Bharti Hexacom, an Indian telecom company, received bids worth $8.43 billion in its IPO, surpassing its offer size of $572 million.

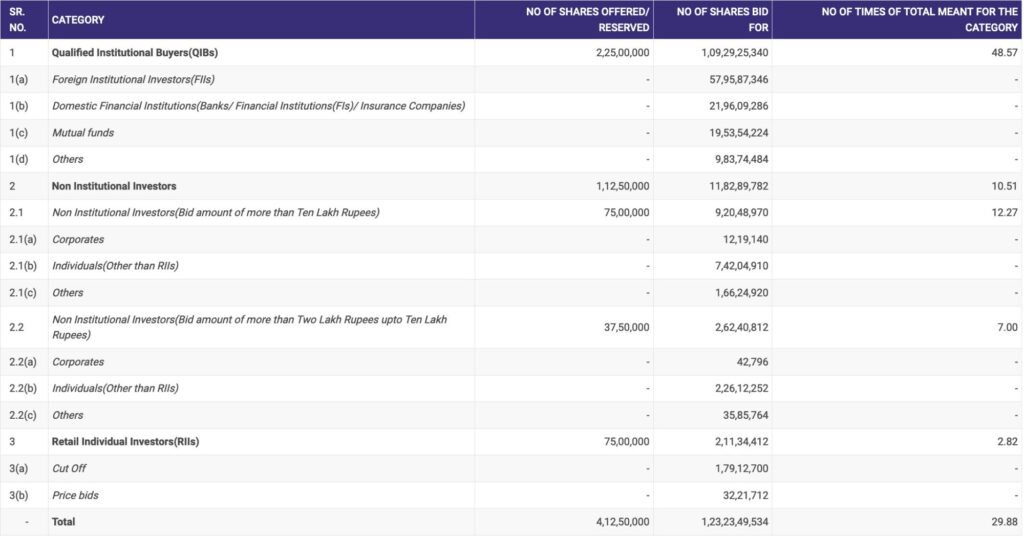

Investors bid for 1.23 billion shares, which was nearly 30 times more than the 41.2 million shares offered.

Analysts predict that Bharti Hexacom could debut on the market at a 15% higher price due to the strong demand for its IPO.

India has witnessed a significant increase in IPO activity in 2024, with 64 companies raising $2.31 billion, compared to $170.6 million from 42 offerings last year.

Bankers expect this trend to continue due to economic growth and political stability as general elections approach.

Telecommunications Consultants India, a government-owned entity, offered to sell half of its 30% stake in Bharti Hexacom, totaling 75 million shares.

Bharti Hexacom provides mobile, fixed-line telephone, and broadband services under the brand “Airtel” in Rajasthan and parts of northeastern India.

Bharti Hexacom, operating in Rajasthan and North East circles since 1995, reported a revenue of Rs 3,420.2 crore for the six months ended September 2023, with a full-year revenue of Rs 6,579 crore for FY23, marking a 22% increase.

The company’s net profit at the end of September 2023 was Rs 69.1 crore, compared to Rs 195.2 crore in the same period of 2022, including an exceptional loss of Rs 303 crore from April to September 2023.

Operational profit for FY23 was Rs 2,925.9 crore, up 54% from the previous fiscal, with a margin of 44%.

Cash flow from operations as of September 30, 2023, was Rs 1,988.7 crore, and net cash stood at Rs 46.3 crore. Total borrowings were Rs 6,235.5 crore.

The approximate breakdown of IPO applications as of April 5, 2024, shows high demand from high-net-worth individuals (HNIs) and retail investors. HNIs above 10 lakhs applied for 46,820 shares, HNIs with 2-10 lakhs applied for around 70,320 shares, and retail investors applied for approximately 7,28,146 shares.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment