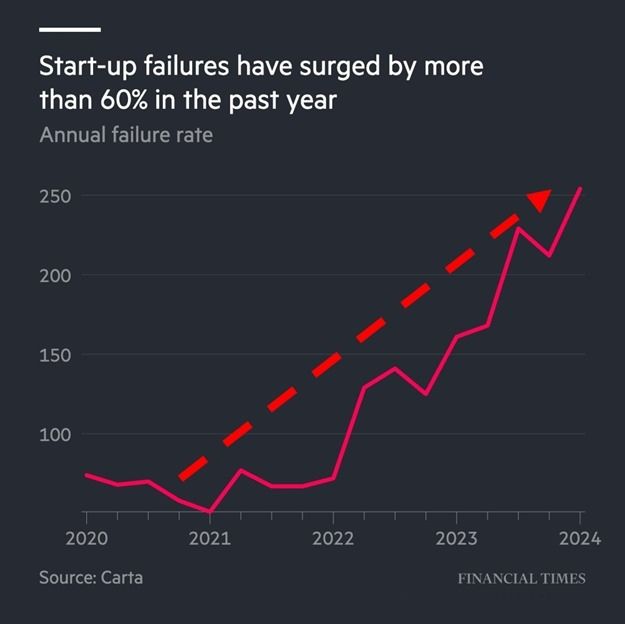

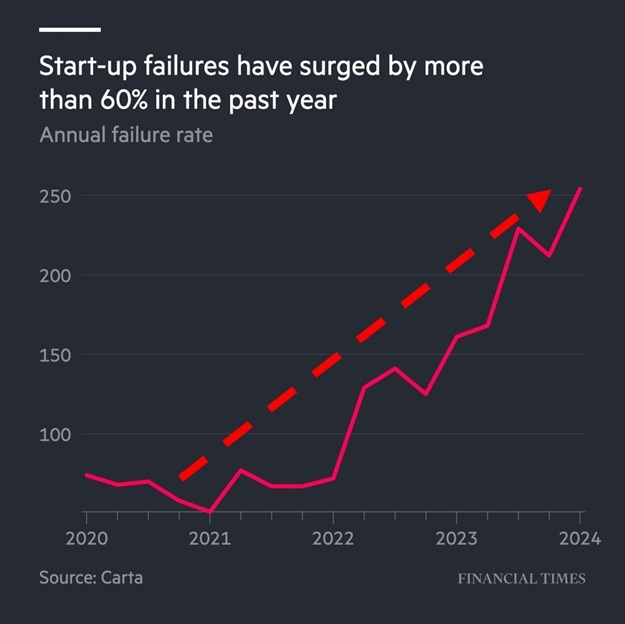

Over the past year, 254 start-ups in the United States have gone out of business, marking the highest number of failures since at least 2019. This increase represents a troubling trend, with the failure rate now seven times higher than it was five years ago. Start-up bankruptcies have surged by over 60% in just the last 12 months.

This sharp rise in failures is linked to the Federal Reserve’s decision to raise interest rates starting in March 2022. Higher interest rates make borrowing more expensive, which is particularly challenging for new and smaller businesses. These businesses often rely on loans to manage their debt and operating costs, so the increased costs have made it harder for them to stay afloat.

The broader economic environment has also contributed to these closures. Along with rising interest rates, there has been a slowdown in venture capital funding. Many start-ups, especially those that grew rapidly during the 2021-2022 tech boom, are now struggling to find financial stability. They are facing reduced access to capital and a tougher operating environment.

Start-ups at all stages of development are feeling the impact. Seed-stage companies have seen failures increase by 102%, while even more established start-ups in Series A and Series B rounds are facing significant challenges. This reflects a broader difficulty for many start-ups in adapting to the new economic realities, where investors are now prioritizing profitability over rapid growth.

As a result, small businesses, small-cap stocks, and start-ups are under serious financial strain. These companies often have less financial cushion and more debt, making them particularly vulnerable to economic changes. With high levels of debt and insufficient revenue, many of these businesses are struggling to survive.

Overall, the combination of rising interest rates, higher costs, and economic uncertainty is leading to a significant increase in the number of start-up shutdowns and bankruptcies across various industries. This challenging environment is making it increasingly difficult for new businesses to not only survive but thrive.

Update

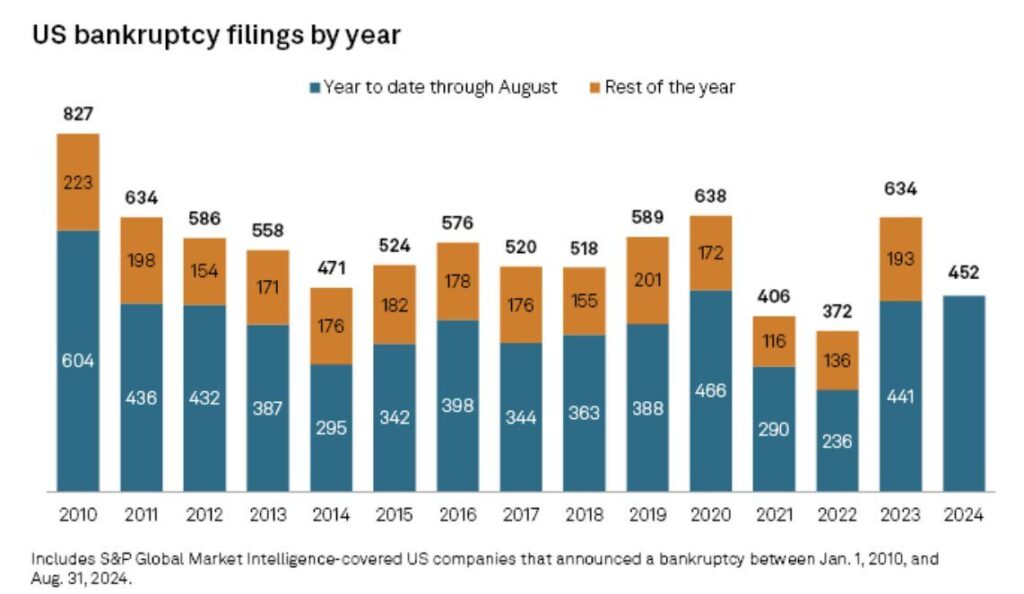

The number of U.S. bankruptcies so far this year has reached 452, marking the second highest 8-month total since 2010.

August saw a significant rise in U.S. bankruptcy filings, reversing the July slowdown. A total of 63 bankruptcies were recorded in August, up from 49 in July, making it the third-highest monthly total this year, behind June’s 72 and April’s 68.

For the year to date, 452 bankruptcy filings have been registered through August. This is close to the 466 filings recorded in 2020 during the pandemic and the 604 filings in 2010.

Notable companies filing for bankruptcy include solar technology provider SunPower Corp, cosmetics wholesaler Avon International, and gas station operator SQRL Service Stations. SunPower’s Blue Raven Solar LLC is expected to be acquired by Complete Solaria Inc. for $45 million.

The hardest-hit sectors are consumer discretionary, industrials, and healthcare, which account for about 60% of the filings. Consumer discretionary has been particularly affected due to inflation and cautious consumer spending.

In recent developments, discount retailer Big Lots filed for Chapter 11 protection as part of its acquisition by Nexus Capital Management LP. Despite these challenges, the U.S. economy grew at an annual rate of 3% in Q2, as businesses continue to manage high interest rates and geopolitical uncertainties.

Update

Bankruptcy filings in the US rose by 8 last week, marking the second-highest week in 2024. The only higher count was in early April when 14 companies filed, the most in 15 years. In Q2 2024, ongoing Chapter 11 cases reached 2,462, the highest in 13 years. This is a sharp rise compared to Q1 2022 when bankruptcies were 60% lower at around 980. The increase is driven by higher interest rates, rising prices, and declining consumer spending.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment