India’s central bank, the RBI, has been talking more with traders about the cash situation in the banking system, sparking speculation that it might take steps to increase liquidity at its policy review on December 6. These talks are focused on the effects of large foreign outflows from stocks and bonds.

Recently, banks have become net borrowers from the RBI, after having a surplus of around 3 trillion rupees ($35 billion) in early November. This situation could worsen due to year-end tax payments.

To address the cash shortage, the RBI may consider measures like buying bonds or lowering the cash-reserve ratio for banks. The shortage has pushed up short-term borrowing rates, making it more expensive for banks and companies to raise money, which could further slow down the economy.

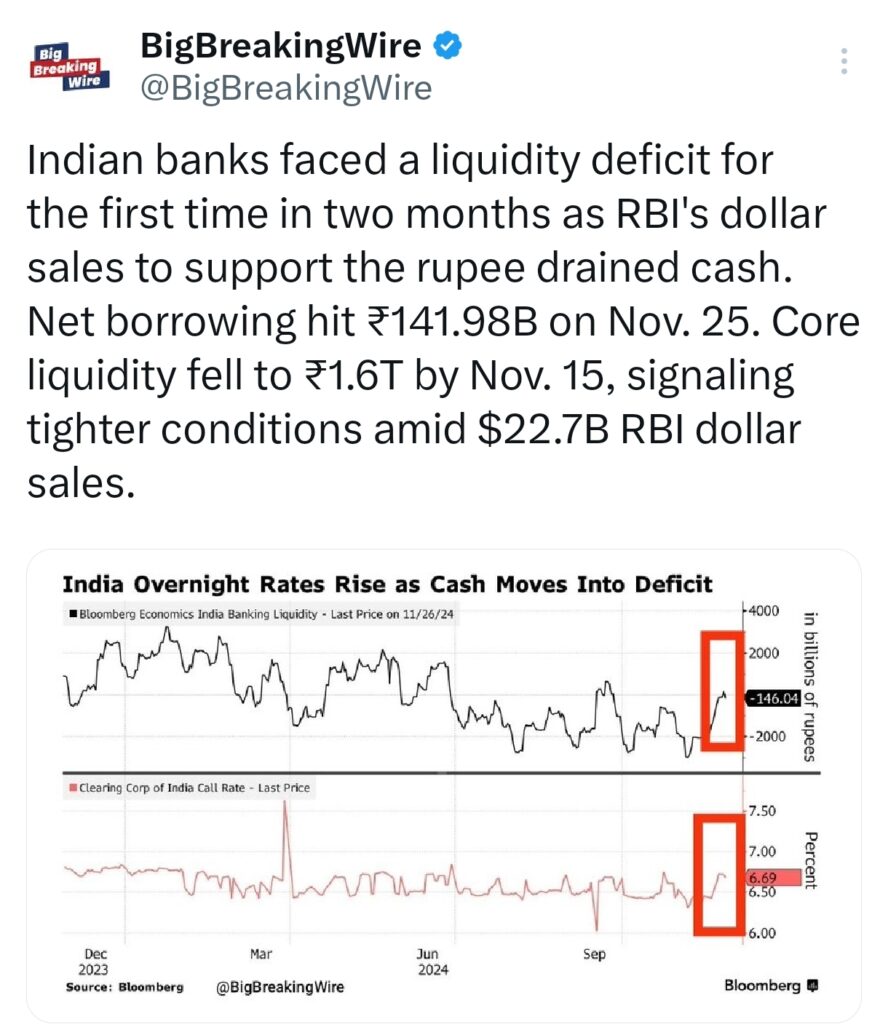

RBI Dollar Sales Trigger Liquidity Shortfall

Indian banks experienced a liquidity shortfall for the first time in two months as the Reserve Bank of India (RBI) sold dollars to support the rupee, leading to a drain in cash. On November 25, net borrowing by banks reached ₹141.98 billion. Additionally, core liquidity fell to ₹1.6 trillion by November 15, indicating tighter financial conditions. The RBI’s dollar sales, totaling $22.7 billion, contributed to the reduced liquidity in the banking system, making it harder for banks to meet their funding needs and affecting the overall cash situation in the market.

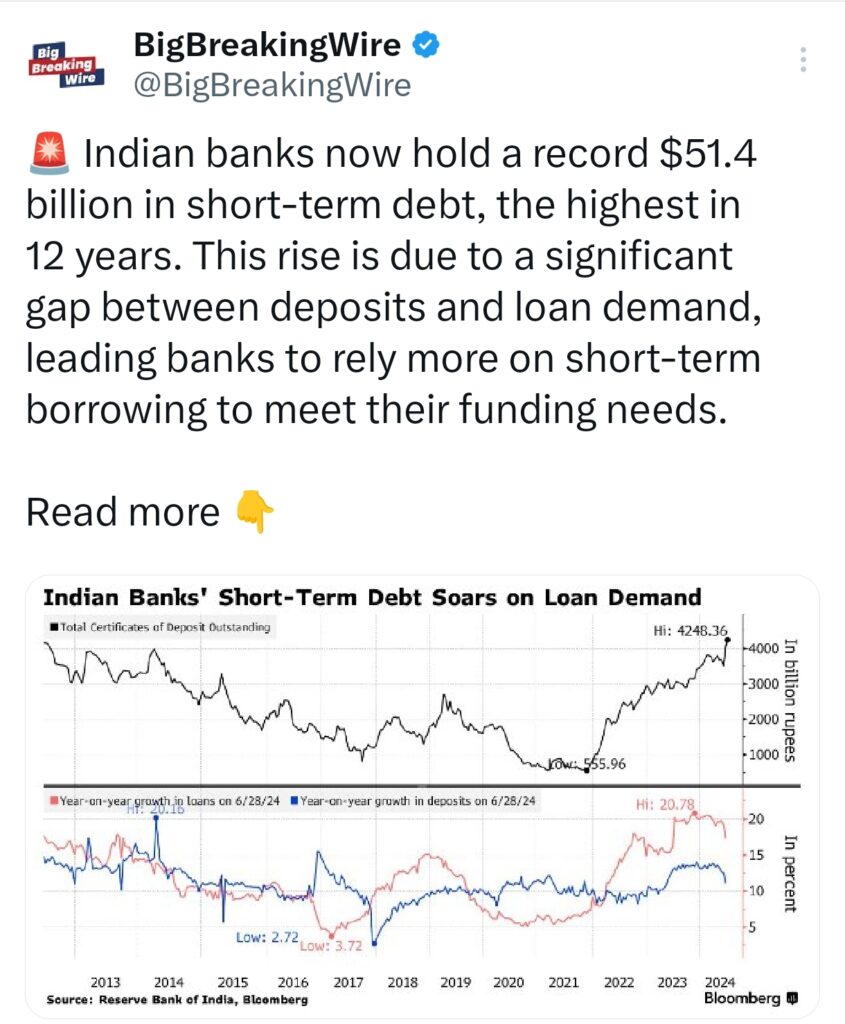

Indian Banks Face Record Short-Term Debt

Indian banks currently hold a record $51.4 billion in short-term debt, the highest amount in the past 12 years. This increase is driven by a noticeable mismatch between the growth in deposits and the demand for loans. As a result, banks are turning to short-term borrowing more than ever before to fulfill their funding requirements. The gap between the available deposits and the loan growth has led to an increased reliance on short-term debt instruments to bridge the funding gap and manage liquidity.

Fitch Warns Indian Banks May Face Borrowing Surge

Fitch Ratings has raised concerns that Indian banks may need to increase their borrowing due to challenges in attracting new deposits. With deposit rates remaining low and inflation impacting real income, banks are facing long-term issues in growing their deposit base. This has resulted in a decline in the loan-to-deposit ratio (LDR), which has dropped to 20%, the lowest in two decades. If these trends persist, banks may be forced to rely more on external borrowing to meet their funding needs, which could put additional pressure on their liquidity and financial stability.