SEBI, the Securities and Exchange Board of India, has banned well-known market expert Sanjiv Bhasin and 11 others from the securities market. This action follows an investigation into a Rs 11.09 crore front-running scam.

What Is the Case About?

Between January 2020 and June 2024, SEBI looked into complaints that Sanjiv Bhasin was using his position and popularity on TV and social media to manipulate stock prices. According to SEBI, he bought shares before publicly recommending them, and once the prices went up after his tips, he sold them for profit.

This type of trading is known as front-running, which is illegal in the stock market.

How the Scam Worked

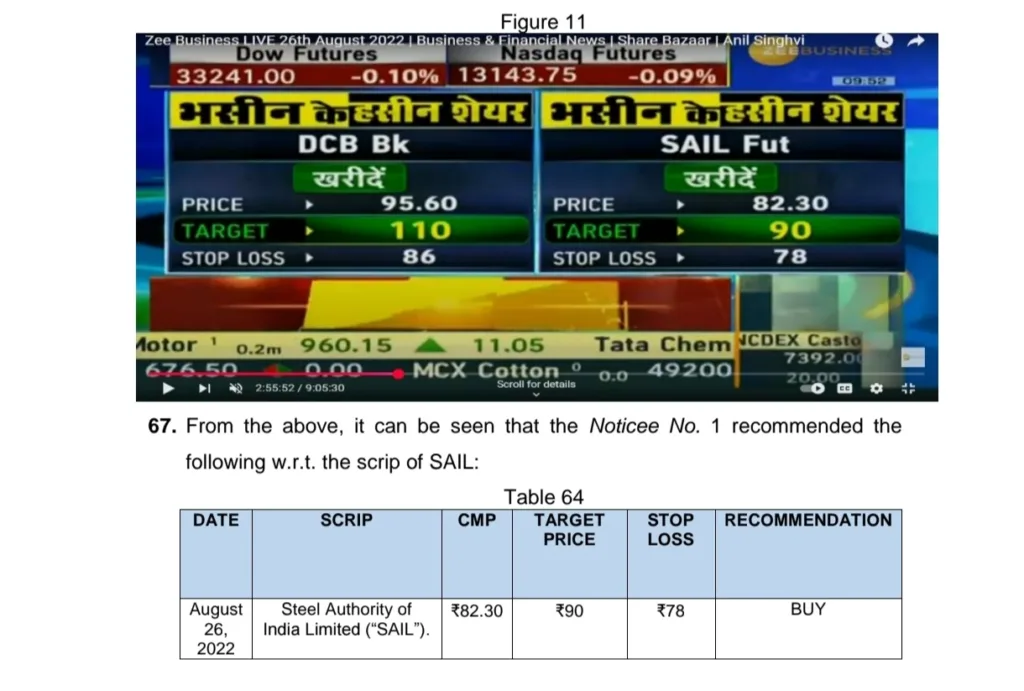

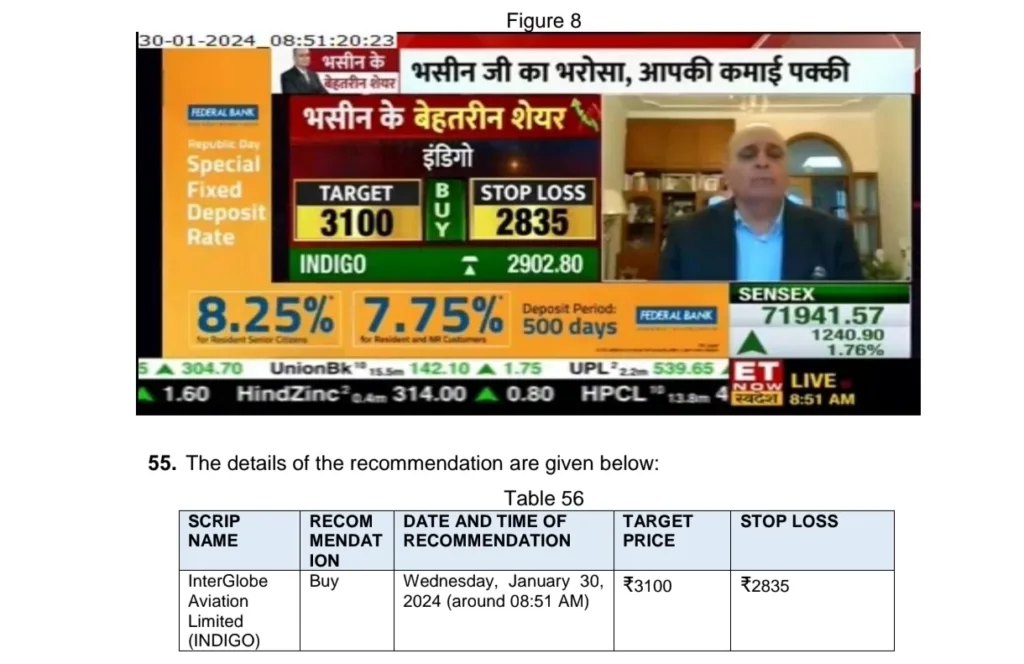

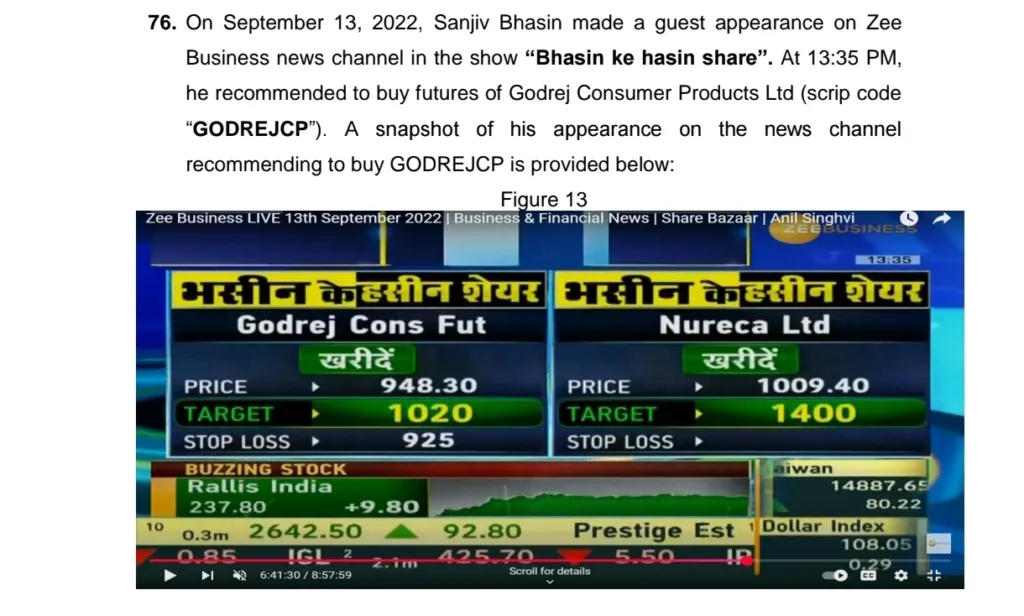

Sanjiv Bhasin made stock recommendations on business channels and platforms like Telegram.

Before making these recommendations public, he took buy positions in the same stocks.

Once the stock price went up due to public reaction, he sold the shares to earn quick profits.

SEBI found that this method helped Bhasin and his associates earn unlawful gains of Rs 11.09 crore.

Who Else Was Involved?

The scam involved accounts linked to:

Venus Portfolios

Gemini Portfolios

Leo Portfolios

HB Stockholdings

These were operated by people related to or connected with Bhasin, such as his wife, cousin Lalit Bhasin, and brother-in-law Ashish Kapur.

How Did They Coordinate?

SEBI found that the group was in regular contact with brokers and dealers, especially from RRB Master Securities, a Delhi-based firm linked to Bhasin. They used phone calls and WhatsApp messages to plan trades before making the recommendations public.

SEBI noted that over 40,000 trades were executed in this coordinated manner.

What Is Front-Running?

Front-running is an illegal act where someone uses non-public, advance information to trade stocks before others. It gives the person an unfair advantage and hurts ordinary investors who don’t have access to insider knowledge.

What Action Did SEBI Take?

SEBI passed an interim order and show-cause notice against all 12 individuals and entities.

They have been barred from buying, selling, or dealing in the securities market.

SEBI said this step was necessary to protect investors and maintain market fairness.

The order was passed without a hearing, considering the seriousness of the violations and the risk of further harm.

Why This Matters

This case highlights the dangers of trusting stock recommendations blindly and the importance of transparency in financial advice. SEBI’s swift action is meant to send a strong message: misusing market influence for personal gain will not be tolerated.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment