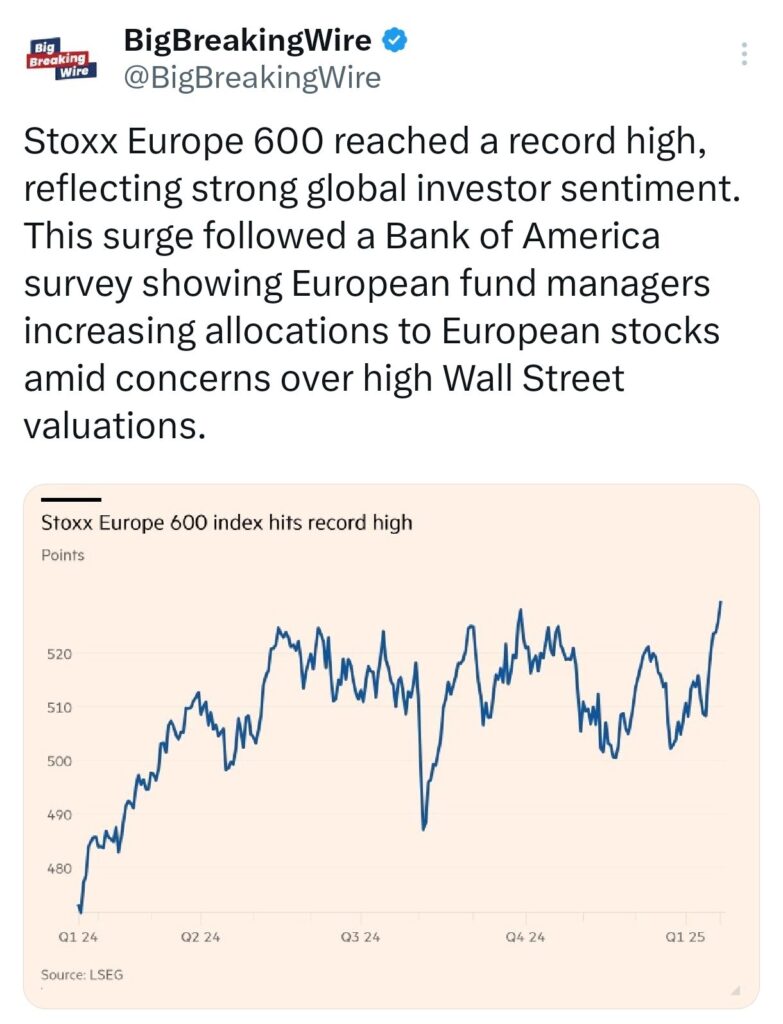

The Stoxx Europe 600 reached a new record high, signaling bullish sentiment among global investors. This surge followed a Bank of America survey of European fund managers, showing an increase in allocations to European equities. Investors are shifting focus amid concerns over inflated valuations on Wall Street.

After the FTSE reached a new high, the Stoxx index has also hit a new peak. Wall Street is just 1-2% away from its own record highs. However, India’s Nifty is down by around 11-12% from its previous highs. Many sectoral indices in India have fallen more than 20-25%, and several individual stocks are down over 35-40% from their peak values.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment