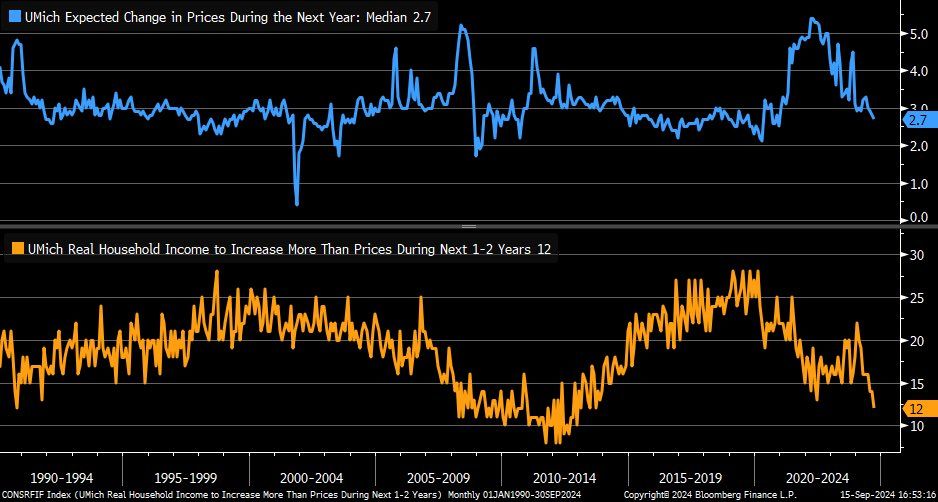

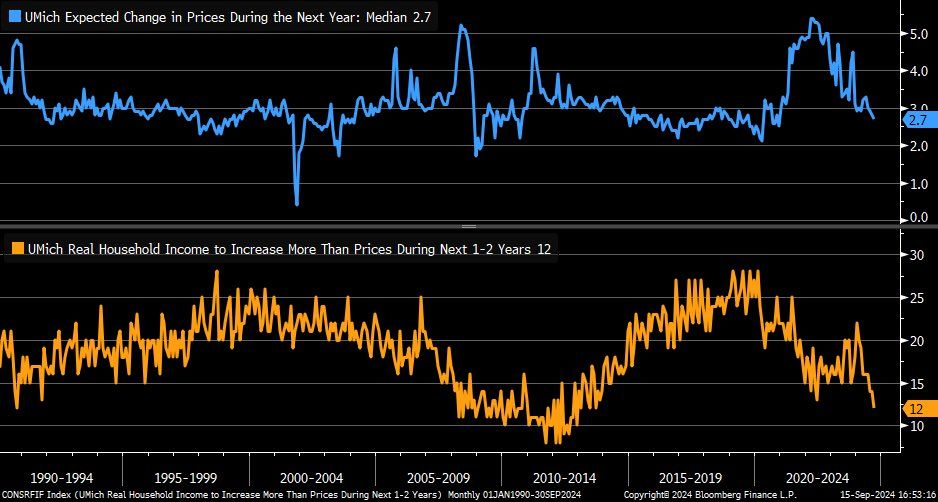

Recent data reveals that U.S. consumers’ expectations for their income to rise faster than prices have fallen to their lowest level since 2013. This signals growing concerns about the ability to keep up with inflation in the next one to two years.

A majority of Americans now expect that their earnings will not be able to match or exceed the rising cost of living. This negative outlook has worsened in recent months, despite expectations that inflation may gradually decrease. As essential costs, such as food and energy, continue to climb, consumer confidence has been significantly impacted.

Key factors contributing to this decline in economic confidence:

1. Rising Food Prices: Food prices have reached record highs, placing an increased burden on household budgets. This makes it difficult for families to allocate money for other essential items and savings.

2. Diminished Income Growth Expectations: The anticipation of income growth has fallen to its lowest point since 2020. With fewer people expecting pay raises or promotions, there is a growing fear of income stagnation.

3. Impact on Consumer Spending: As inflation outpaces wages, many consumers are adjusting their spending habits. This can potentially slow economic growth, as lower confidence typically leads to reduced consumption.

4. Broader Economic Uncertainty: Ongoing issues such as geopolitical tensions, supply chain disruptions, and rising interest rates add to the uncertainty, leaving consumers wary about the future of the economy.

Although inflation is expected to cool, this has done little to reassure Americans about their financial outlook. The combination of high prices and low income growth expectations has led to widespread pessimism about the economy’s direction.

As the gap between income and inflation widens, this trend could continue to affect consumer sentiment, resulting in slower economic recovery.

This drop in economic confidence serves as a reminder of the challenges facing U.S. households as they navigate an increasingly uncertain financial landscape.

By keeping a close eye on inflation and wage growth trends, policymakers may need to consider measures that can help restore consumer confidence and promote financial stability for American households.

This decline in economic optimism highlights the importance of tackling both inflation and wage growth to ensure that the average American is not left behind.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment