The Securities and Exchange Board of India (SEBI) has proposed that all mutual fund schemes should disclose their stress test results. This suggestion was made in a consultation paper released on Thursday.

A stress test measures the time it would take to sell a portfolio based on current trading volumes, helping assess how liquid the portfolio is. Although all mutual fund schemes undergo stress testing, only the results for small- and mid-cap schemes are currently published on the asset management company’s website and on the Association of Mutual Funds in India (AMFI) site.

Currently, asset management companies (AMCs) are required to perform stress tests on all their schemes, except for close-ended and interval schemes.

The new proposal suggests that the stress test results for all mutual fund schemes, except close-ended and interval schemes, should be made public. SEBI believes this would help investors make more informed decisions across all categories of funds.

According to Clause 2.3.2.1 (iii) in the MF Master Circular, all fund houses must conduct stress tests on their schemes every month.

While stress test results are currently only published for small-cap and mid-cap funds, the proposal suggests making results for all schemes available to the public.

This move aligns with the Financial Stability Board’s recommendations from their December 2023 report on addressing liquidity risks in open-ended funds.

The consultation paper also covers eight areas regarding the interests of AMC employees and unit holders. It proposes easing compliance for AMC employees, including reducing the minimum investment amounts required from them and cutting down the frequency of salary disclosures.

SEBI Proposes Stress Test Disclosures for Sectoral and Thematic Funds Amid Rising Inflows

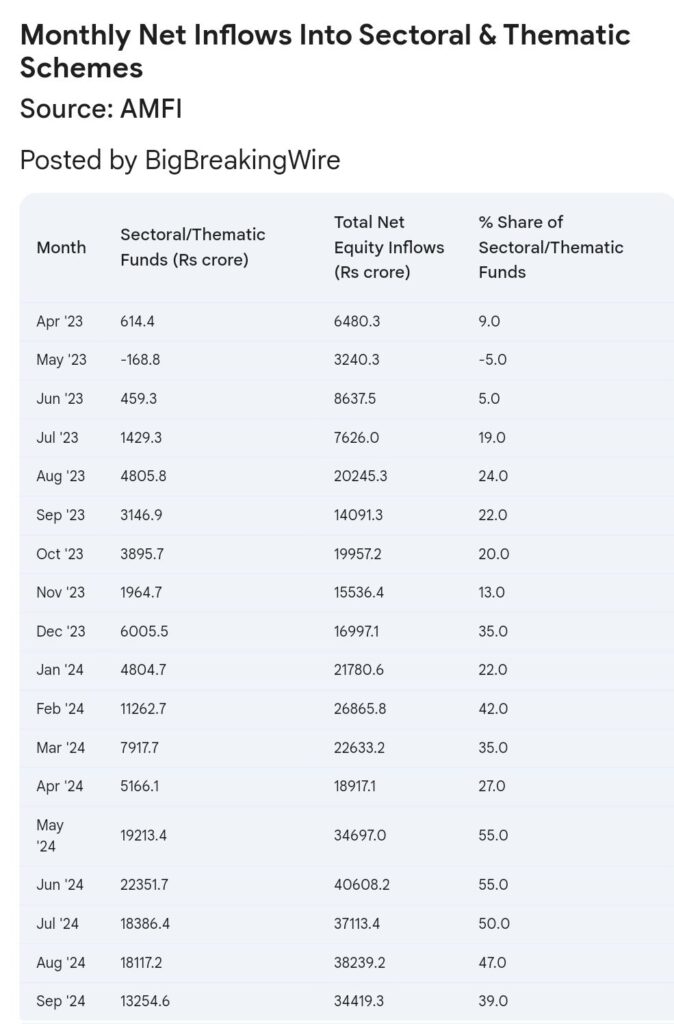

Securities and Exchange Board of India (SEBI) has proposed a new rule in its latest consultation paper, suggesting that asset management companies (AMCs) disclose stress test results for all equity schemes, excluding closed-end and interval schemes. Previously, SEBI required monthly stress test disclosures only for small and midcap schemes on AMFI and AMC websites due to a surge in inflows and a sharp rise in these stocks. Although the inflows have moderated, the new proposal extends the disclosure requirement to sectoral and thematic schemes, which have been seeing a significant rise in investor interest.

Sectoral and thematic schemes have attracted more than one-third of the net monthly equity inflows, leading to concerns. Unlike other equity schemes, these funds don’t have limits on stock exposure, which can lead to high risk. For example, the HDFC Defence Fund had a large concentration in stocks like Bharat Electronics and Hindustan Aeronautics. While this strategy may work, it also means that if these stocks experience a significant drop, the impact on the fund’s NAV could be severe.

Since April 2023, retail investors have invested Rs 3.88 lakh crore in equity schemes, with Rs 1.42 lakh crore (37%) going into sectoral and thematic funds. These funds have now become the largest category of actively managed equity schemes, even surpassing flexicap funds, and had assets under management of Rs 4.67 lakh crore as of the end of September. Given these large inflows, it’s no surprise SEBI wants stress test disclosures for these funds, though including it in a consultation paper was unexpected.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment