Right now, the global economic picture is clear: the US economy is strong, while Europe is struggling.

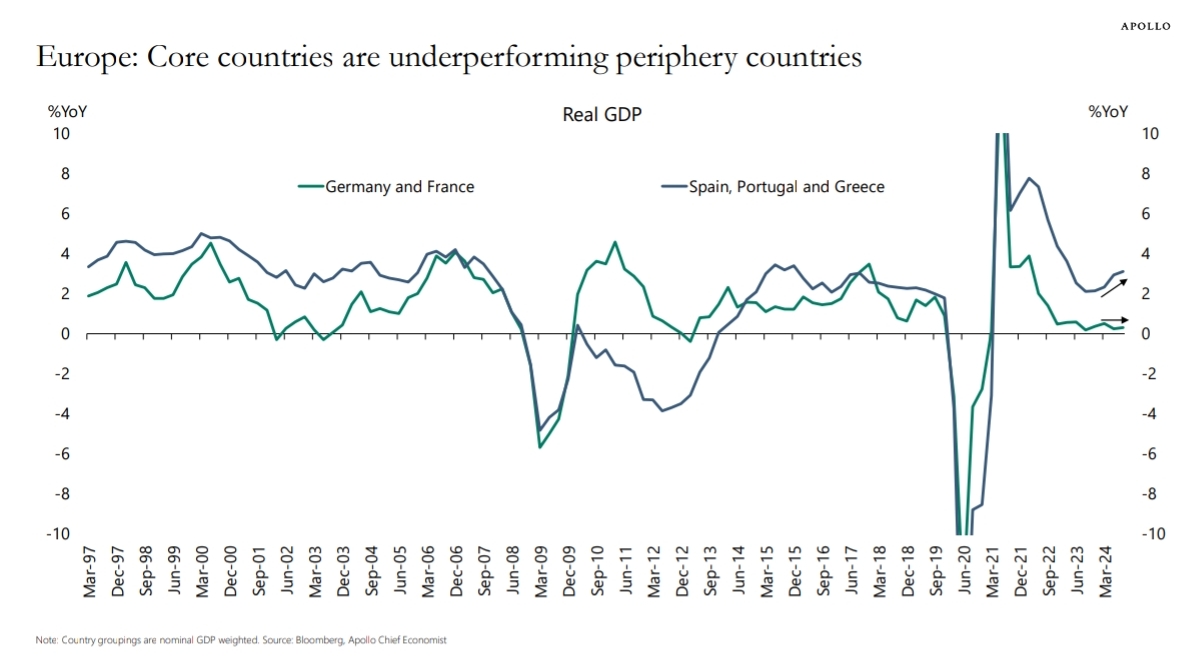

However, the situation within Europe is more complex. Major economies like Germany and France are weak, but peripheral countries like Spain, Portugal, and Greece are performing well (see the chart below).

This unusual divide within Europe could have significant effects on interest rates, credit markets, and overall investment decisions.

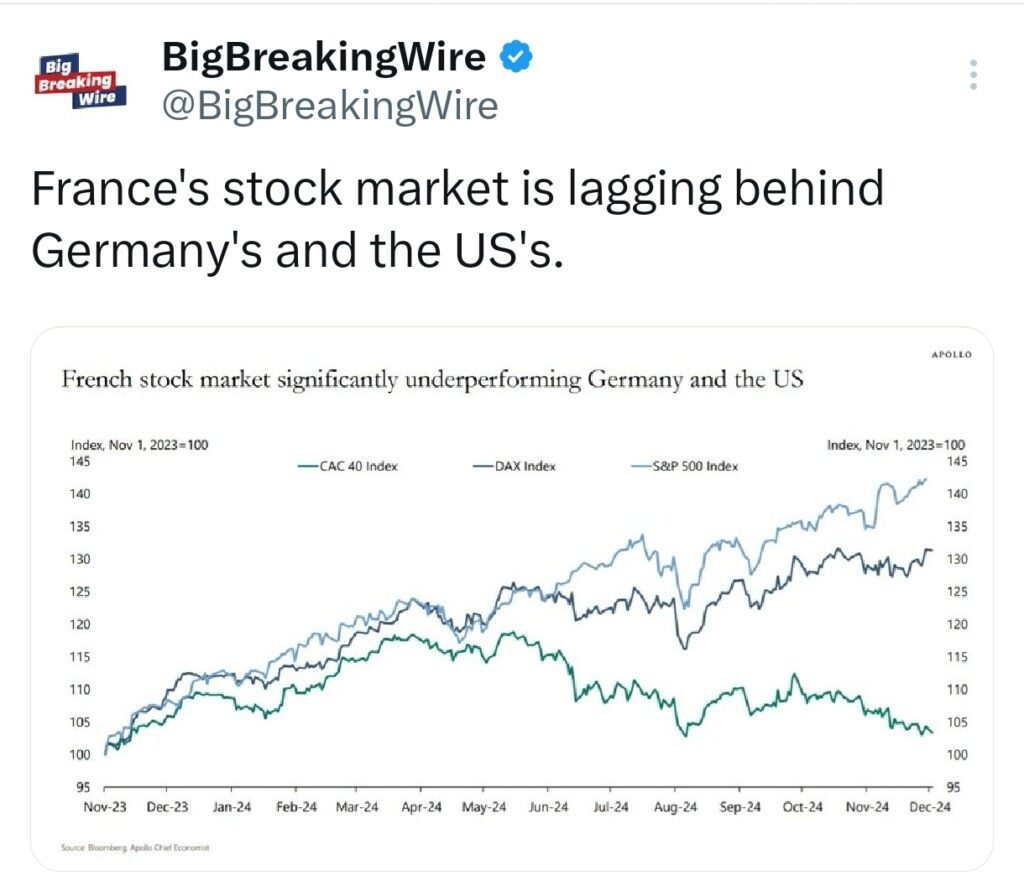

France’s stock market is lagging behind Germany’s and the US’s.

Europe’s Stock Market Faces Largest Underperformance Against the US in 30 Years

Europe’s stock market is underperforming the US by the widest margin since 1995. In 2024, the S&P 500 has surged 25%, while Europe’s Stoxx 600 has only gained 5%, reflecting a significant gap fueled by a global shift toward US assets, particularly after Trump’s victory.

The disparity is also evident in the sheer size of the markets. US equities are now valued at $63 trillion, four times larger than European markets, with the gap doubling over the past decade. A striking difference is in company valuations: Europe does not have a single $500 billion firm, whereas the US boasts eight companies worth over $1 trillion.

The valuation gap between the two markets has also reached historic levels. The Stoxx 600 currently trades at a record 40% discount compared to the S&P 500. At the same time, the euro has dropped to a one-year low, underscoring Europe’s struggles as its markets continue to lag far behind.

UK Stocks Poised to Outperform Europe

UK stocks are set to outperform European markets, as major institutions like Goldman Sachs, Société Générale, BlackRock, and JPMorgan Asset Management argue the London market is better positioned to withstand the impact of US President-elect Trump’s trade tariff plans.