U.S. President Donald Trump has announced sweeping new tariffs on several imported goods, effective October 1, 2025. The biggest move is a 100% tariff on all branded or patented pharmaceutical products unless the company is building a pharmaceutical manufacturing plant inside the United States.

Details of the Tariff on Pharmaceuticals

According to Trump’s post on Truth Social, pharmaceutical companies will avoid the tariff only if they are actively building a plant in the U.S. The definition of “IS BUILDING” includes either breaking ground or being under construction. If construction has started, the tariff will not apply to that company’s products.

“Starting October 1st, 2025, we will be imposing a 100% Tariff on any branded or patented Pharmaceutical Product, unless a Company IS BUILDING their Pharmaceutical Manufacturing Plant in America,” Trump wrote.

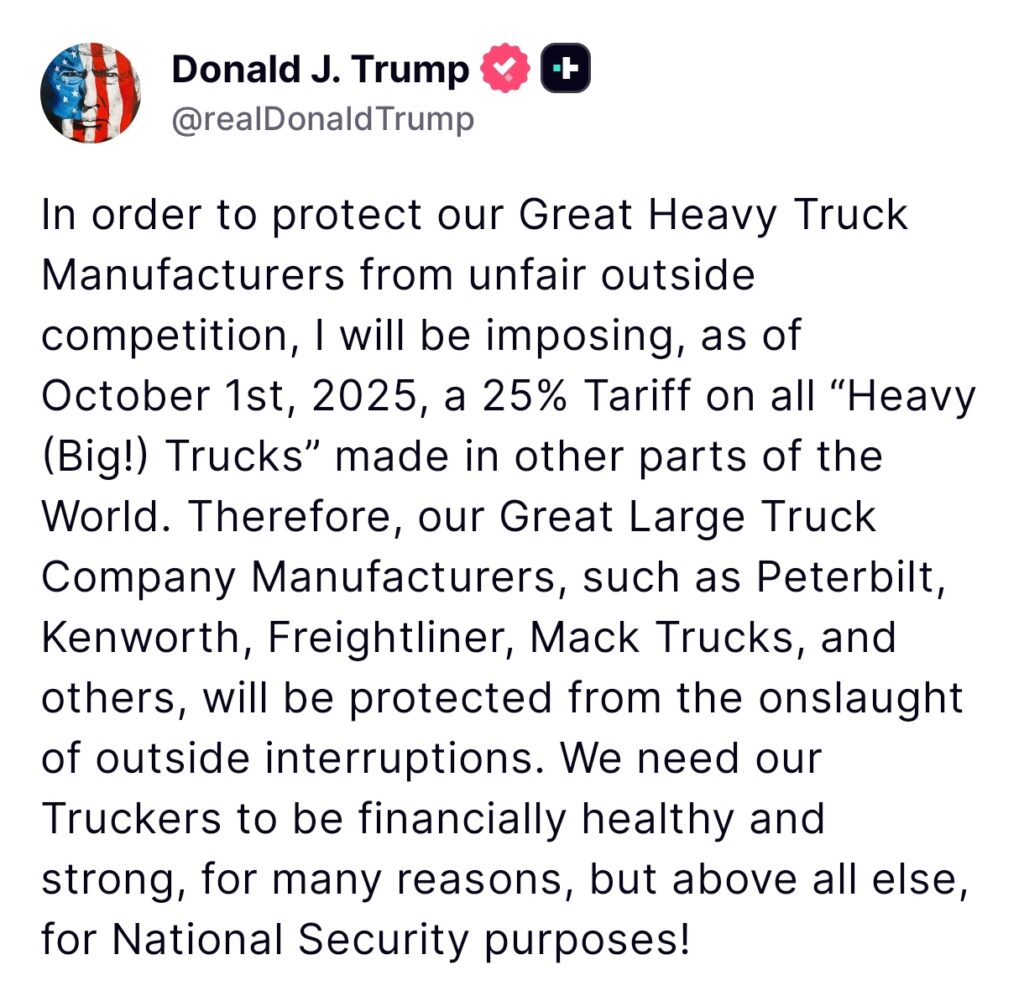

Additional Tariffs on Trucks, Cabinets, and Furniture

The new measures are not limited to medicines. Trump also announced tariffs on other goods:

- Heavy Trucks: 25% tariff on all heavy-duty trucks made outside the U.S.

- Kitchen Cabinets: 50% tariff due to “flooding” of imports.

- Upholstered Furniture: 30% tariff to protect local manufacturers.

Trump explained that these steps are designed to protect American industries from what he called “unfair outside competition.” He highlighted the importance of protecting U.S. truck manufacturers such as Peterbilt, Kenworth, Freightliner, and Mack Trucks, calling it a matter of national security.

Impact on Indian Drugmakers

The U.S. remains the largest export market for Indian pharmaceutical companies, especially for affordable generic medicines. In 2024, India exported $3.6 billion (Rs 31,626 crore) worth of pharmaceuticals to the U.S. In just the first half of 2025, exports reached $3.7 billion (Rs 32,505 crore).

Leading Indian drugmakers such as Dr. Reddy’s Laboratories, Sun Pharma, Lupin, and Aurobindo have benefited from the U.S. market’s demand for lower-cost generics. While the new tariff specifically targets branded and patented medicines (mostly dominated by multinational giants), there is uncertainty about complex generics and specialty medicines, which could also be impacted.

Experts believe Indian companies may face indirect challenges if the U.S. broadens the definition of targeted drugs or if multinational rivals shift strategies to protect market share.

Why These Tariffs Matter

The pharmaceutical tariff is intended to push foreign companies to set up factories in America, boosting local jobs and reducing dependency on imports. Similarly, the truck, furniture, and cabinet tariffs aim to revive U.S. manufacturing and protect domestic workers from global price competition.

However, global trade experts warn that such aggressive tariffs could lead to retaliation from other countries and may increase costs for U.S. consumers and businesses.

Conclusion

President Trump’s new tariff policy marks a major shift in U.S. trade strategy, targeting key sectors like pharmaceuticals, heavy trucks, furniture, and home goods. For India, the move brings risks for its booming pharmaceutical exports, particularly if the scope of the tariffs expands beyond patented medicines.

The coming months will reveal whether pharmaceutical firms decide to invest in new U.S. manufacturing plants to avoid the steep 100% tariff and how Indian drugmakers adapt to the changing U.S. trade landscape.

U.S. Tariffs Have Limited Impact on Chinese Healthcare

Jefferies analysts say the new U.S. tariffs on pharmaceutical imports won’t greatly affect China’s healthcare sector. Most Chinese pharmaceutical companies have very little sales in the U.S., so the tariffs don’t hit them directly.

For Chinese biotech firms, investors might worry about U.S. expansion, but most are still 1-2 years away from selling in the U.S. Moreover, many have U.S. partners, which protects them from these tariffs, leaving China’s healthcare giants largely unaffected.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment