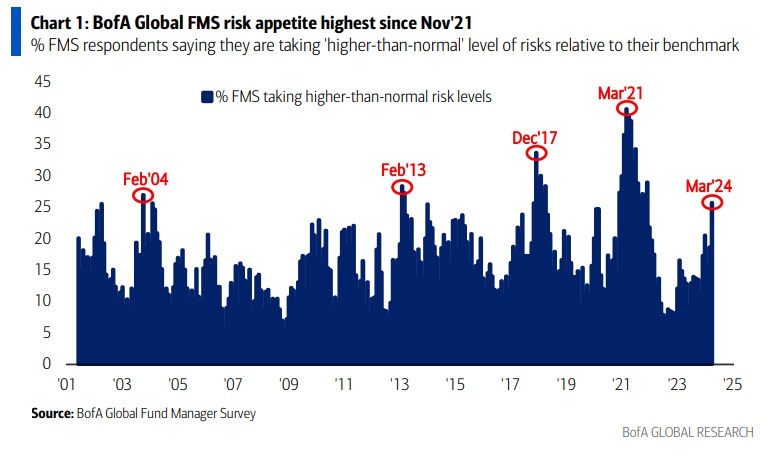

A recent survey by BofA indicates that fund managers continue to pursue increased global investment opportunities, coinciding with investors’ heightened risk appetite reaching its highest level since 2021.

The most crowded trades currently include being long on the ‘Magnificent 7’ (58%), shorting Chinese equities (14%), going long on Japanese equities (13%), holding long positions in Bitcoin (10%), cash (3%), and investment-grade corporate bonds (2%).

According to the poll, stock allocation has reached a two-year peak, with fund managers notably shifting their focus towards Europe, emerging markets, and financial sectors in what is described as a significant rotation.

Investor sentiment, gauged by cash reserves, equity distribution, and economic growth forecasts, has surged to its most optimistic level since January 2022.

According to the poll, investors held differing views on whether artificial intelligence stocks are experiencing a bubble, with 40% affirming and 45% negating the notion.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment