Bitcoin faced a retracement upon approaching $68,850, falling just $150 short of its record peak. Shortly thereafter, rapid market fluctuations led to a $2,000 plunge within 3 minutes, resulting in the liquidation of approximately $20 million in long positions, as reported by CoinGlass data. Presently, BTC is traded above $66,600.

Within the last 24 hours, $105 million worth of Bitcoin shorts were liquidated.

BlackRock, in a recent SEC filing, expressed its intent to acquire additional Bitcoin ETFs for its Strategic Income Opportunities Fund. The filing indicates a focus on ETFs holding Bitcoin directly, leveraging BlackRock’s affiliate-sponsored Bitcoin ETPs.

BlackRock’s Spot BTC ETF stands out as the top-performing in the market, contributing to the rising demand for Bitcoin ETFs. On Monday, Bitcoin ETF trading volume exceeded $4 billion, hitting $5.4 billion, the second-largest day since launch. BlackRock’s ETF total value reached $2,410,752,472.

MicroStrategy, under Michael Saylor, plans a private offering of $600 million Convertible Senior Notes. Proceeds from the sale will be used to acquire more bitcoin and for general corporate purposes. These unsecured, senior obligations will bear interest semi-annually from September 15, 2024. MicroStrategy has been a prominent Bitcoin investor and aims to expand its holdings with support from its clients.

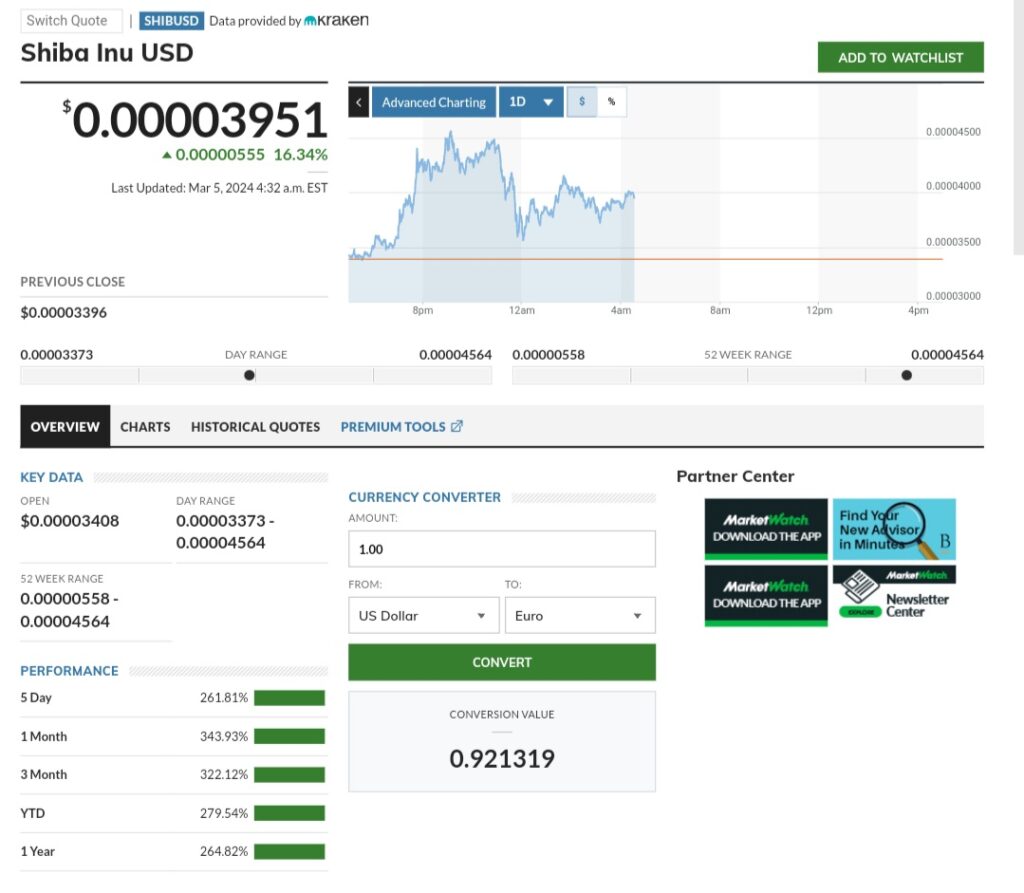

Shiba Inu (SHIB) cryptocurrency has seen a staggering 279% surge year-to-date.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment