SEBI Chairperson Madhabi Puri Buch and her husband, Dhaval Buch, have released a detailed response to the allegations made by Hindenburg Research on August 10, 2024. These allegations suggest that Madhabi Puri Buch had investments in offshore entities linked to the Adani group, raising concerns about potential conflicts of interest and regulatory misconduct.

In their statement, the Buchs offered a thorough rebuttal, highlighting their dedication to transparency and adherence to regulatory standards.

They concluded by reaffirming their commitment to transparency and regulatory compliance, while criticizing the Hindenburg report as an attempt to undermine SEBI and its Chairperson.

This statement comes amid increased scrutiny of SEBI’s regulatory practices and ongoing political debate regarding the allegations in the Hindenburg report.

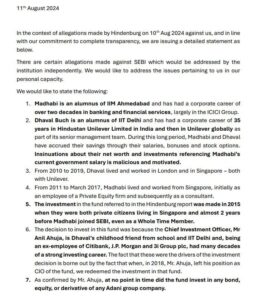

Here is the press statement from Madhabi Puri Buch and Dhaval Buch:

1. Madhabi is a graduate of IIM Ahmedabad with over twenty years of experience in banking and financial services, primarily within the ICICI Group.

2. Dhaval Buch, an IIT Delhi alumnus, has had a distinguished 35-year career at Hindustan Unilever Limited in India and Unilever globally. During their careers, Madhabi and Dhaval have accumulated their savings through their salaries, bonuses, and stock options. Any insinuations regarding their net worth or investments, particularly referencing Madhabi’s current government salary, are unfounded and driven by malice.

3. From 2010 to 2019, Dhaval worked and resided in London and Singapore, both with Unilever.

4. Madhabi lived and worked in Singapore from 2011 to March 2017, first with a Private Equity firm and later as a consultant.

5. The investment in the fund mentioned in the Hindenburg report was made in 2015 while both were private citizens residing in Singapore, nearly two years before Madhabi joined SEBI as a Whole Time Member.

6. The investment decision was influenced by the Chief Investment Officer, Mr. Anil Ahuja, who is Dhaval’s longtime friend from school and IIT Delhi. Mr. Ahuja’s extensive career in investment with Citibank, J.P. Morgan, and 3i Group plc was a significant factor in their decision. This is supported by the fact that the investment was redeemed in 2018 after Mr. Ahuja left his role as CIO.

7. Mr. Ahuja has confirmed that at no time did the fund invest in any bond, equity, or derivative of any Adani group company.

8. Dhaval’s appointment as Senior Advisor to Blackstone Private Equity in 2019 was due to his expertise in Supply Chain management, and this appointment occurred before Madhabi became SEBI Chairperson. This appointment has been publicly known. Dhaval has never been involved with Blackstone’s Real Estate division.

9. Upon his appointment, Blackstone Group was promptly added to Madhabi’s recusal list at SEBI.

10. Over the past two years, SEBI has issued more than 300 circulars, including initiatives for “Ease of Doing Business,” aligning with its developmental mandate. All SEBI regulations are approved by its Board after comprehensive public consultation. Claims suggesting that a few regulations concerning the REIT industry were favors to specific parties are unfounded and malicious.

11. The two consulting companies established by Madhabi during her time in Singapore, one in India and one in Singapore, were made dormant immediately upon her appointment to SEBI. These companies and her shareholding were fully disclosed to SEBI.

12. After retiring from Unilever in 2019, Dhaval began his consultancy practice through these companies, leveraging his expertise in Supply Chain with prominent Indian industry clients. Attempts to link the income from these companies to Madhabi’s current government salary are baseless.

13. The transfer of shareholding in the Singapore entity to Dhaval was disclosed to SEBI, Singapore authorities, and Indian tax authorities.

14. SEBI enforces strict disclosure and recusal norms according to its officers’ code of conduct. All required disclosures and recusals have been meticulously adhered to, including those related to securities.

15. Hindenburg has received a show cause notice for various violations in India. It is regrettable that instead of responding to the notice, they have chosen to undermine SEBI’s credibility and attempt to discredit the SEBI Chairperson.

Dhaval Buch Madhabi Puri Buch Mumbai

August 11, 2024

Update

The Financial Services Commission of Mauritius clarified on Tuesday that the offshore funds named in Hindenburg Research’s August 10, 2024 report are not based in Mauritius.

The FSC stressed that it does not permit shell companies and emphasized that “IPE Plus Fund” and “IPE Plus Fund 1,” mentioned in the report, are neither registered with nor domiciled in Mauritius.

The FSC denied any links between the funds and the country.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment