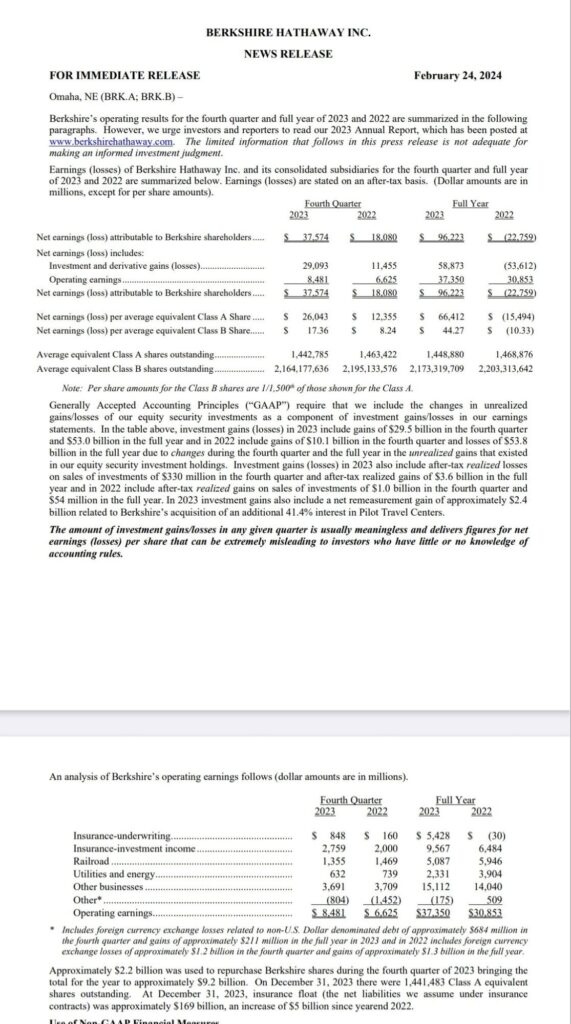

In Q4 2023, Berkshire Hathaway reported operating earnings of $8.48 billion, reflecting a 28% year-over-year increase. Additionally, the company repurchased shares amounting to $2.2 billion during the quarter. As of December 31, 2023, the insurance float stood at $169 billion.

Berkshire Hathaway’s net earnings surged to $37.57 billion, marking a substantial year-over-year increase from $18.08 billion.

In 2023, Berkshire Hathaway Inc. recorded total revenues of $364.5 billion, reflecting an increase from the previous year’s $302.1 billion.

Additionally, Berkshire Hathaway’s cash reserves surged to a record high of $167.6 billion by the end of the fourth quarter. This substantial increase in cash reserves highlights the company’s strong financial position and its ability to weather economic uncertainties or capitalize on investment opportunities.

Despite the lack of complete information on their portfolio moves, recent filings provide valuable insights into Berkshire Hathaway’s investment decisions, particularly regarding publicly traded equities.

Berkshire Hathaway’s investment portfolio is valued at $347 billion and consists of holdings in 41 different companies. Notably, the top five holdings represent over 80% of the total portfolio value, indicating a significant concentration of investments in these key assets.

Among Berkshire Hathaway’s top holdings are renowned companies such as Apple, Bank of America, Coca-Cola, American Express, and Visa. These companies span across the technology and consumer goods industries, aligning with Berkshire Hathaway’s investment strategy and the preferences of Buffett and Munger.

The latest 13F filing also reveals Berkshire Hathaway’s strategic move to increase its stake in five Japanese trading companies: Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co. Ltd., and Sumitomo Corp. This gradual increase, from 5% to 7.4% between August 2020 and April 2023, signifies a long-term investment approach by Berkshire Hathaway.

Furthermore, Berkshire Hathaway may potentially raise its stake in these Japanese trading companies to 9.9%, indicating a strong commitment to its investment strategy in the Japanese market.

In summary, Berkshire Hathaway’s impressive financial performance, record-high cash reserves, strategic investment decisions, and concentration in key holdings reflect its robust position in the market and its adherence to a long-term investment philosophy.

Warren Buffett’s letter to Berkshire Hathaway shareholders begins with a homage to Charlie Munger.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment