On December 12, the Indian rupee hit its lowest point ever, falling to 84.8625 against the US dollar. This was due to strong demand for the dollar in the non-deliverable forwards (NDF) market and increased dollar buying from importers, including oil companies. However, the Reserve Bank of India (RBI) intervened by selling dollars, which limited the rupee’s losses.

RBI has been actively trading NDFs, with an offshore net short dollar position of $60 billion, surpassing its $19 billion onshore record. Barclays estimates the overall net short position at $70 billion, indicating a shift to offshore interventions to manage the rupee’s value and curb the dollar’s strength.

Bearish Bets on Won, Rupee Surge Amid Tariff Fears

Bearish bets on the South Korean won and Indian rupee have reached a two-year high due to rising concerns over potential U.S. tariffs hurting emerging market assets. Short positions on the won hit their highest level since October 2022, while those on the rupee surged to their sharpest level since November 2022, according to a Reuters poll. The Indian rupee has recently hit record lows, impacted by slowing economic growth, ongoing foreign investment outflows, and the weakening Chinese yuan. Analysts predict the rupee will remain weak, with the Reserve Bank of India expected to cut rates in February, which could push the USD/INR higher.

State-run banks were observed offering dollars, likely on behalf of the RBI, to help stabilize the rupee. Meanwhile, other Asian currencies showed mixed results, and the offshore Chinese yuan rose slightly to 7.26 after dipping to 7.29 in the previous session. The dollar index remained stable at 106.5.

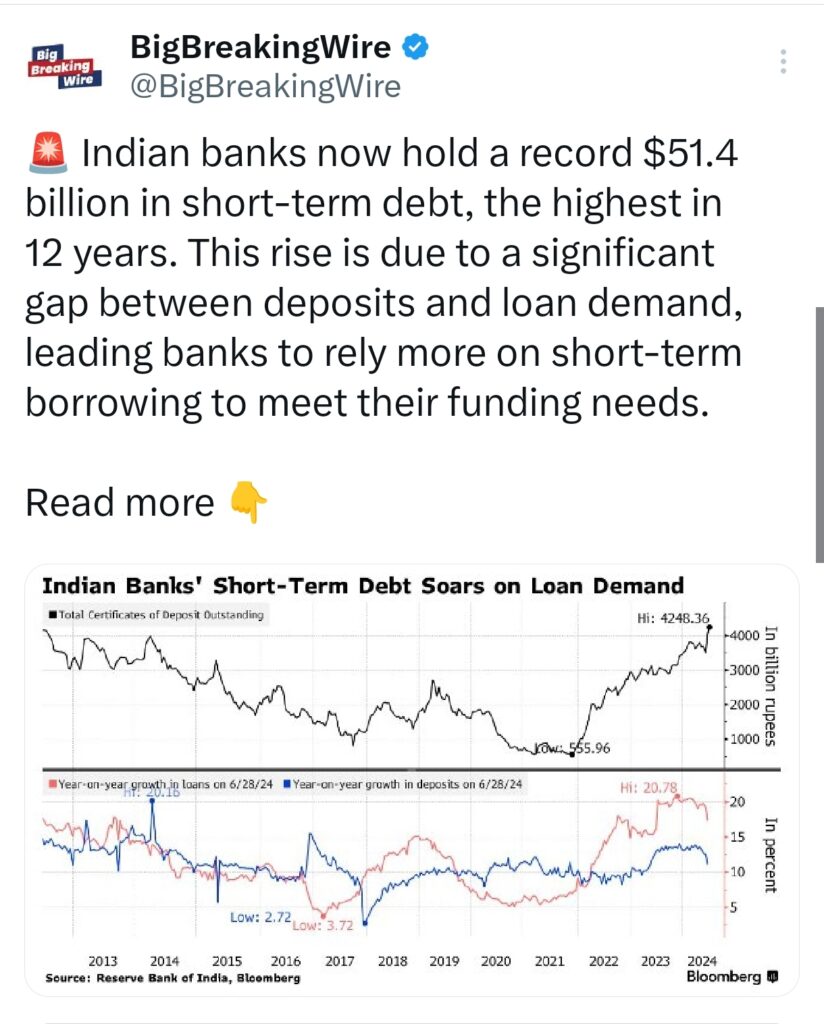

Indian banks are currently holding a record high of $51.4 billion in short-term debt, marking the highest level in the past 12 years. This surge in short-term borrowing is primarily driven by a significant disparity between the growth in deposits and the demand for loans. As a result, banks are increasingly relying on short-term debt to bridge the gap and meet their funding requirements.

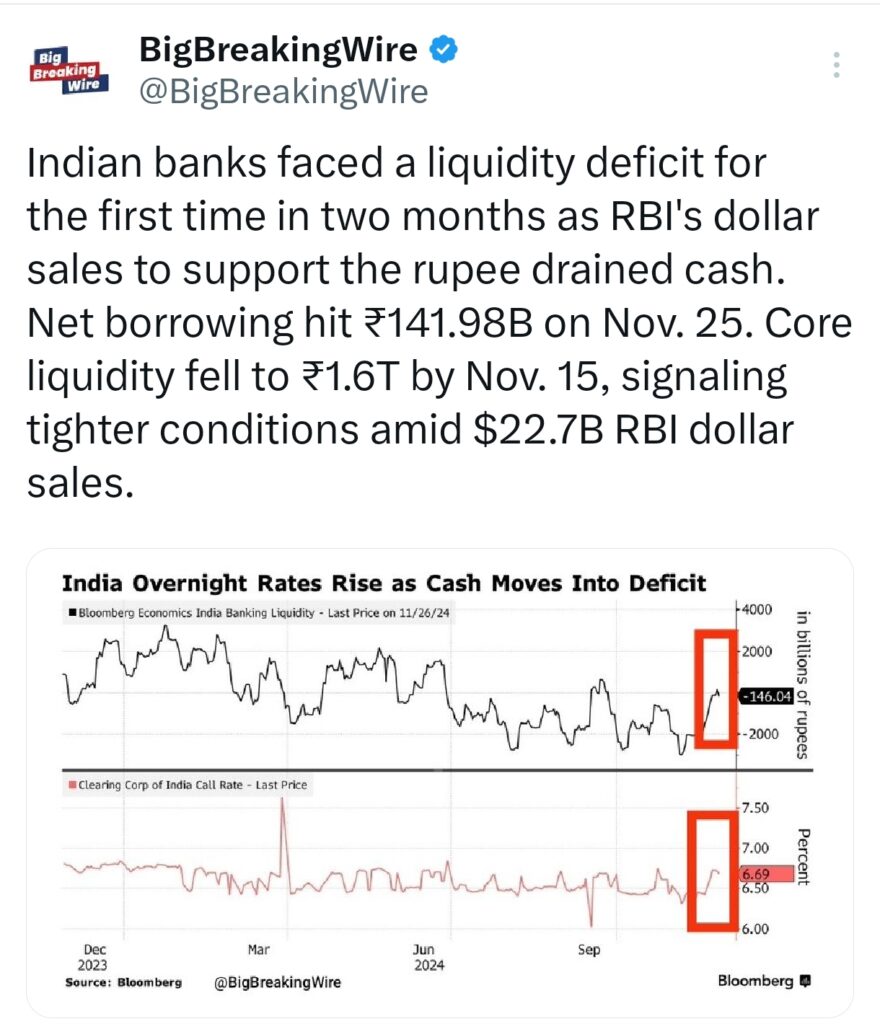

For the first time in two months, Indian banks experienced a liquidity deficit due to the Reserve Bank of India’s (RBI) dollar sales aimed at supporting the value of the rupee. On November 25, net borrowing by banks rose to ₹141.98 billion. Core liquidity had already decreased to ₹1.6 trillion by November 15, signaling tightening financial conditions. This reduction in liquidity came as the RBI sold a total of $22.7 billion in dollars to stabilize the rupee.