Retail investors—individuals trading on their own rather than through institutions—are now more active in the market than ever before. According to recent data from Goldman Sachs and JP Morgan, their participation has hit all-time highs, especially in penny stocks and the options market.

Penny Stocks See Surging Volumes

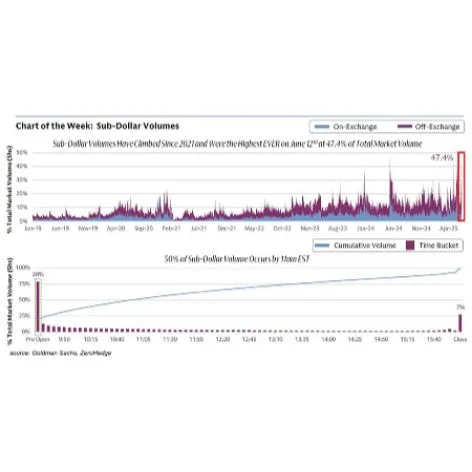

Penny stocks, which are typically defined as shares trading below $5, have become a key indicator of retail activity. On Thursday, these stocks accounted for 47.4% of the total market volume, a record-breaking figure. This surpasses the previous high of around 45.0% seen in May 2024, and is more than double the activity seen during the retail trading boom of 2020.

This suggests that retail investors are not just present—they are dominating trading in this segment.

Interestingly, about 20% of trading volume in stocks priced under $1 occurred during pre-market hours. Pre-market trading is often seen as a space for more experienced or risk-taking traders, which hints at a growing comfort level among retail participants.

Options Market Sees High Retail Involvement

Retail investors are also making waves in the options market. According to JP Morgan, individual investors made up around 18.5% of total options trading volume last week, making it one of the highest shares on record. Options trading is often seen as more complex and riskier than trading regular stocks, showing that retail investors are becoming more sophisticated and confident in their strategies.

Why This Matters

Retail investor activity can move markets in unexpected ways. When large groups of individual investors focus on particular stocks or sectors, they can cause sharp price movements—both up and down. We saw this clearly during the GameStop and AMC rallies in 2020 and 2021.

The current surge in activity shows that individual investors are not stepping back, despite market volatility, interest rate concerns, or inflation fears. Instead, they are diving deeper into the market—especially in riskier corners like penny stocks and options.

What Should You Know as an Investor?

If you’re a retail investor:

Be aware of the risks, especially when trading penny stocks or options. These areas can see large price swings.

Stay informed. It’s important to follow reliable financial news and understand the fundamentals of the companies you invest in.

Don’t follow hype blindly. Just because a stock is trending on social media doesn’t mean it’s a good investment.

Conclusion

Retail investors are now a major force in financial markets, setting new records in both stock and options trading. Their growing influence means that markets could remain highly reactive to trends driven by online communities, social media buzz, and short-term momentum.

As always, smart investing requires patience, research, and discipline—no matter how active the market becomes.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment