Securities and Exchange Board of India (SEBI) has uncovered a front-running scheme involving Sachin Bakul Dagli, an equity dealer at PNB MetLife India Insurance, and eight other entities. These individuals gained illegally from this scheme, which lasted for over three years, accumulating a total of Rs 21.16 crore.

SEBI’s interim order, issued on Friday, prohibited Dagli and the eight other entities from participating in the securities market. The illegal gains made by the involved parties have also been seized.

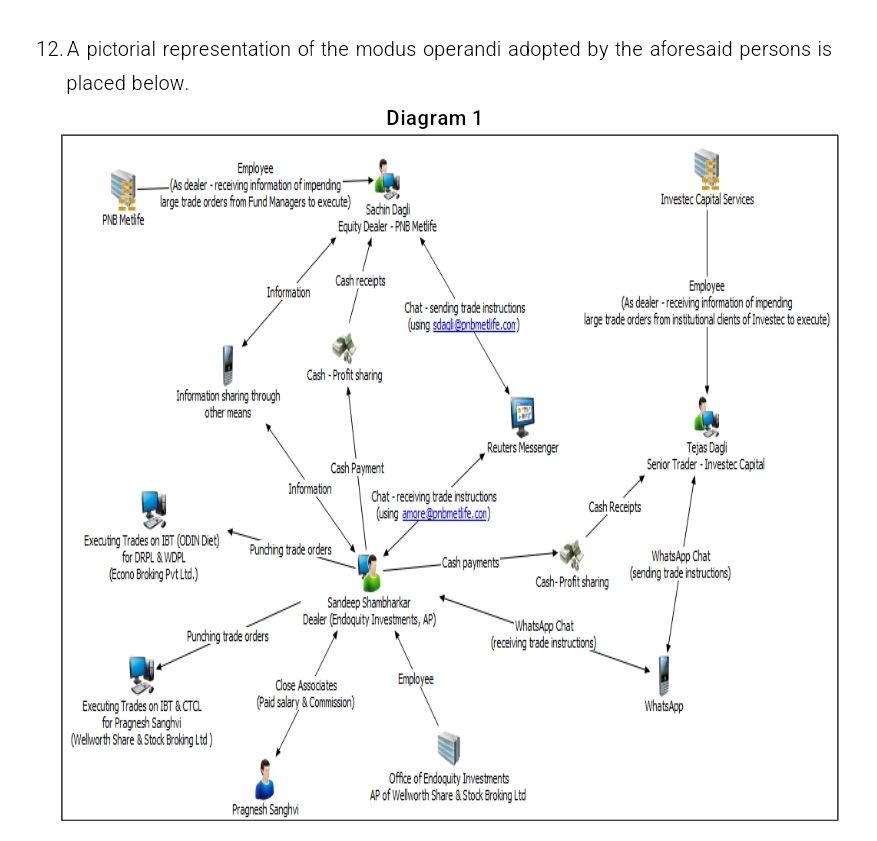

The investigation revealed that Sachin Bakul Dagli and his brother, Tejas Dagli, who works as an equity sales trader at Investec, had access to confidential, non-public information regarding trade orders from PNB MetLife and Investec’s institutional clients. This sensitive information was shared through chat platforms.

The entities then executed trades using this non-public information, employing a Buy-Buy-Sell or Sell-Sell-Buy pattern to profit from market movements triggered by large client trades. In total, 6,766 instances of front-running trades were identified, primarily involving accounts belonging to DRPL, WDPL, and Pragnesh Sanghvi. These trades resulted in unlawful gains of Rs 21.16 crore.

The front-running activities persisted for more than three years, prompting SEBI to take strict action. The regulator has now restricted these entities from buying, selling, or dealing in securities, either directly or indirectly, until further notice. The total amount of Rs 21.16 crore in illegal gains has been impounded from the nine entities involved.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment