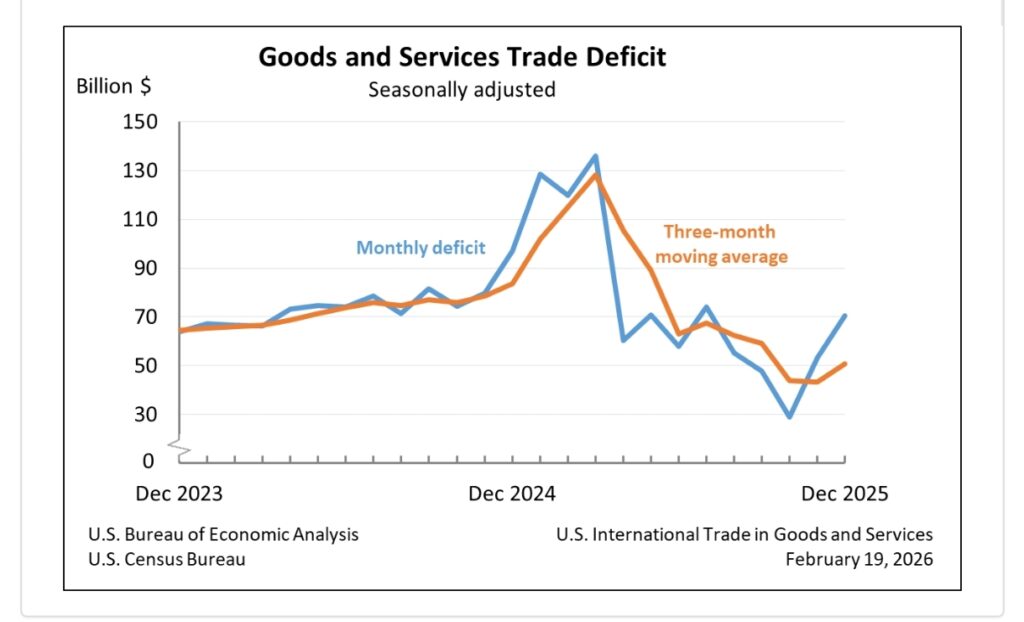

The U.S. trade deficit widened sharply to $70.3 billion in December 2025, according to official data from the U.S. Census Bureau and the Bureau of Economic Analysis. The increase was driven mainly by a strong rise in goods imports, especially computer accessories, industrial supplies, and nonmonetary gold.

For the full year 2025, the U.S. goods and services deficit reached $901.5 billion, one of the largest annual gaps in modern trade history. Both exports and imports grew significantly, showing strong global demand but also continued reliance on foreign goods.

This trend matters for investors, policymakers, and global markets because rising trade deficits can affect currency strength, interest rates, inflation trends, and global trade balances.

What Happened in the U.S. International Trade Data for December 2025

The U.S. trade deficit increased by $17.3 billion from November’s revised $53.0 billion to $70.3 billion in December 2025. This marked a sharp monthly expansion driven largely by rising imports.

Imports of goods surged by $10.2 billion to $280.2 billion, while services imports also increased to $77.4 billion. At the same time, exports showed weaker momentum, with real goods exports falling by 2.8% in December.

| Key Trade Indicators (December 2025) | Value |

|---|---|

| Goods and Services Deficit | $70.3 Billion |

| Goods Imports | $280.2 Billion |

| Services Imports | $77.4 Billion |

| Services Exports | $106.5 Billion |

| Real Goods Deficit | $97.1 Billion |

Why Did the U.S. Trade Deficit Rise in December 2025

The main reason behind the widening deficit was a strong increase in goods imports, particularly industrial supplies and capital goods. Imports of industrial supplies rose by $7.0 billion, while capital goods imports increased by $5.6 billion.

Within capital goods, computer accessories jumped by $3.4 billion and telecommunications equipment rose by $1.3 billion. Nonmonetary gold imports increased by $1.8 billion, copper by $1.5 billion, and crude oil imports also climbed by $1.0 billion.

Meanwhile, consumer goods imports fell by $3.5 billion, mainly due to a $4.6 billion drop in pharmaceutical preparations, partially offsetting the overall surge in imports.

| Major Import Changes (December 2025) | Change |

|---|---|

| Industrial Supplies and Materials | + $7.0 Billion |

| Capital Goods | + $5.6 Billion |

| Computer Accessories | + $3.4 Billion |

| Nonmonetary Gold | + $1.8 Billion |

| Pharmaceutical Preparations | – $4.6 Billion |

Bigger Context Behind the U.S. Trade Deficit in 2025

For the full year 2025, the U.S. trade deficit stood at $901.5 billion, slightly lower than $903.5 billion in 2024. Exports rose to $3,432.3 billion, while imports increased to $4,333.8 billion, showing continued expansion in global trade flows.

The goods deficit increased by $25.5 billion to $1,240.9 billion, but this was partly balanced by a strong services surplus of $339.5 billion, which grew 8.9% year over year.

Exports of goods rose by $117.7 billion in 2025, driven by capital goods, computers, aircraft, natural gas, and finished metal shapes. However, crude oil and automotive exports declined, reflecting shifts in global demand and energy trade patterns.

| Annual U.S. Trade Summary (2025) | Value |

|---|---|

| Total Exports | $3,432.3 Billion |

| Total Imports | $4,333.8 Billion |

| Total Trade Deficit | $901.5 Billion |

| Goods Deficit | $1,240.9 Billion |

| Services Surplus | $339.5 Billion |

Country-Wise Trade Deficits and Surpluses in U.S. Trade Data 2025

The U.S. recorded its largest trade deficits with the European Union ($218.8 billion), China ($202.1 billion), Mexico ($196.9 billion), Vietnam ($178.2 billion), and Taiwan ($146.8 billion) in 2025.

The deficit with Taiwan increased significantly as imports surged to $201.4 billion, while exports rose only modestly. The deficit with Vietnam also widened sharply due to rising imports of manufactured goods.

However, the U.S. maintained trade surpluses with the Netherlands ($60.7 billion), South and Central America ($52.4 billion), the United Kingdom ($32.2 billion), and Hong Kong ($28.5 billion).

How the Rising U.S. Trade Deficit Affects Markets, Inflation, and the Dollar

A widening trade deficit often signals strong domestic demand but also higher reliance on foreign goods. This can put pressure on the U.S. dollar over time and influence monetary policy expectations.

Higher imports of capital goods and technology products suggest continued business investment and supply chain activity. However, declining real exports indicate slower external demand, which may affect manufacturing growth.

For investors, trade data is a key indicator for tracking economic strength, global demand trends, and potential policy shifts by the Federal Reserve.

What Happens Next for the U.S. Trade Balance in 2026

Looking ahead, trade trends will likely depend on global growth, interest rates, and geopolitical trade policies. If imports continue to outpace exports, the deficit could remain elevated in 2026.

Strong services exports, especially in financial services, intellectual property, and business services, may continue to offset part of the goods deficit. Future inflation data, energy prices, and global supply chains will also play a critical role.

Frequently Asked Questions

Why did the U.S. trade deficit increase in December 2025?

The deficit rose mainly due to a sharp increase in goods imports, especially industrial supplies, computer accessories, and capital goods.

What was the total U.S. trade deficit in 2025?

The total U.S. goods and services trade deficit was $901.5 billion in 2025.

Which countries had the largest U.S. trade deficits in 2025?

The largest deficits were with the European Union, China, Mexico, Vietnam, and Taiwan.

Did U.S. exports grow in 2025?

Yes, total exports increased by $199.8 billion in 2025, driven by capital goods, services, and technology-related products.

Conclusion

The December 2025 trade data shows a clear shift toward higher imports and slower export growth, leading to a wider monthly deficit. While strong services exports continue to support the overall balance, the rising goods deficit highlights structural trade dependence that policymakers and markets will closely monitor in 2026.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment