CPI inflation in India is projected to average 4.8% for the financial year 2024-25, with a potential upward bias due to fluctuating food prices, according to a report by the State Bank of India (SBI). The report highlights that while fuel and light inflation have remained negative for 15 straight months, food prices are now the primary driver of inflation.

Rate Cuts Expected by February 2025

The report suggests that the Reserve Bank of India (RBI) could begin reducing interest rates in February 2025, with an expected cumulative cut of 75 basis points over the rate-cut cycle. Interestingly, the RBI’s decision is unlikely to be influenced by fluctuations in the US dollar, as seen in 2018 when rate hikes were avoided despite significant pressure on the rupee.

Inflation Targeting Shows Progress

SBI’s analysis indicates a convergence of retail inflation rates among Indian states towards the RBI’s 4% target, demonstrating the effectiveness of inflation targeting policies. Using a Sigma-Type methodology, the report observes that both headline CPI and food inflation are narrowing their dispersion across states. However, while the convergence in headline CPI is advancing steadily, food inflation remains more volatile, slowing overall progress.

Regional Differences in Food Inflation

The report highlights that higher-income and middle-income states have experienced a sharper decline in food inflation over the past decade compared to lower-income states. This trend is partly attributed to labor migration from low-income regions to more developed states, where employment opportunities are greater, leading to faster disinflation in high-income areas.

Limited Impact of Wages on Food Inflation

A key observation in the report is the low correlation (0.11) between rural inflation and average daily wages of non-agricultural laborers. This suggests that rising wages have had little effect on food prices, and India has largely avoided a wage-price spiral, where higher wages drive up price levels.

Welfare Schemes Keep Food Prices in Check

Government welfare initiatives, such as programs providing free and subsidized food grains, are playing a critical role in controlling inflation, according to a senior official cited in the report. These schemes are helping to mitigate food price pressures, particularly in rural and low-income areas.

As India continues to navigate inflationary trends, food prices are expected to remain a key factor, while policies and structural shifts, including migration and welfare programs, play an important role in shaping the broader inflation landscape.

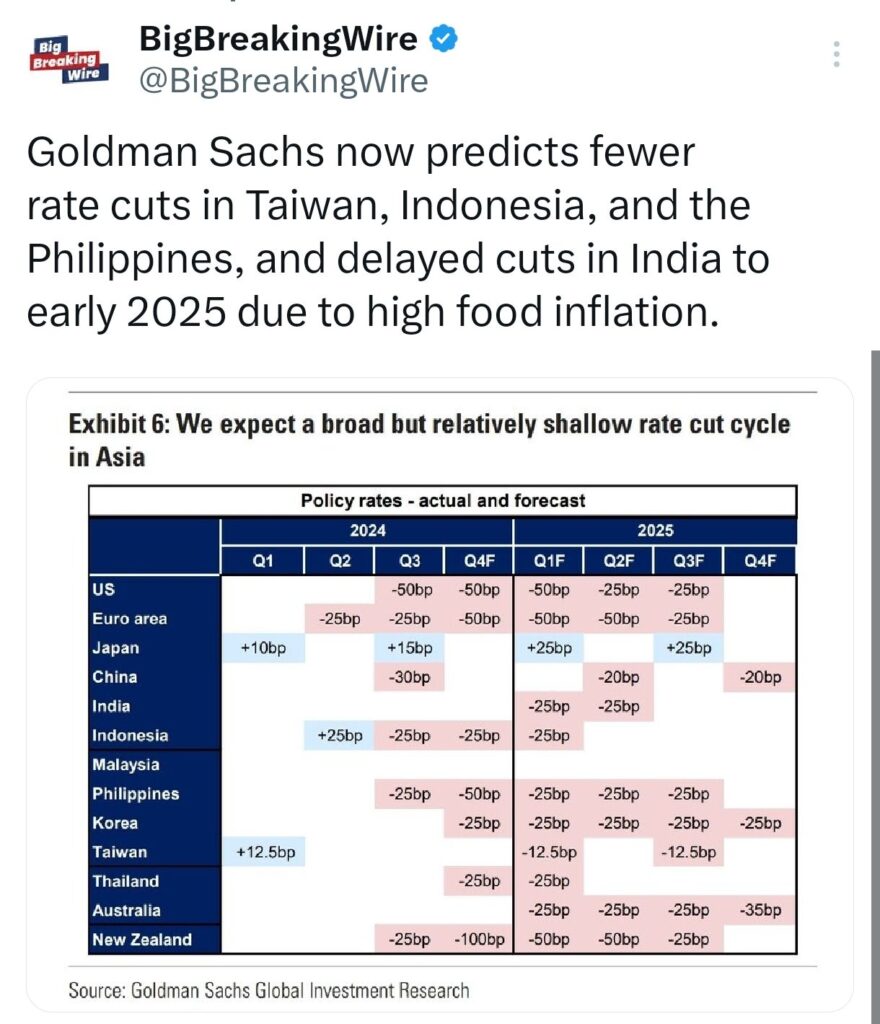

Goldman Sachs Sees Delayed Rate Cuts in Asia

Goldman Sachs has revised its outlook on monetary policy for several Asian economies, predicting fewer interest rate cuts in Taiwan, Indonesia, and the Philippines. Additionally, the investment bank now expects India to delay its rate cuts until early 2025, citing persistent high food inflation as a key factor influencing the timing of monetary easing.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment