Market Regulator SEBI Takes Action Against Khaitan Family and Associate

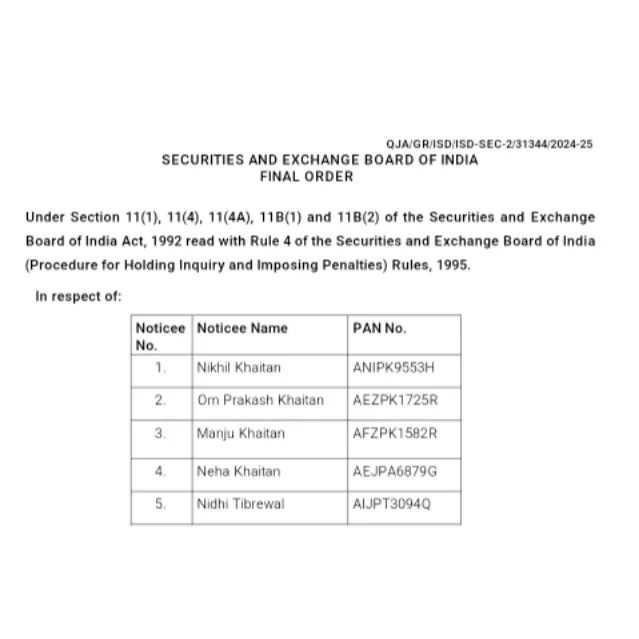

In a major crackdown on market malpractice, the Securities and Exchange Board of India (SEBI) has barred five individuals from the securities market for one year. These individuals, including members of the Khaitan family Nikhil Khaitan, Prakash Khaitan, Manju Khaitan, Neha Khaitan and Nidhi Tibrewal, were found guilty of front-running trades, a fraudulent practice that gave them unlawful profits amounting to over Rs 1.52 crore.

What Is Front-Running?

Front-running is an illegal stock market activity where someone trades shares using confidential information about an upcoming large order from a client. This allows the trader to make profits before the client’s trade affects the market price. It disrupts fair market practices and creates an uneven playing field for other investors.

SEBI’s Investigation: Six Years of Unfair Trading

SEBI began probing suspicious trades based on alerts received regarding irregular activity in various stocks. The investigation covered a six-year period, from September 2016 to August 2022. It revealed that Nikhil Khaitan, who was acting as a dealer for large clients (referred to as “Big Clients”), misused sensitive information related to upcoming trades.

Rather than acting in the best interest of these clients, Nikhil shared or used this information for personal gain. He placed early trades through the accounts of Om Prakash Khaitan, Manju Khaitan, Neha Khaitan, and Nidhi Tibrewal — collectively known as the front-runners. This group executed trades ahead of the large client’s official transactions and earned significant profits.

SEBI’s Final Verdict

SEBI’s 49-page final order concluded that the actions of the Khaitan family and Nidhi Tibrewal violated the Prohibition of Fraudulent and Unfair Trade Practices (PFUTP) regulations. The regulator emphasized that the trades not only disturbed the natural balance of supply and demand in specific stocks but also manipulated price and volume, causing artificial movement in the market.

G Ramar, the Adjudicating Officer of SEBI, noted that the front-running trades distorted the integrity of the securities market. According to the order, “All noticees are responsible for disgorging the wrongful gains obtained by misusing non-public information.”

Penalties and Market Ban

Along with a one-year ban from accessing the securities market, the individuals have also been ordered to return the illegal profits. SEBI directed that the group — Nikhil Khaitan, Om Prakash Khaitan, Manju Khaitan, Neha Khaitan, and Nidhi Tibrewal — must jointly and severally repay Rs 1.52 crore within 45 days from the date of the order.

Monetary Penalties Imposed:

Nikhil Khaitan: Rs 10 lakh

Om Prakash, Manju, Neha Khaitan, and Nidhi Tibrewal: Rs 5 lakh each

These fines are in addition to the disgorgement amount.

SEBI Reiterates Its Stand on Market Integrity

SEBI has made it clear that any action disrupting the transparency and fairness of the market will face strict consequences. By penalizing the individuals involved in this case, the regulator aims to reinforce investor confidence and discourage unfair trading practices.

This case underlines SEBI’s commitment to detecting and addressing complex financial misconduct, especially when such activities go undetected over several years.

Final Thoughts

The SEBI order against the Khaitan family and Nidhi Tibrewal sends a strong message to market participants: unethical behavior and misuse of insider information will not be tolerated. As the Indian financial markets continue to grow, such regulatory vigilance is critical to ensure fairness, protect investors, and maintain trust in the system.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment