Technical analysis is a popular method used by traders and investors to evaluate and predict future price movements in the stock market, cryptocurrencies, forex, and other financial instruments. Unlike fundamental analysis, which looks at a company’s financial health, technical analysis focuses on price action, volume, and historical patterns.

In this article, you’ll learn everything you need to know about technical analysis — from its basic principles to the tools and strategies used by professional traders.

Note: This is just an intro. More deep analysis & strategies coming soon. Stay connected!

Table of Contents

1. What is Technical Analysis?

2. Key Principles of Technical Analysis

3. Types of Technical Charts

4. Common Technical Indicators

5. Support and Resistance

6. Candlestick Patterns

7. Chart Patterns Every Trader Should Know

8. Timeframes in Technical Analysis

9. Limitations of Technical Analysis

10. Final Thoughts

What is Technical Analysis?

Technical analysis is a method of forecasting price direction by analyzing past market data, primarily price and volume. It is based on the idea that “history tends to repeat itself” in predictable patterns and that all known information is already reflected in the price.

Traders use technical analysis to identify entry and exit points, plan risk management, and make informed decisions — whether for short-term trades or long-term investments.

Key Principles of Technical Analysis

1. Market Discounts Everything

This principle suggests that all factors — company fundamentals, news, economic data — are already reflected in the asset’s price. So, analysts focus on price action only.

2. Price Moves in Trends

Prices move in trends: uptrends, downtrends, or sideways (range-bound). Identifying these trends helps traders follow the market rather than fight it.

3. History Repeats Itself

Human psychology and market behavior tend to repeat over time. Technical analysis leverages this idea using patterns and indicators to forecast future movement.

Types of Technical Charts

1. Line Chart

Simple and clean

Plots closing prices over time

Good for beginners

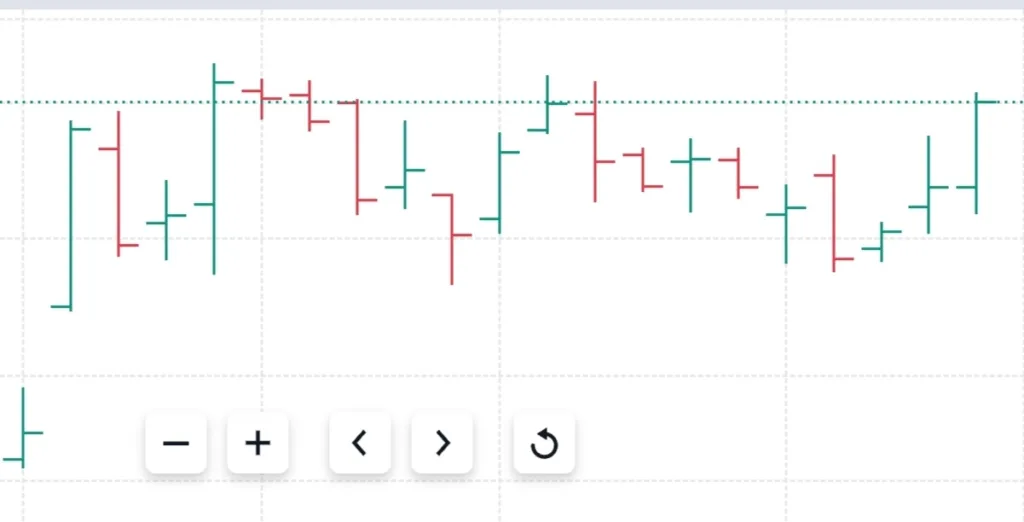

2. Bar Chart

Shows open, high, low, and close (OHLC)

Gives more details than a line chart

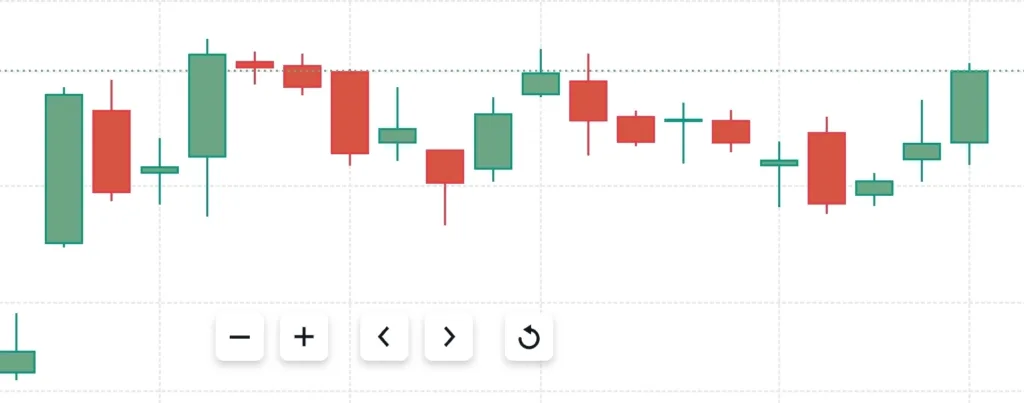

3. Candlestick Chart

Most popular

Displays OHLC data using visual candles

Great for spotting patterns and trends

Common Technical Indicators

Technical indicators help traders measure trends, momentum, volatility, and volume. Here are some popular ones:

1. Moving Averages (MA)

Smoothens price data

Simple Moving Average (SMA) and Exponential Moving Average (EMA)

Used to identify trend direction

2. Relative Strength Index (RSI)

Measures momentum

Scale: 0 to 100

Above 70 = Overbought, Below 30 = Oversold

3. MACD (Moving Average Convergence Divergence)

Tracks trend strength and reversals

Consists of MACD line, signal line, and histogram

4. Bollinger Bands

Measures volatility

Composed of a middle moving average and two outer bands

Prices tend to return to the mean

5. Volume

Indicates the strength of a price move

High volume = strong move, Low volume = weak move

Support and Resistance

What is Support?

Support is a price level where buying interest is strong enough to prevent further decline. Traders often place buy orders near support levels.

What is Resistance?

Resistance is a price level where selling interest is strong enough to stop price from rising. Traders often take profits or short here.

Why Are They Important?

Helps identify entry/exit points

Used to place stop-loss or target levels

Often aligns with key psychological levels

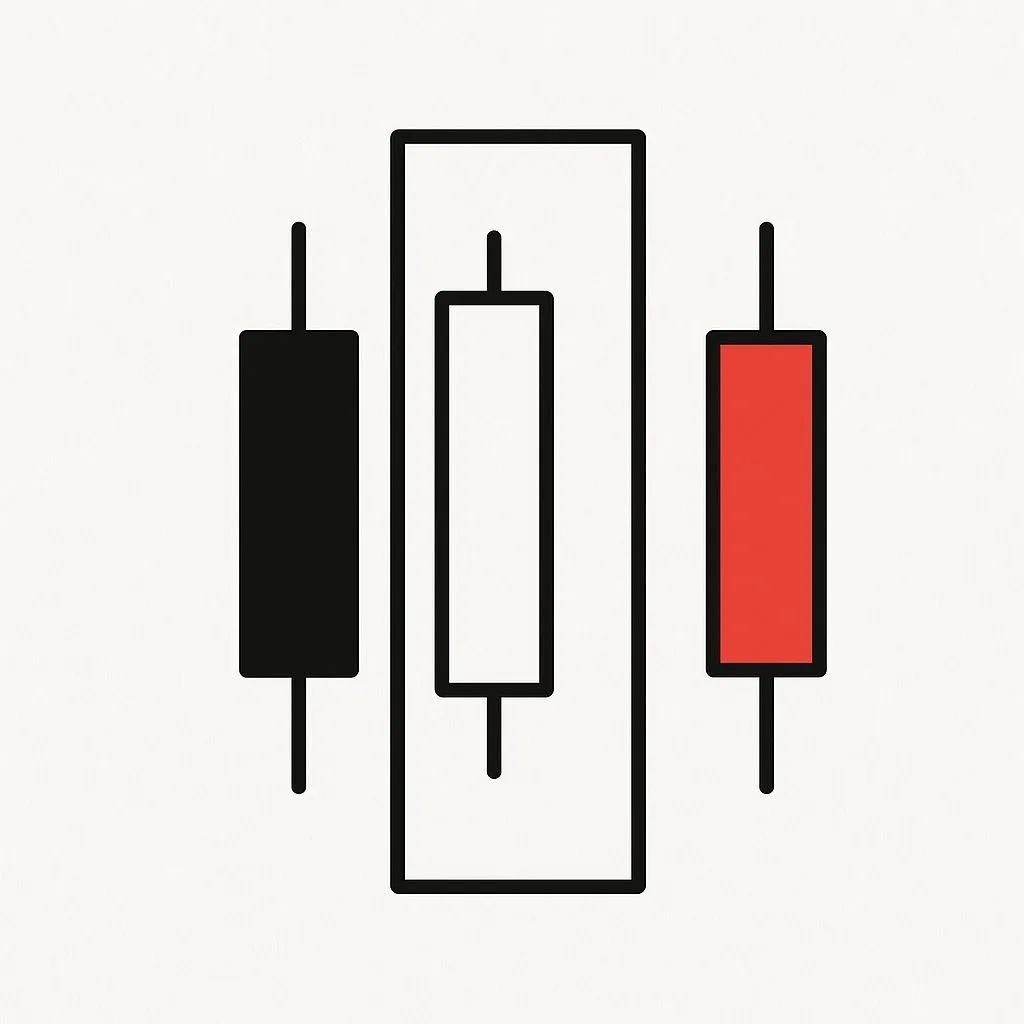

Candlestick Patterns

Candlestick patterns are visual indicators of market sentiment. Some common types include:

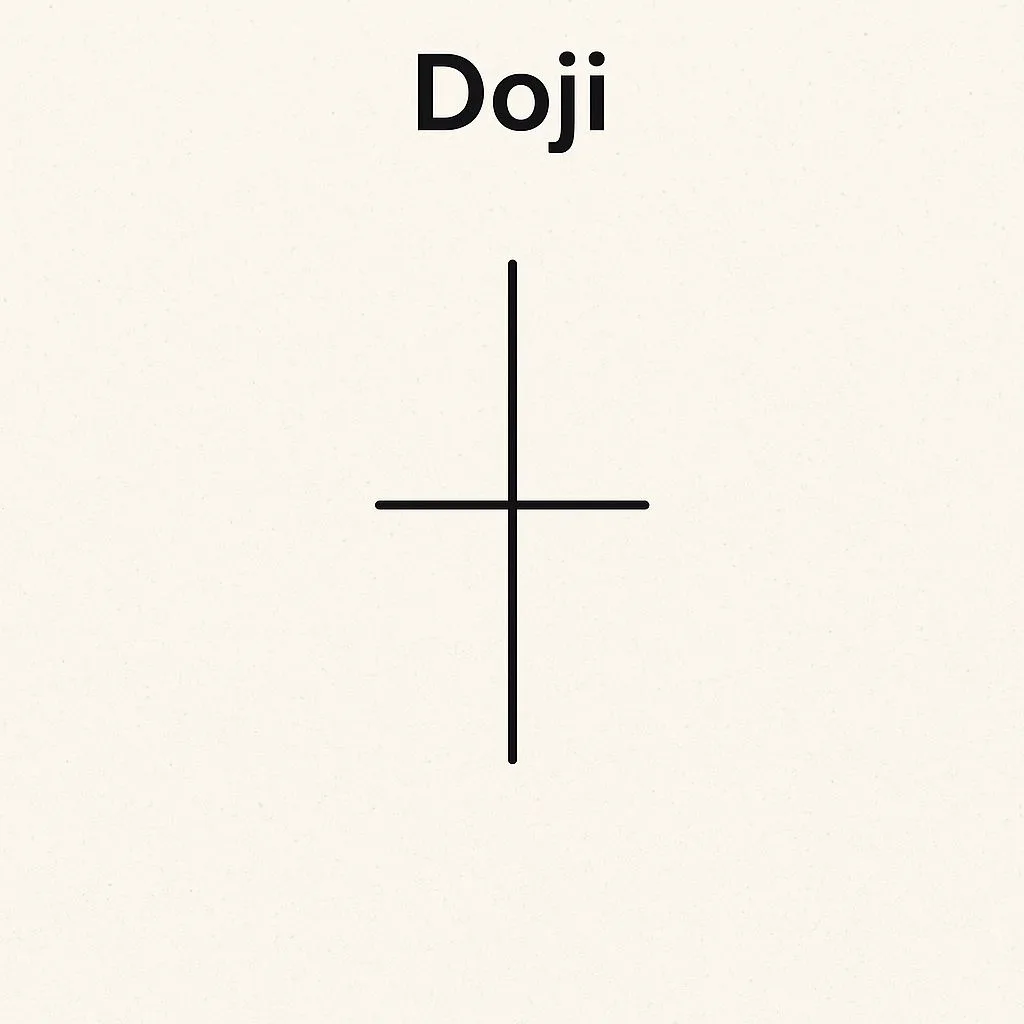

1. Doji

Indicates indecision

Often appears before reversals

2. Hammer

Bullish reversal pattern

Appears after a downtrend

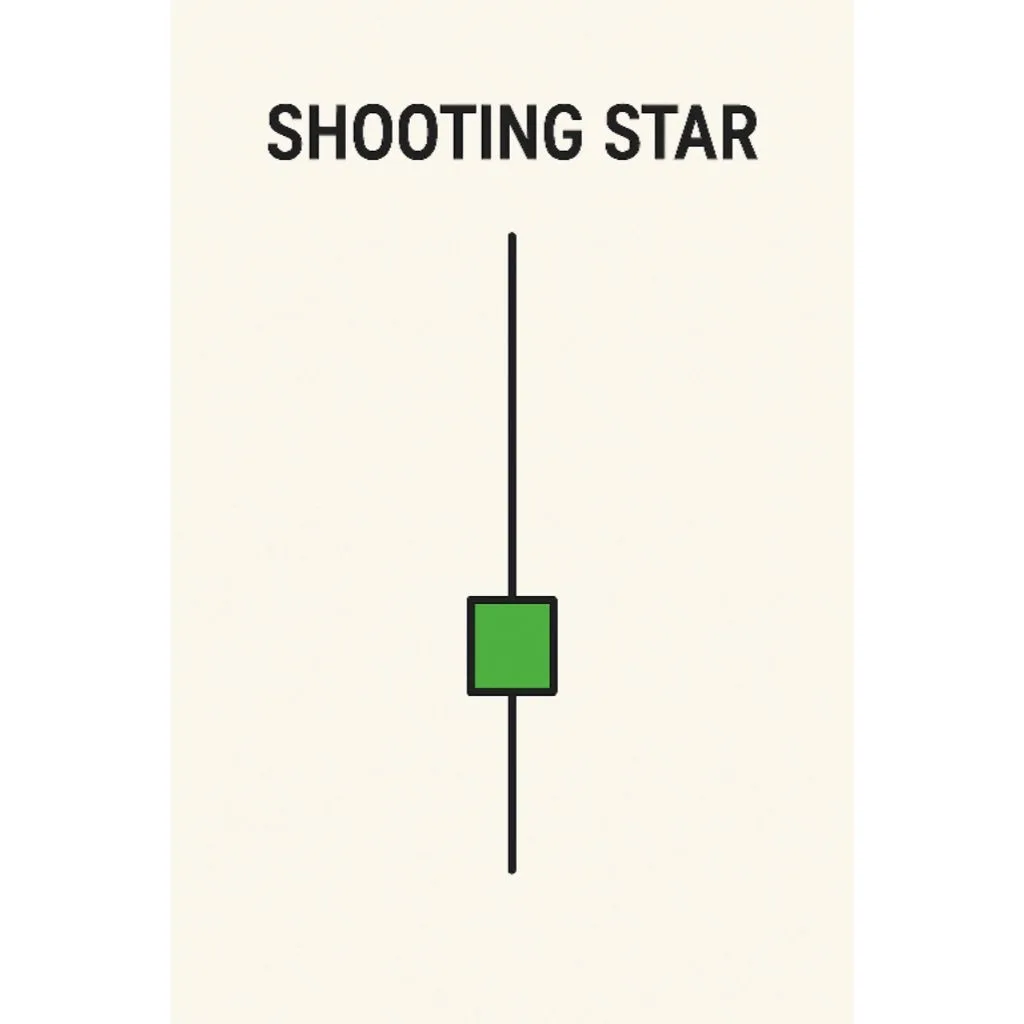

3. Shooting Star

Bearish reversal pattern

Appears after an uptrend

4. Engulfing Patterns

Bullish or bearish

Shows strong reversal when a candle fully engulfs the previous one

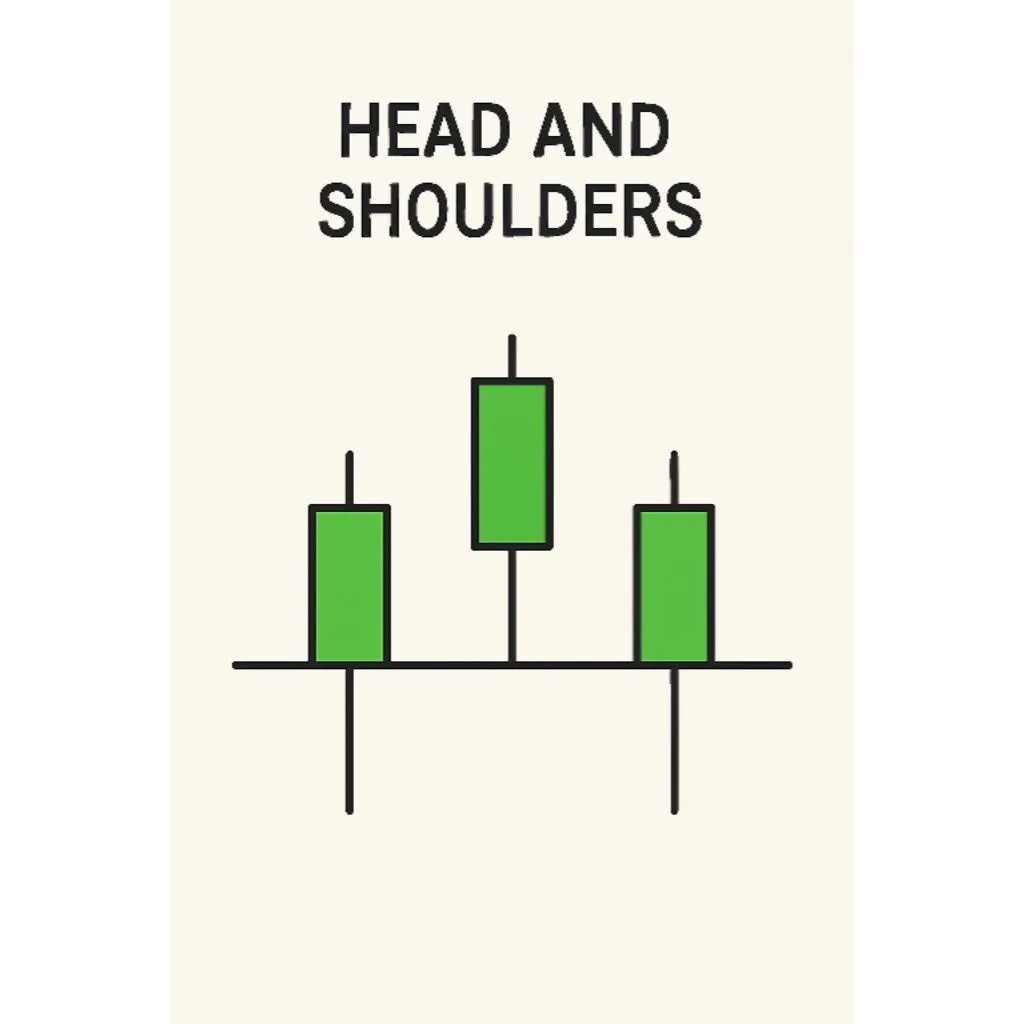

Chart Patterns Every Trader Should Know

Chart patterns help predict future price moves. These patterns are categorized into continuation and reversal patterns.

1. Head and Shoulders

Reversal pattern

Signals trend change (top or bottom)

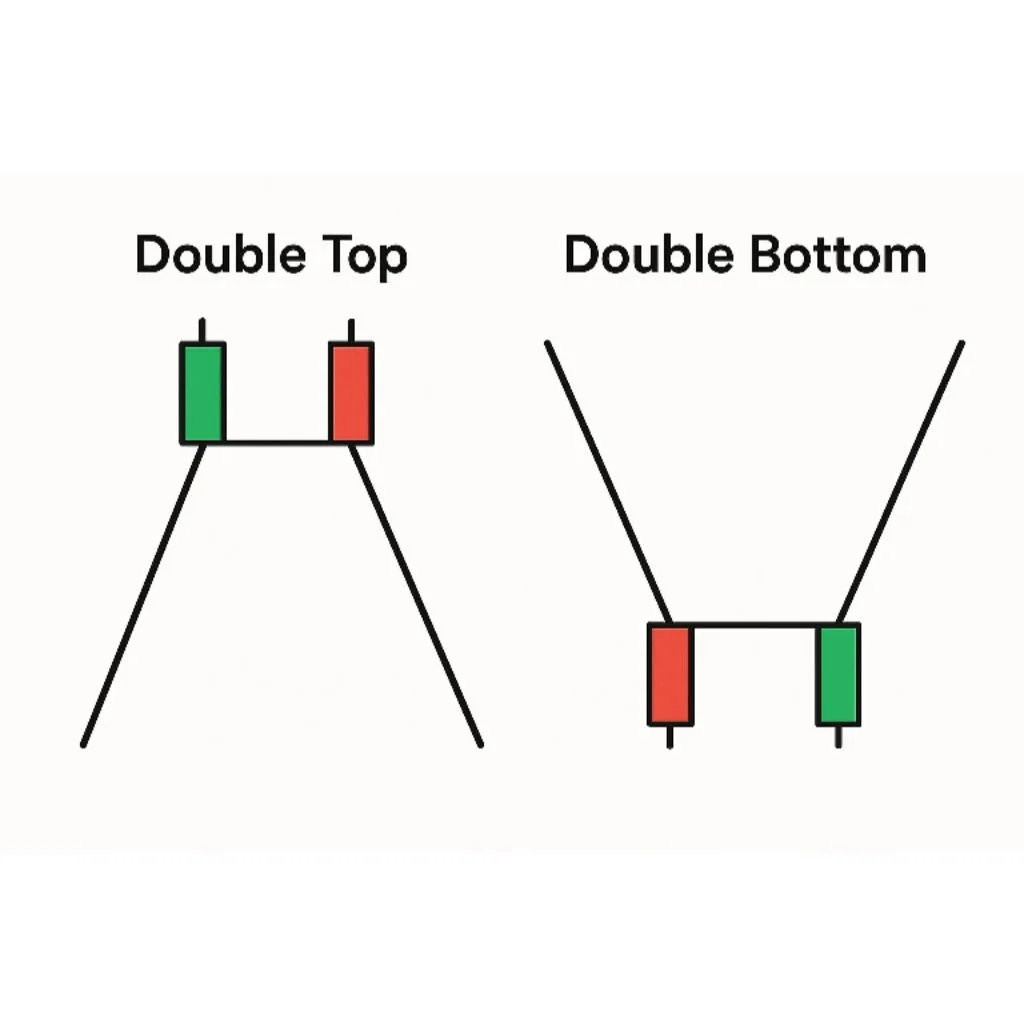

2. Double Top and Double Bottom

Reversal signals

Double top = bearish, Double bottom = bullish

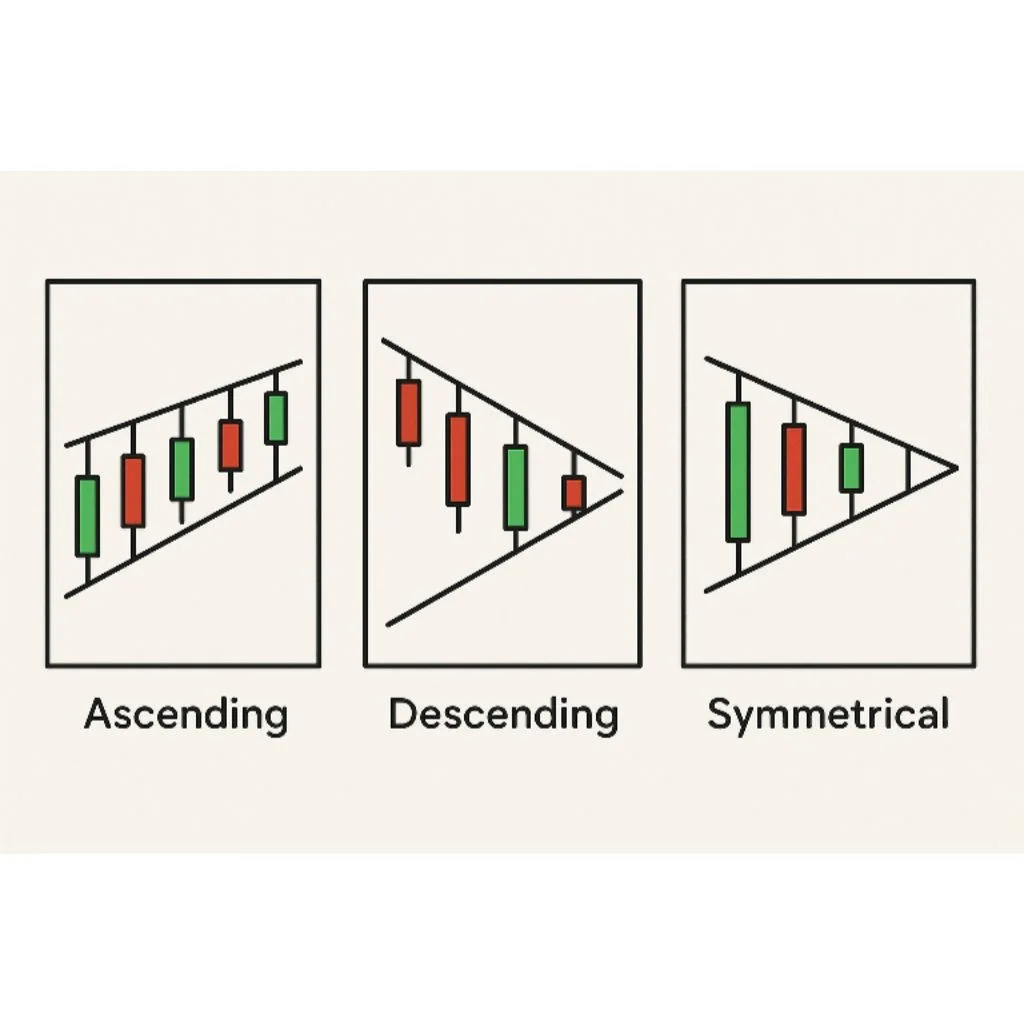

3. Triangles (Ascending, Descending, Symmetrical)

Continuation patterns

Show consolidation before breakout

4. Flags and Pennants

Short-term continuation patterns

Often follow strong price moves

Timeframes in Technical Analysis

Different traders use different timeframes based on their goals:

Trader Type Time frame Used

Scalper 1-minute to 5-minute

Day Trader 5-minute to 15-minute

Swing Trader 1-hour to daily

Position Trader Daily to weekly

Timeframes also affect signal reliability. Higher timeframes usually give stronger, more reliable signals.

Limitations of Technical Analysis

While powerful, technical analysis has some limitations:

Lagging Indicators: Most indicators are based on past data and may react late.

False Signals: Patterns may not always work as expected.

Subjective Interpretation: Different traders may read the same chart differently.

Ignores Fundamentals: Technical analysis doesn’t consider earnings, news, or economic events.

Pro Tip: Combine technical analysis with fundamental analysis for better accuracy.

Final Thoughts

Technical analysis is a powerful tool that helps traders make informed decisions using charts, indicators, and patterns. Whether you’re trading stocks, crypto, or forex, understanding technical analysis can give you a competitive edge.

However, no method guarantees success. Always combine your analysis with proper risk management, backtesting, and real-world experience.

Note: This is just an introductory guide. More in-depth analysis, advanced strategies, and real-world examples are coming soon. Stay connected to keep learning and mastering technical analysis!

Frequently Asked Questions (FAQs)

Q1. Is technical analysis good for beginners?

Yes, with proper learning and practice, beginners can effectively use technical analysis. Start with basic charts and indicators before moving to advanced strategies.

Q2. Can technical analysis predict the future?

It can’t predict the future with 100% accuracy, but it helps identify probabilities and potential outcomes based on historical patterns.

Q3. What is the best technical indicator?

There’s no single “best” indicator. Most traders use a combination like RSI, Moving Averages, and MACD for balanced insights.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment