What is a Commodity Swap?

A commodity swap is a financial agreement between two parties to exchange cash flows based on the price of a commodity. These swaps are used to manage risks associated with price fluctuations in commodities like crude oil, natural gas, gold, and agricultural products.

Unlike trading in the physical market, commodity swaps are financial contracts where actual delivery of the commodity does not take place. Instead, cash settlements are made based on the agreed-upon terms.

How Does a Commodity Swap Work?

A commodity swap functions like a fixed-for-floating interest rate swap but is based on commodity prices. The two primary types of commodity swaps are:

1. Fixed-for-Floating Commodity Swap

One party agrees to pay a fixed price for the commodity.

The other party agrees to pay a floating price, which varies based on market conditions.

If the floating price is higher than the fixed price, the fixed-price payer benefits.

If the floating price is lower, the floating-price payer benefits.

2. Floating-for-Floating Commodity Swap

Both parties agree to pay based on different floating price benchmarks.

This type of swap helps in managing risks when multiple pricing indices are involved.

Example of a Commodity Swap

Let’s say a petroleum company wants to hedge against rising crude oil prices. It enters into a commodity swap with a financial institution:

The company agrees to pay a fixed price of $80 per barrel.

The financial institution pays the floating market price.

If the market price rises to $90 per barrel, the company gains because it still pays $80.

If the price falls to $70 per barrel, the financial institution benefits.

This way, the company protects itself from price fluctuations while the financial institution earns from the contract.

Purpose of Commodity Swaps

1. Risk Management

Companies and investors use commodity swaps to protect against unpredictable price changes in essential raw materials.

2. Hedging Strategy

Firms that rely on commodities for production, such as airlines (jet fuel) or food manufacturers (wheat), use swaps to stabilize costs.

3. Speculative Investment

Traders and investors use commodity swaps to speculate on future price movements without holding physical commodities.

Key Participants in Commodity Swaps

Several market players are involved in commodity swaps:

Producers (oil companies, farmers, miners) who hedge against falling prices.

Consumers (manufacturers, airlines, food industries) who hedge against rising prices.

Financial Institutions & Banks that facilitate and structure the swaps.

Traders & Investors looking for profit opportunities.

Advantages of Commodity Swaps

1. Hedging Against Price Volatility

Businesses can lock in prices and avoid unexpected losses due to price swings.

2. Cash Flow Predictability

Companies get better financial planning by ensuring stable commodity costs.

3. No Need for Physical Storage

Unlike spot market trading, commodity swaps are cash-based, eliminating the need for physical storage.

4. Customizable Contracts

Commodity swaps can be tailored to fit specific business needs and pricing structures.

Disadvantages of Commodity Swaps

1. Counterparty Risk

If one party defaults, the other may suffer financial losses.

2. Complexity

Commodity swaps involve financial derivatives that require expert knowledge.

3. Limited Market Liquidity

Unlike stocks and bonds, finding counterparties for specific commodity swaps can be challenging.

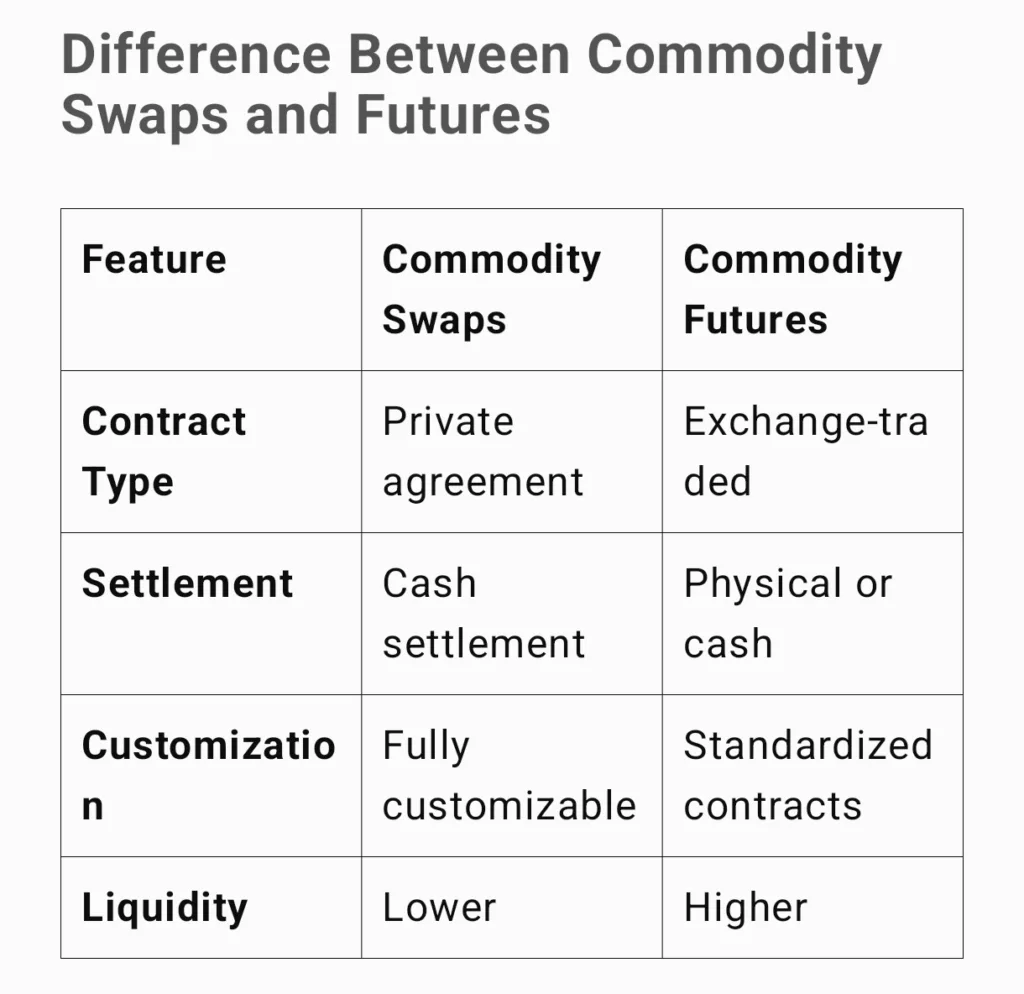

Difference Between Commodity Swaps and Futures

Popular Commodities for Swaps

The most commonly traded commodities in swap contracts include:

Crude Oil & Natural Gas

Gold & Silver

Agricultural Products (Wheat, Corn, Coffee, Sugar)

Metals (Copper, Aluminum, Iron Ore)

Conclusion

Commodity swaps are essential financial instruments used by companies and investors to hedge against price risks and stabilize costs. While they offer advantages like risk management and cash flow predictability, they also come with complexities and counterparty risks.

For businesses that rely on commodities, understanding and utilizing commodity swaps can be a powerful strategy for financial stability and long-term growth.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment