ANTIQUE on Allied Blenders

Initiates a Buy with a target price of Rs 405.

Sees growth in premium brands with new launches and global partnerships.

Expands mass-market segment profitably, with a strong foothold in high-margin states.

Backward integration, premium products, and cost-cutting to boost margins.

Projects revenue and EBITDA growth of 9% and 29% from FY24 to FY27, driven by 13% volume and 15% value growth in the premium segment.

JPMorgan on Apollo Tyres

Maintains Overweight with a target price of Rs 555.

Q2 was a weaker quarter as anticipated.

Commentary on H2 pricing will be crucial.

Net debt increased due to seasonal working capital needs.

Goldman Sachs on Eicher Motors

Maintains Buy with a target price of Rs 5400.

Q2 met expectations; sees good risk-reward in product cycle and demand.

Likes new product launches and demand visibility on recent models.

Inventory rebuilding supported by the Replenishment Model.

Bullet 350’s Battalion Black variant addressed customer indecisiveness.

CITI on Eicher Motors

Maintains Buy but lowers target price to Rs 5350 from Rs 5500.

Q2 EBITDA was slightly below estimates due to higher marketing costs.

Focuses on volume growth over margins.

Increases volume estimates for FY25-27 due to strong demand and higher marketing activities.

UBS on Apollo Tyres

Maintains Buy with a target price of Rs 605.

Q2 FY25: Indian operations below expectations on weak commercial vehicle demand.

European operations strong, with revenue and profit growing 6% and 19% year-over-year.

Standalone revenue rose by 1% year-over-year, lower than competitors CEAT and MRF.

Heavy exposure to the commercial vehicle segment, which saw a slowdown.

Jefferies on Entero Health

Maintains Buy; raises target price to Rs 1680 from Rs 1510.

Q2 in-line with expectations, maintaining FY25 guidance.

Reiterates FY25 revenue growth target of 35-40%.

Completed 9 acquisitions in FY25, with a revenue of Rs 750 crore for FY24.

Jefferies on Sunteck Realty

Maintains Buy; raises target price to Rs 700 from Rs 690.

Strong sales momentum with a solid balance sheet.

Pre-sales growth above 30%.

FY25 launch pipeline aligns with guidance.

Stock trades at 11x FY25 earnings; large project launches could boost performance.

BOFA on Alkem Labs

Maintains Underperform; raises target price to Rs 4640 from Rs 4560.

Reports weak revenue growth overall.

Margins are ahead of guidance but not sufficient.

Expects earnings downgrade to continue despite higher margins.

JPMorgan on Vodafone Idea

Maintains Neutral with a target price of Rs 10.

Missed revenue and EBITDA expectations.

Capex will ramp up in the second half.

Stock performance to hinge on management’s debt funding update.

Goldman Sachs on L&T

Maintains Buy with a target price of Rs 3960.

Expects strong setup for the second half.

Revenue growth outlook favorable.

Recently won large hydrocarbon projects in the Middle East, with execution to begin in 2H FY25.

CLSA on BHEL

Maintains Underperform; raises target price to Rs 205 from Rs 189.

Fossil fuel resurgence offers a unique opportunity, which BHEL is capitalizing on.

Secured 16% of NTPC’s FY25 contract inflow.

Valuation is high, and recent corrections aren’t adequate.

Nomura on Alkem Labs

Maintains Neutral with a target price of Rs 6,097.

Expects slower revenue growth but better margins in FY25.

Volume growth impacted by contract losses and supply chain issues.

US business expected to decline by mid-single digits year-over-year in FY25.

FY25 revenue growth revised to mid-single digits from 10% previously.

Margins expected to expand by 100 basis points to 18.5-19%.

Jefferies on Eicher Motors

Retains Buy with a target price of Rs 5,500 (current price Rs 4,859).

Q2 EBITDA flat year-over-year, but 8% below estimates due to lower Royal Enfield margins.

Signs of recovery in Royal Enfield volumes.

Royal Enfield positioned well in the premium two-wheeler segment.

Believes toughest competition phase is over.

Jefferies on PI Industries

Maintains Buy with a target price of Rs 5,100 (current price Rs 4,446).

CSM exports achieved double-digit growth.

Domestic revenue met expectations, and pharma performed slightly above.

Management revised FY25 revenue growth target to high single digits.

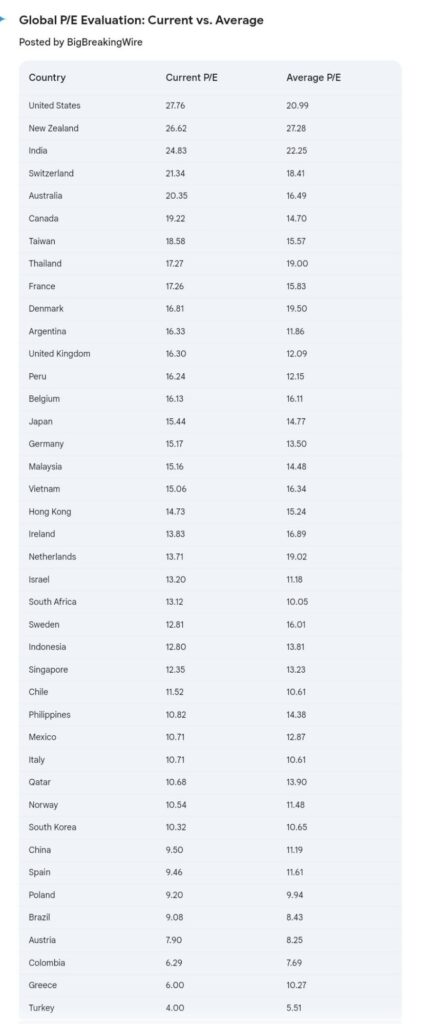

India Falls to 3rd in Global P/E Rankings; U.S. Takes the Lead

India has dropped to the 3rd position in current P/E ratios globally, with the U.S. now leading. India previously held the top spot as of October 7.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment