Mixed Signals for Indian Markets in 2025

Bank of America (BofA) expects the Nifty 50 to reach 26,500 in 2025, reflecting a limited upside of less than 9% from current levels. Broader markets are also likely to lag due to high valuations, while the Nifty is anticipated to underperform US equities in USD terms.

Earnings and Valuation Outlook

The report highlights that earnings growth in 2025 will depend on commodities, capital expenditure (capex), and credit expansion. However, valuations remain stretched, leaving little room for growth unless supported by reforms or large-scale investments. Despite a recent correction, the market continues to trade at premium levels, which could hinder further upside without strong economic changes.

Recent Market Trends

The Nifty 50 closed at 24,457 on December 2, gaining 0.8% on the day, but is still 7.5% below its 52-week high of 26,277. Meanwhile, the Sensex ended 6% below its peak of 85,978. In October, Foreign Institutional Investors (FIIs) offloaded Indian equities worth ₹1.1 lakh crore amid weaker-than-expected earnings and optimism around the U.S. economy.

Shift in FII Activity

November saw some relief as FII outflows slowed to ₹45,974 crore, indicating waning momentum for the “Sell India, Buy China” trend. Despite this, FII flows are expected to remain subdued in 2025 due to high US bond yields, while Domestic Institutional Investor (DII) inflows could also taper off. Robust fundraising, however, might balance the situation to some extent.

Challenges and Risks Ahead

BofA warns of potential volatility stemming from US trade, immigration, fiscal, and geopolitical policies, which could keep Indian markets on edge. On the upside, fiscal or monetary stimulus and policy reforms might create opportunities for growth. A lighter events calendar in 2025 could also open the door for meaningful economic adjustments.

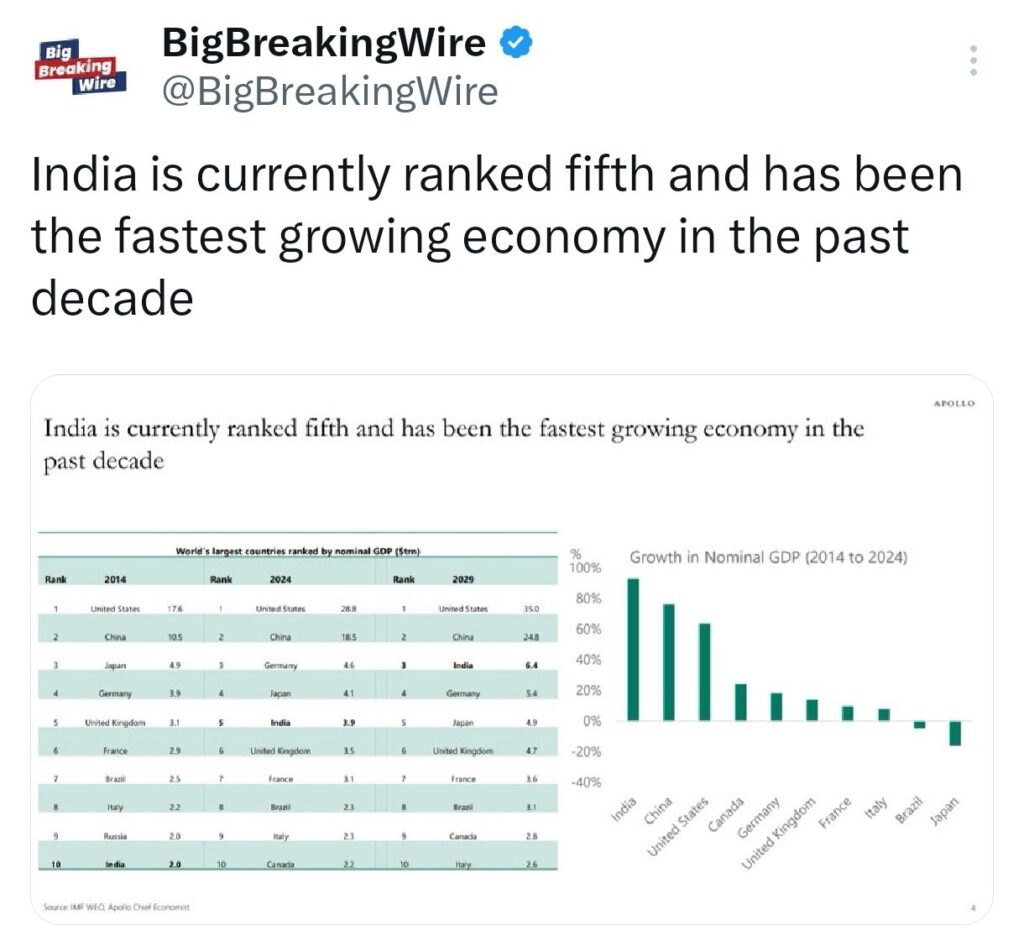

Chart of the day

India currently holds the fifth position globally and has been the fastest-growing economy over the past decade.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment