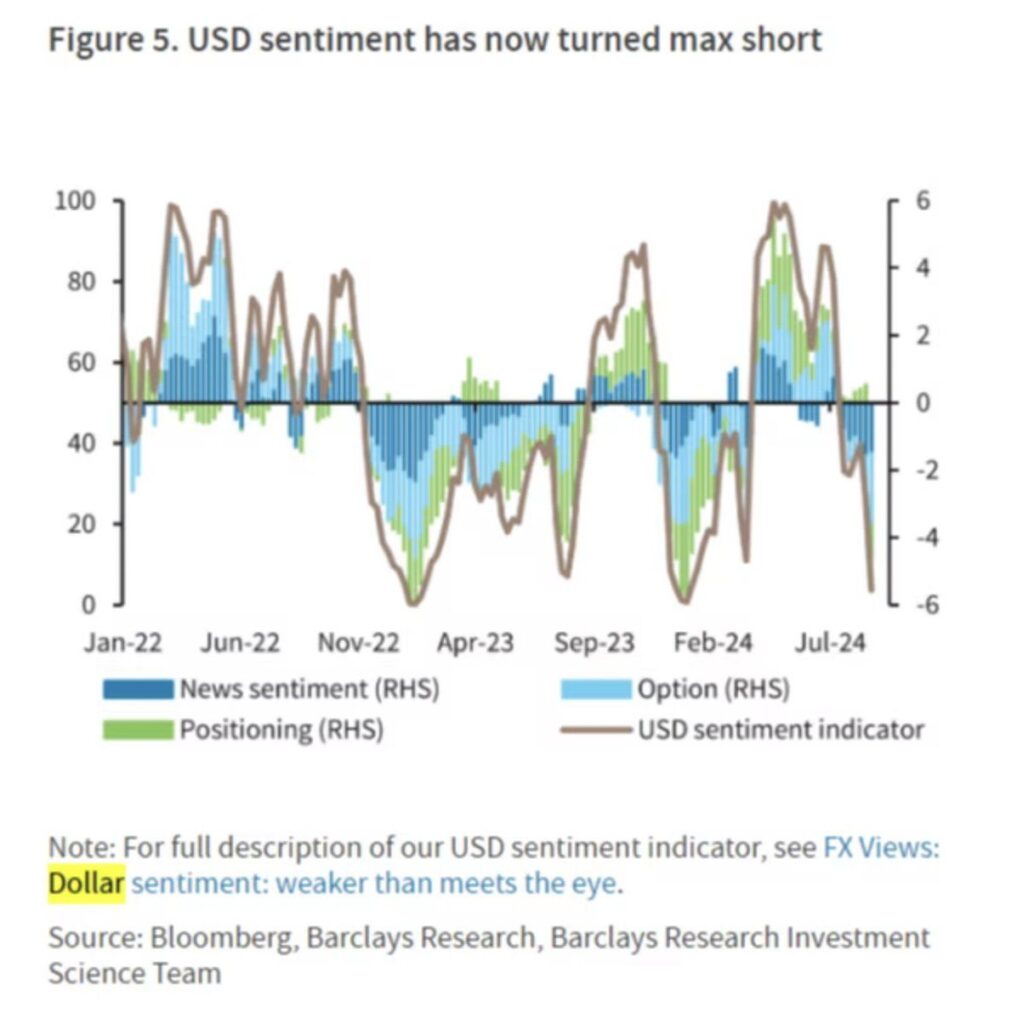

The sentiment around the U.S. Dollar has shifted dramatically, with traders and investors now holding the most bearish outlook in years. As of the latest reports, market participants are positioning for further declines in the dollar, driven by expectations of a more dovish stance from the Federal Reserve and growing confidence in global economic recovery.

Key Factors Behind the Bearish Sentiment

1. Federal Reserve’s Policy Outlook: The Federal Reserve has signaled a potential pause or slower pace in interest rate hikes, which is reducing the dollar’s appeal. Lower interest rates typically weaken a currency as they offer lower returns on investments.

2. Global Economic Recovery: With the global economy showing signs of recovery, especially in Europe and Asia, investors are diversifying away from the dollar. The Euro and other major currencies have gained strength as their economies bounce back faster than anticipated.

3. Rising Inflation Concerns: Concerns about inflation in the U.S. have also contributed to the bearish sentiment. As inflation rises, the purchasing power of the dollar diminishes, leading to a weaker currency.

4. Shift in Risk Appetite: There’s been a noticeable shift in risk appetite among investors, with more funds flowing into emerging markets and commodities, which are seen as higher-risk but higher-reward investments. This shift is reducing demand for the traditionally safe-haven dollar.

5. Technical Indicators: Technical analysis shows that the U.S. Dollar Index (DXY) has breached key support levels, suggesting that further declines may be imminent. Traders are closely watching for the next levels of support, which, if broken, could lead to an accelerated sell-off.

Recent Developments

– Speculative Positions: Data from the Commodity Futures Trading Commission (CFTC) reveals that net short positions on the dollar have surged, with hedge funds and other speculators increasing their bearish bets.

– Central Bank Actions: Central banks around the world, particularly in Europe and Asia, are starting to tighten their monetary policies, which could further weaken the dollar as their currencies strengthen.

– Market Sentiment: A recent survey of currency strategists showed that a majority expect the dollar to decline further over the next few months, with some predicting a fall of up to 5% against a basket of major currencies.

As the U.S. dollar sentiment turns max short, investors should be cautious and stay informed about the latest market developments. The next few months could see increased volatility in currency markets, with significant implications for global trade and investment strategies.

U.S. Dollar Index $DXY is currently trading below its 200-day moving average by the widest margin since July 2023.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment