UBS has expressed concerns about rising non-performing loans (NPLs) and a decline in portfolio quality across several Indian banks and NBFCs. Here’s a detailed summary of their outlook:

Bank Ratings and Target Price Changes

– IndusInd Bank: UBS maintained its neutral rating but reduced the target price to ₹1,150 (from ₹1,350), citing portfolio risks.

– Axis Bank: Retained its neutral stance, lowering the target price to ₹1,210 (from ₹1,250).

– AU Small Finance Bank: UBS remained neutral, cutting the target price to ₹640 (from ₹750).

– Top Picks: HDFC Bank, ICICI Bank, and Federal Bank remain UBS’s preferred stocks in the sector.

Key Concerns

UBS raised alarms about:

– NPL Risks: Higher risks of bad loans, especially in commercial vehicle (CV) and business loan segments.

– Portfolio Quality: Static pool analysis of recent disbursements revealed a decline in overall quality.

NBFC Outlook

For non-banking financial companies (NBFCs), UBS:

– Increased credit cost estimates by 1–20 basis points for FY25 and FY26.

– Reduced earnings per share (EPS) forecasts by 1–7% for companies like Bajaj Finance, Cholamandalam Investment, Shriram Finance, and M&M Finance.

– Raised credit cost estimates by 2–25 basis points across multiple lenders, reflecting the trend of rising NPLs.

Overall, UBS’s cautious stance reflects growing concerns about credit quality and profitability in both the banking and NBFC sectors.

SBI seeks ¥30B loan at 60bps over TONA

State Bank of India (SBI) is planning to secure a ¥30 billion ($197 million) loan, with Mitsubishi UFJ Financial Group leading the arrangement. The loan, which has a tenure of five years, is being raised in Gujarat International Finance Tec-City (GIFT City) and will carry a margin of 60 basis points (bps) over the Tokyo Overnight Average Rate (TONA).

Additionally, other Indian banks are pursuing a separate syndicated loan deal amounting to $1.25 billion, reflecting increased interest in raising funds through international markets. These moves indicate a growing trend of Indian banks leveraging foreign funding sources for expansion and operational needs.

UBS Warns of Risks to India Amid US-China Tensions

UBS Chief Strategist Bhanu Baweja warns that India’s booming stock market may face risks if US-China trade tensions escalate, potentially triggering disinflationary effects from weakened Chinese exports. UBS has held an underweight view on Indian equities since 2022, advising caution for aggressive buyers as China’s outlook could impact markets.

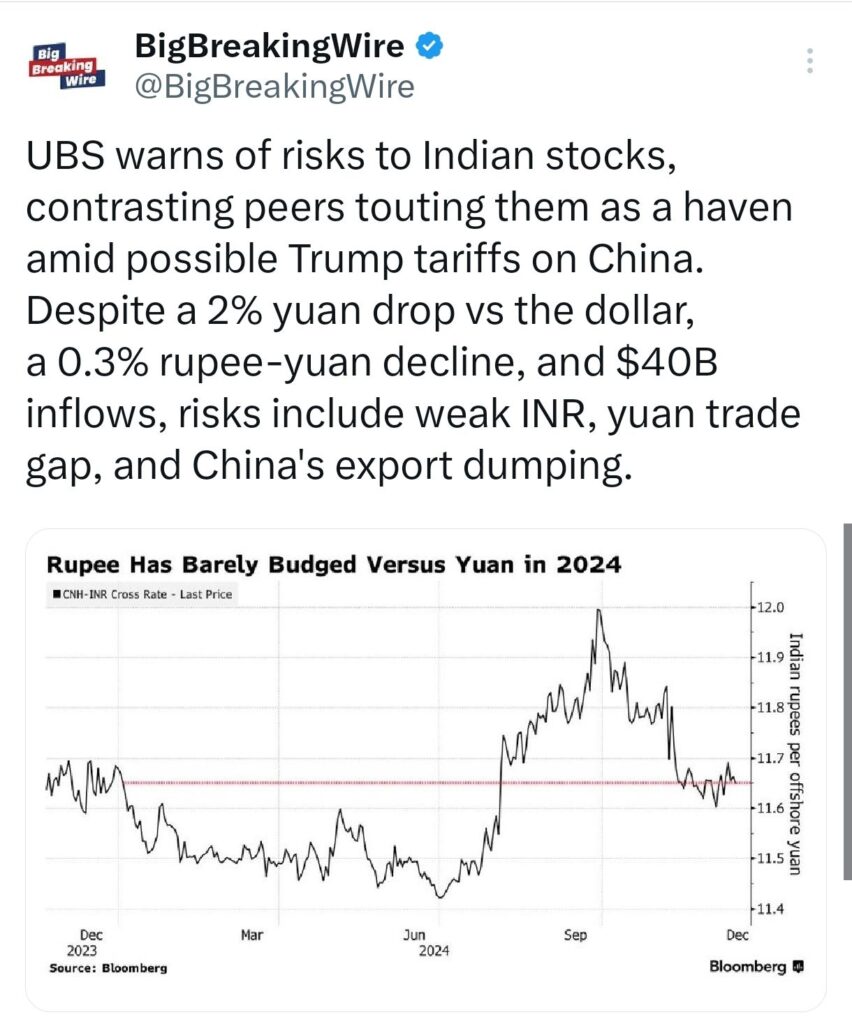

UBS Flags Risks to Indian Stocks Amid Tariffs

UBS warns that Indian stocks face risks, despite strong inflows and outperforming emerging markets for four consecutive years. While some see India as a haven, especially if Trump imposes tariffs on China, concerns arise from a weakening rupee, which has only fallen 0.3% against the yuan this year. The yuan’s growing influence and China’s potential export dumping could impact India’s market, especially with disinflationary pressures.

Indian banks’ short-term debt hits $51.4B

Indian banks have accumulated a record $51.4 billion in short-term debt, marking the highest level in 12 years. This surge is driven by a growing mismatch between deposit growth and loan demand, pushing banks to increasingly rely on short-term borrowing to address their funding requirements.

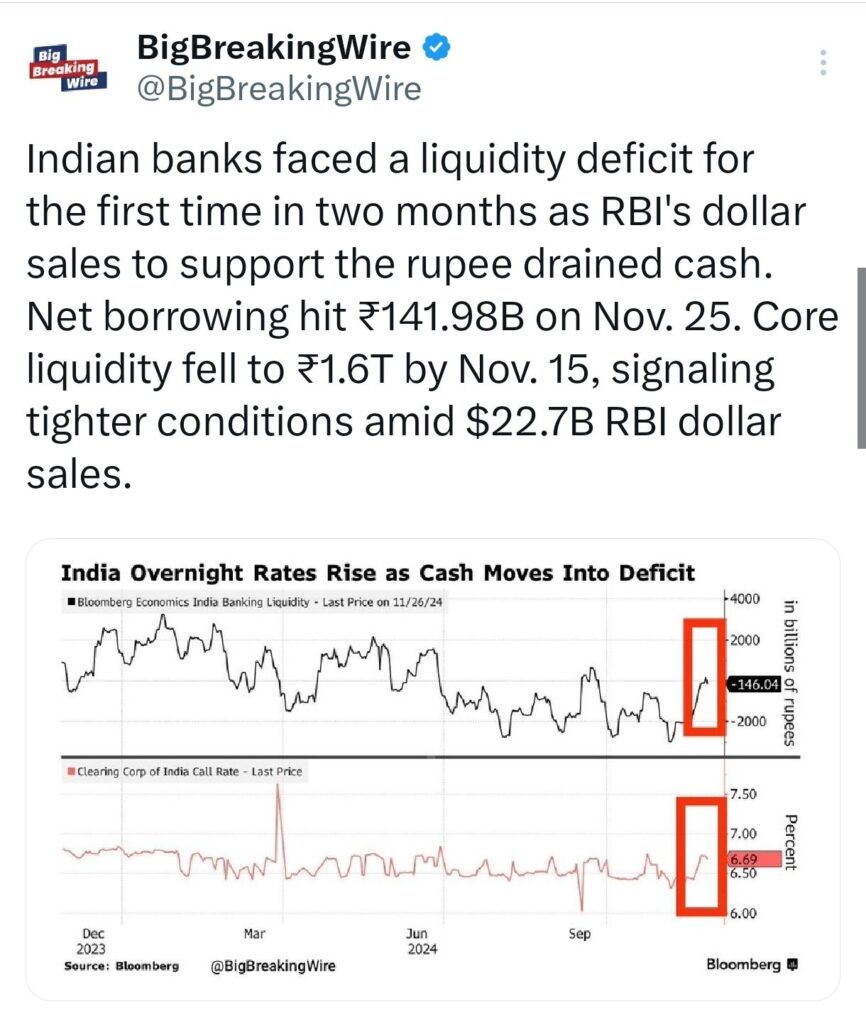

In addition, banks recently experienced a liquidity deficit for the first time in two months. This was primarily due to the Reserve Bank of India (RBI) selling dollars to support the rupee, which drained liquidity from the banking system. On November 25, net borrowing by banks reached ₹141.98 billion.

Core liquidity, which reflects the overall cash availability in the system, dropped to ₹1.6 trillion by November 15. This tightening in liquidity conditions follows $22.7 billion in dollar sales by the RBI, underscoring the challenges faced by banks amid rising funding pressures.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment