Analysts’ comments on NVIDIA’s Q2 earnings report, with full details:

BofA (Buy, PT: $165):

“NVIDIA delivered a strong Q2 performance, achieving $30 billion in sales. However, the Q3 outlook, while slightly ahead of consensus, fell short of more optimistic expectations due to the delayed ramp-up of the Blackwell GPU by one quarter. Despite this, we remain confident in NVIDIA’s growth potential, especially as generative AI deployments are still in their early stages. The next generation of AI models will demand significantly more computing power, which positions NVIDIA well for continued growth. We find the current valuation compelling and maintain our Buy rating.”

Piper Sandler (Overweight, PT: $140):

“We see NVIDIA’s recent stock pullback following Q2 results as a buying opportunity. The company’s fundamentals are solid, and although there has been some margin compression, NVIDIA is well-positioned to capitalize on the strong demand for AI, particularly with its Hopper and Blackwell GPUs. We expect gross margins to stabilize, supporting the company’s continued growth trajectory.”

Cantor Fitzgerald (Overweight, PT: $175):

“Despite concerns surrounding the delays in the Blackwell GPU, NVIDIA exceeded its guidance by $2 billion and projected $2.5 billion in quarter-over-quarter growth into Q3. The company expects ‘several billion dollars’ from Blackwell in Q4, which minimizes concerns about the delay. Although gross margin guidance is slightly below Street expectations, it remains in the mid-70s and is expected to improve with higher average selling prices (ASPs) and continued growth. NVIDIA’s AI narrative remains strong, and we view the recent pullback as a buying opportunity.”

JPMorgan (Overweight, PT: $155):

“NVIDIA’s Q2 results surpassed consensus expectations in terms of revenue, gross margins, and earnings per share, though they were slightly below market expectations. The company has guided to an 8% quarter-over-quarter revenue increase for October, driven by robust AI demand and ongoing investments in Hopper H100 and H200 GPUs. Despite a two-month delay in Blackwell GPU shipments due to a mask change, we do not see any impact on the overall revenue profile for calendar years 2024 and 2025, as Hopper’s strong performance offsets the delay. We expect gross margins to improve throughout next year, with NVIDIA maintaining a competitive edge through its aggressive product launch schedule.”

KeyBanc (Overweight, PT: $180):

“NVIDIA’s Q2 results outperformed consensus estimates but did not meet buyside expectations, partly due to the delay in the Blackwell GPU. The company confirmed the delay but mentioned that customer samples have already been shipped, with ‘several’ billion dollars in Blackwell revenue anticipated in Q4. Hopper revenues are expected to grow in the latter half of the year, and although gross margins were guided slightly lower, NVIDIA’s leadership in generative AI remains evident.”

Summit Insights (Buy):

“The gross margin outlook for NVIDIA’s October and January quarters is disappointing due to a mask change on the upcoming Blackwell GPU, creating short-term uncertainty in gross margin and topline performance. However, we expect the transition from Hopper to Blackwell to be resolved by early 2025, with NVIDIA selling off all low-margin existing mask steps in the next two quarters. We anticipate outperformance to reaccelerate in fiscal year 2026.”

Jefferies (Buy, PT: $150):

“While NVIDIA’s Q2 results exceeded expectations, the performance fell short of elevated market expectations. Concerns around the Blackwell delay have now been addressed, and demand for Hopper remains robust. The guidance beat of $32.5 billion was slightly below investor expectations, but the company is on track to generate several billion dollars in Blackwell revenue in Q4. The overall narrative remains intact, and we view the recent pullback as an investment opportunity.”

Citi (Buy, PT: $150):

“NVIDIA’s results demonstrated strong performance, with July quarter sales hitting the high end of expectations and confidence in the Blackwell ramp. Although the gross margin outlook was impacted by product mix, we expect a strong recovery in revenue and margins in Q1 as Blackwell launches. As AI adoption is still in its early stages, we maintain our Buy rating on NVIDIA’s long-term potential.”

Stifel (Buy, PT: $165):

“NVIDIA delivered strong results and guidance, particularly in data center compute platforms. The company addressed concerns about the Blackwell delay, citing a mask change to improve yields, and expects significant revenue contributions starting in the fourth fiscal quarter. While near-term margins may be affected, we believe NVIDIA is well-positioned for future growth and maintain our Buy rating.”

Mizuho (Outperform, PT: $140):

“NVIDIA’s October quarter guidance was strong, driven by Hopper ramps and solid data center growth. Despite a pullback due to a slight miss on expectations, we see continued strength in AI server demand and expect NVIDIA to benefit from the growing need for AI infrastructure. We maintain our Outperform rating and have raised our price target.”

Wells Fargo (Overweight, PT: $165):

“Despite concerns regarding the Blackwell delay, NVIDIA’s overall outlook remains strong, with continued growth expected in the data center and AI segments. We maintain our Overweight rating, confident in the company’s strategic positioning and its product roadmap.”

Bernstein SocGen Group (Outperform, PT: $155):

“NVIDIA continues to deliver impressive results amidst high expectations, with strong growth in the data center segment and several billion dollars of Blackwell revenue anticipated in Q4. Demand for Hopper remains robust, and we expect significant growth next year, driven by a diversified customer base and expanding AI opportunities.”

Oppenheimer (Outperform, PT: $150):

“NVIDIA reported strong results, with data center demand driving the upside. Concerns about the Blackwell delays are minimal, and the company is on track for a production ramp in the fourth fiscal quarter. We see NVIDIA as the best-positioned company in AI, benefiting from its comprehensive hardware and software stack, and we reiterate our Outperform rating.”

Edward Jones (Hold):

“NVIDIA continues to lead the high-performance GPU market, commanding a 90% market share in data center accelerator chips. Management has positioned the company well in the generative AI space, but given the high expectations, it will be challenging to consistently exceed them. We believe the stock already reflects an optimistic growth outlook and is appropriately valued.”

DA Davidson (Neutral, PT: $90):

“NVIDIA reported strong revenue growth, particularly in the data center segment, but we remain cautious due to potential headwinds from the AI infrastructure build-out cycle and the Blackwell delay. While the company is well-positioned, our fiscal year 2025 estimates remain below consensus, and we model a sequential decline in fiscal year 2026. Therefore, we maintain our Neutral rating.”

Goldman Sachs (Conviction Buy, PT: $135):

“Despite lower-than-expected gross margin guidance, NVIDIA’s data center revenue potential remains strong across cloud, consumer internet, and enterprise customers. With a redesign of the Blackwell GPU, management expects several billion dollars in revenue in the fourth fiscal quarter, supported by increasing Hopper revenue. We maintain our Conviction Buy rating, confident in NVIDIA’s positioning in AI and accelerated computing.”

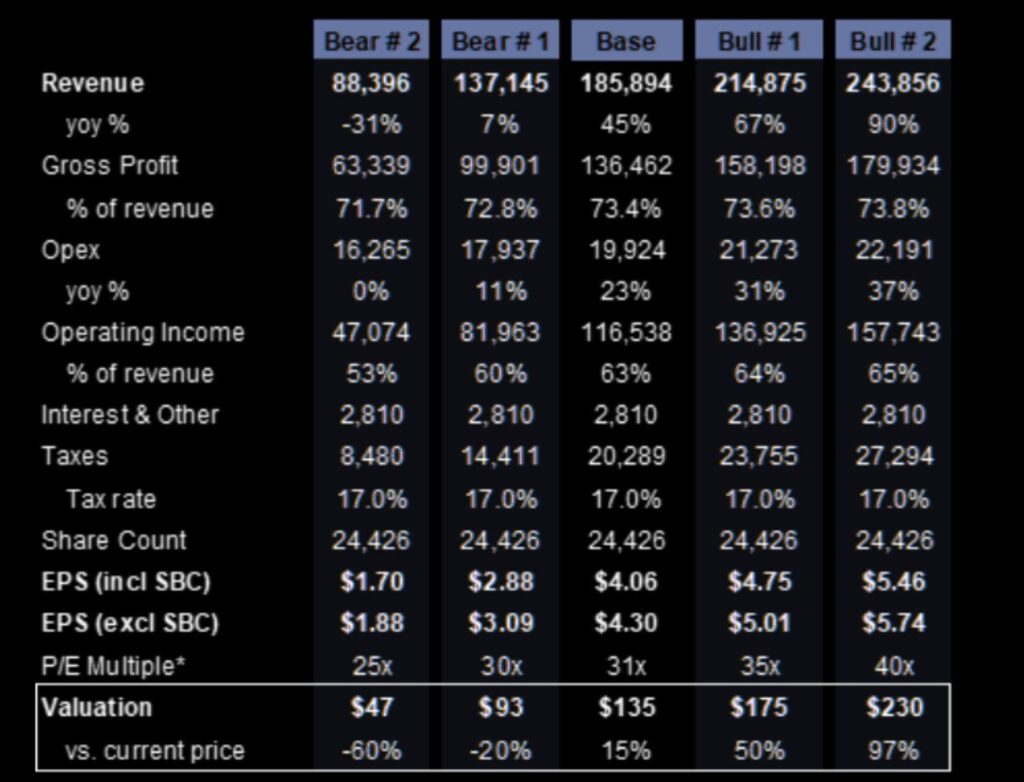

Goldman Sachs presents five different scenarios for Nvidia, suggesting that $NVDA’s valuation could range anywhere from $47 to $230, depending on the direction it takes.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment