A fresh report released by SEBI (Securities and Exchange Board of India) reveals a major concern for retail investors in India’s equity derivatives market. According to the study, individual traders lost more than Rs 1.06 lakh crore in the financial year ending March 2025 by trading in Futures and Options (F&O).

The report shows that while fewer people are trading, the losses have grown bigger. SEBI has highlighted this as a major risk for market stability and investor protection.

Retail Traders Lost Big in FY25

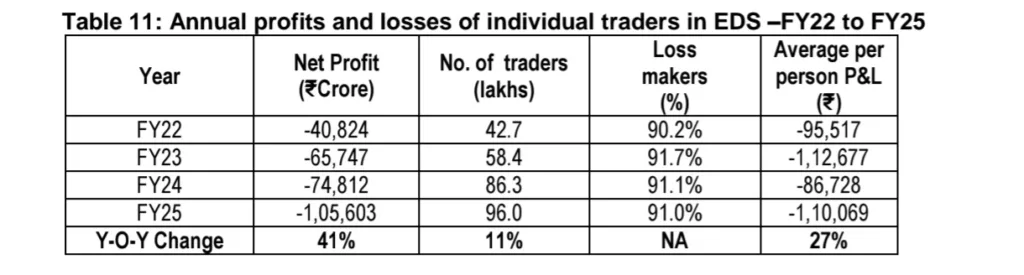

SEBI’s study shows:

91 percent of individual investors suffered losses in F&O trades.

The total loss for retail investors in FY25 was Rs 1.06 lakh crore, a sharp 41 percent rise from Rs 74,812 crore in FY24.

The average loss per trader also went up from Rs 86,728 to Rs 1.1 lakh.

Total Loss in 4 Years: Rs 2.86 Lakh Crore

F&O trading has led to a combined loss of Rs 2.86 lakh crore over the last four years:

FY22: Rs 40,824 crore

FY23: Rs 65,747 crore

FY24: Rs 74,812 crore

FY25: Rs 1,05,603 crore

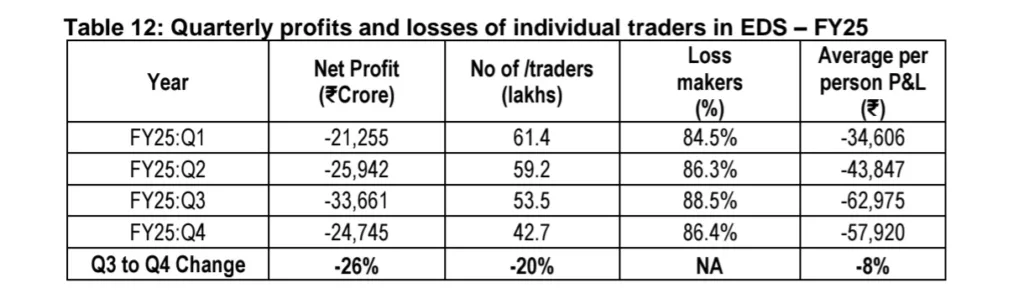

Decline in Trader Participation and Mixed Profit-Loss Trend in FY 2024-25

In FY 2024-25, the number of unique individual traders in the equity derivatives segment (EDS) dropped sharply—from about 61.4 lakh in Q1 to around 42.7 lakh in Q4, following the introduction of new derivatives regulations from November 20, 2024. Over the first three quarters, both the total net loss and the average loss per trader steadily increased. However, in Q4, individual trader losses declined at both the total and per-person level. Despite this improvement, the overall amount of losses and the percentage of traders making losses in Q4 still remained higher than the levels seen in Q1.

Index Options Still Dominate F&O

The most popular F&O instruments continue to be index options:

In FY25, premium turnover in index options dropped by 9 percent, and notional turnover fell 29 percent compared to FY24.

Still, these were 14 percent and 42 percent higher, respectively, than two years ago.

Retail traders seem to prefer short-term bets on Nifty and Bank Nifty, which are high-risk, high-reward instruments.

SEBI’s Warning and Action Plan

Despite its efforts—like reducing weekly contract expiries and increasing lot sizes—SEBI noted that retail participation in index options remained strong. In fact, in May 2025, retail traders accounted for 35.4 percent of the total premium turnover, which is slightly higher than before the curbs.

SEBI now says it may tighten regulations further to protect small investors and keep the markets more stable.

Jane Street Case Raises Red Flags

The release of this report follows SEBI’s action against Jane Street Group, a US-based proprietary trading firm. SEBI alleged the firm manipulated index trades on expiry days, misleading and luring small traders. Jane Street has denied these claims and is preparing to defend its position.

This controversy has added urgency to SEBI’s focus on fair and transparent trading practices.

Lessons for Retail Traders

The key takeaway from this report is simple: F&O trading is not for everyone. It carries high risk, and the majority of retail investors are not equipped with the knowledge or tools to manage that risk.

SEBI’s message is clear:

Avoid speculative trading.

Focus on informed, long-term investments.

Improve financial literacy before entering complex markets.

This rising trend reflects how high-risk the F&O market has become, especially for retail participants with limited experience.

Trading Activity Declines, But Risk Remains

While SEBI’s regulatory actions led to a 20 percent drop in the number of active traders between December 2024 and May 2025 (compared to the same period the year before), F&O interest remains higher than two years ago.

Some key trends:

Active retail traders: 20 percent lower than last year but 24 percent higher than two years ago.

Premium turnover: Down 11 percent from last year but 36 percent up from two years ago.

Conclusion

India may be the world’s largest equity derivatives market by volume, but this SEBI report shows that retail investors are paying the price for the growing craze in F&O trading.

If 91% of traders are losing money, it’s time for serious reflection. Regulators are stepping in, but individual responsibility and caution are equally important.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment