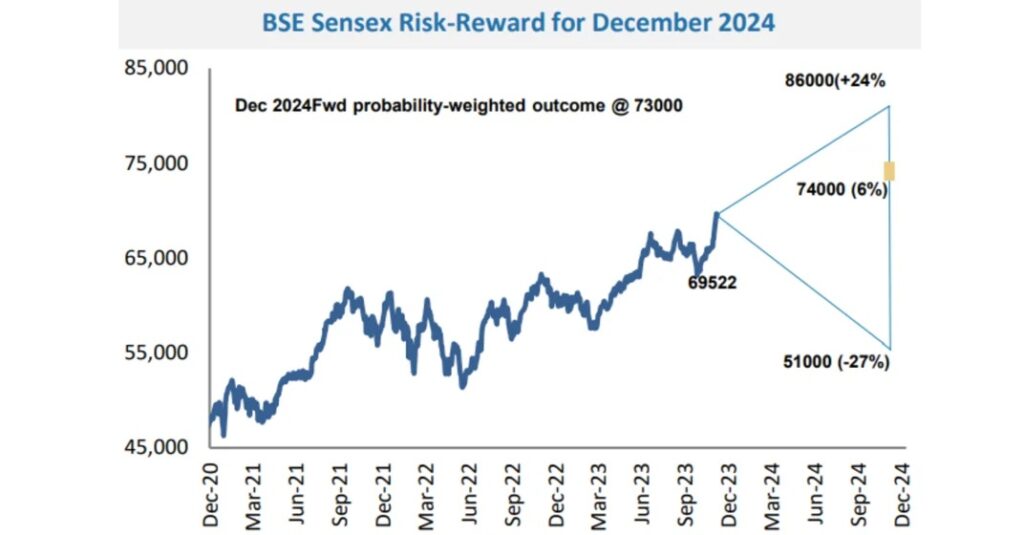

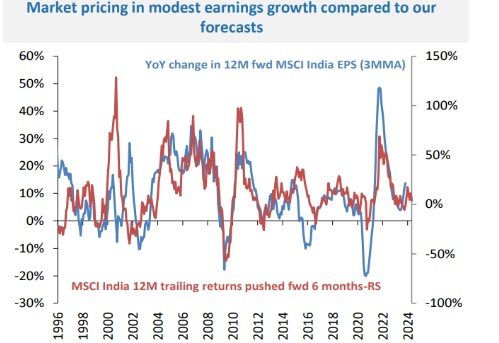

Morgan Stanley is optimistic about India’s economic outlook in 2024, projecting a 14% increase in the S&P BSE Sensex by December. This growth is contingent on political stability and a majority mandate ensuring consistent policies. The firm anticipates a 21.5% annual earnings compound through 2026, emphasizing macro stability driven by improving terms of trade and stable foreign flows.

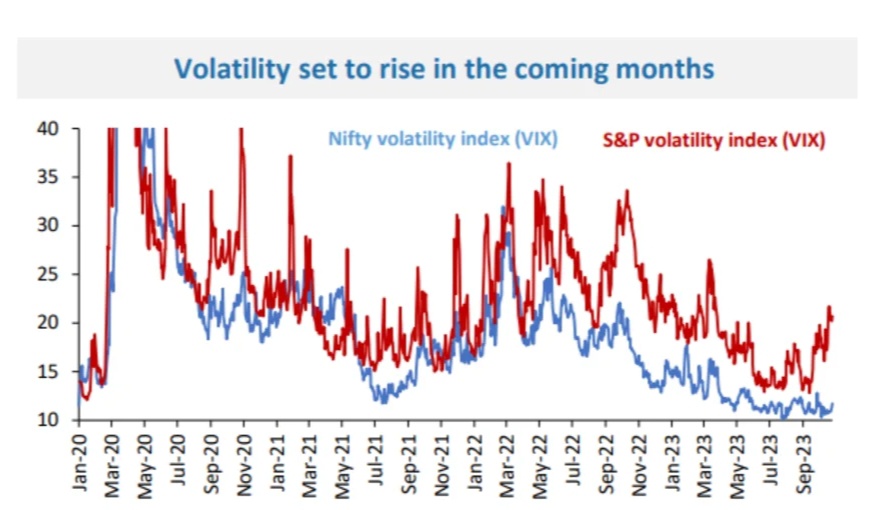

The foundation for this positive outlook lies in expectations of 20% annual earnings growth, fueled by emerging private investment, corporate balance sheet re-leveraging, increased discretionary consumption, and a reliable source of domestic risk capital. The reduced correlations and volatility of Indian stocks relative to emerging markets contribute to India’s favorable position.

Key catalysts for 2024 include political dynamics, with the market likely to rise before the Lok Sabha election, favoring continuity and a majority government. Earnings are expected to strengthen, driven by robust margins from increased capital spending. Global factors, such as softer markets and oil price fluctuations, could impact India’s absolute and relative returns.

The firm identifies key portfolio themes, being overweight on consumer discretionary, industrials, financials, and technology, while cautioning against defensives and global cyclicals. It advocates buying domestic cyclicals, expecting strong growth with benign inflation. Large caps are predicted to outperform, with emphasis on themes like clean energy, defense indigenization, and digital transformation.

Morgan Stanley also highlights potential risks, including a 30% market drawdown if election results deviate from expectations and a slowdown in global growth affecting earnings. It anticipates a rate cut by the Reserve Bank of India in mid-2024 but expects a shallow rate cycle due to domestic growth impulses. Additionally, the inclusion of India in the global bond index in June is anticipated to prompt significant inflows. Overall, the outlook is positive, but the firm acknowledges potential volatility and advises strategic investment approaches.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment