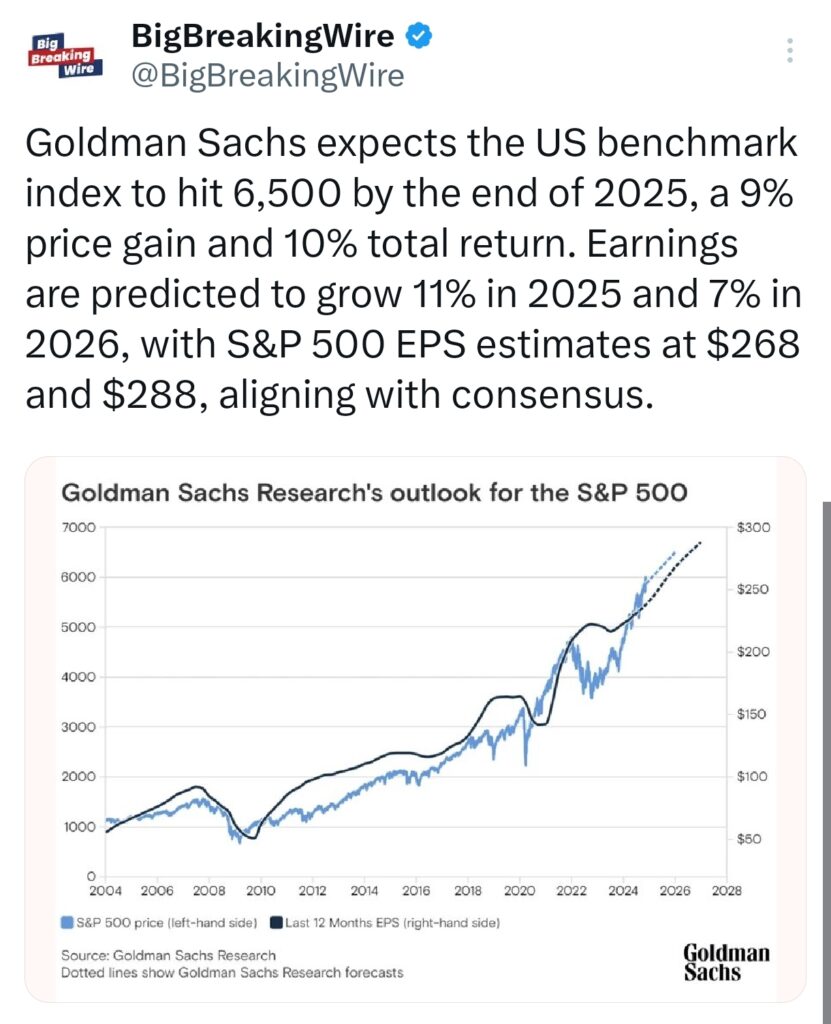

Goldman Sachs projects the US benchmark index to reach 6,500 by the end of 2025, marking a 9% price gain and a 10% total return, including dividends. Earnings are expected to rise 11% in 2025 and 7% in 2026. Corporate revenue growth is forecasted at 5%, in line with nominal GDP growth, while S&P 500 EPS estimates for 2025 and 2026 are $268 and $288, matching consensus estimates, though below the bottom-up forecasts of $274 and $308.

US Stock Valuations at 1990s Highs

US stock valuations are rising and are now at levels not seen since the late 1990s. Some of this increase is due to expectations that new policies will boost earnings, but even after considering the current economic situation, stock valuations still look very high. Credit spreads (the difference between corporate and government bond yields) are also narrow, and even riskier market segments have seen their premiums shrink. This suggests that long-term returns from stocks may be low, with only around a 3% annualized return expected over the next decade, mainly due to the concentration of a few large companies in the market.

Despite high valuations, stocks could keep rising if economic growth continues, as we’ve seen in 2024. However, if economic risks increase more than expected, stock prices could drop more sharply than usual. The sharp drops and spikes in volatility we saw in August could signal this risk. Additionally, it’s important to watch for a point when the market fully reflects our optimistic economic forecasts. When this happens, we may need to be more cautious and protect against the risk of prices falling.