President Donald Trump has announced plans to impose a 25% import tax on all steel and aluminum entering the U.S., with importers set to pay this fee on top of existing tariffs. This decision is expected to impact Canada, the U.S.’s largest supplier of aluminum, the hardest.

Trump stated that details of reciprocal tariffs would be revealed later in the week, indicating that countries imposing tariffs on U.S. goods could face similar penalties. However, he did not specify which nations would be affected or if any exemptions would be made. Speaking while traveling to the Super Bowl in New Orleans, Trump said, “If they charge us, we charge them.”

The new tariffs come as part of Trump’s broader trade policy, which has previously targeted countries like Canada, Mexico, and the European Union. During his first term, he imposed a 25% tariff on steel imports and 10% on aluminum from these countries. While agreements with Canada and Mexico eventually lifted these tariffs, EU duties remained until 2021. Trump confirmed this week that the 25% steel tariff would apply to all imports.

Canada and Mexico are major trading partners for the U.S. in steel, with Canada also being a significant aluminum supplier. In response to Trump’s move, Ontario Premier Doug Ford criticized the tariffs, calling them “shifting goalposts” and a risk to the economy.

The announcement has already shaken markets in steel-exporting countries like South Korea. Shares of POSCO Holdings, South Korea’s leading steel company, dropped 3.5%, while Hyundai Steel fell 3%. Kia Corp, a major carmaker, also saw its stock dip by 3.8%.

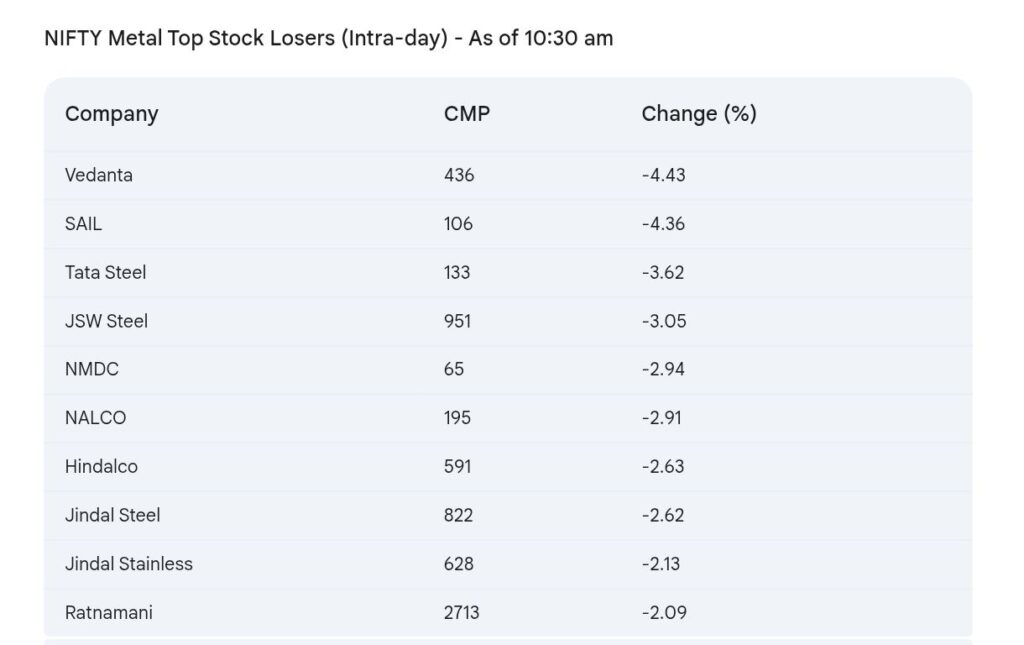

India’s Nifty Metal index dropped by more than 2%, making it the worst-performing index today. Major metal companies like Tata Steel, JSW Steel, and Hindalco Industries fell around 3%, ranking among the worst Nifty 50 performers. Other companies like Steel Authority of India, Vedanta, NMDC, NALCO, and Jindal Steel dropped by 3-4%. The Nifty Metal index was the hardest-hit sector, down over 2%.

This latest move is a continuation of Trump’s aggressive trade policies, which have already led to retaliation from China and other countries. The tariffs are likely to escalate tensions further, affecting international trade relations.

China Announces Retaliatory Tariffs on U.S. Goods Starting February 10, 2025

In response to the U.S. imposing a 10% tariff on all Chinese imports, China has announced its own tariffs on various U.S. goods, starting February 10, 2025. Here’s what will happen:

15% Tariff: China will impose a 15% tariff on U.S. coal and liquefied natural gas (LNG).

10% Tariff: U.S. crude oil, agricultural machinery, and some vehicles will be taxed at 10%. These tariffs affect about $14 billion worth of U.S. products, which is much smaller compared to the $450 billion worth of Chinese goods affected by U.S. tariffs.

Udpate

According to a CNBC interview, White House economic adviser Kevin Hassett said that former President Trump would decide when to stop waivers on steel imports. He also mentioned that India has very high tariff rates. Additionally, Hassett stated that Trump aimed to fight inflation by increasing the labor supply and reducing overall demand.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

One Comment