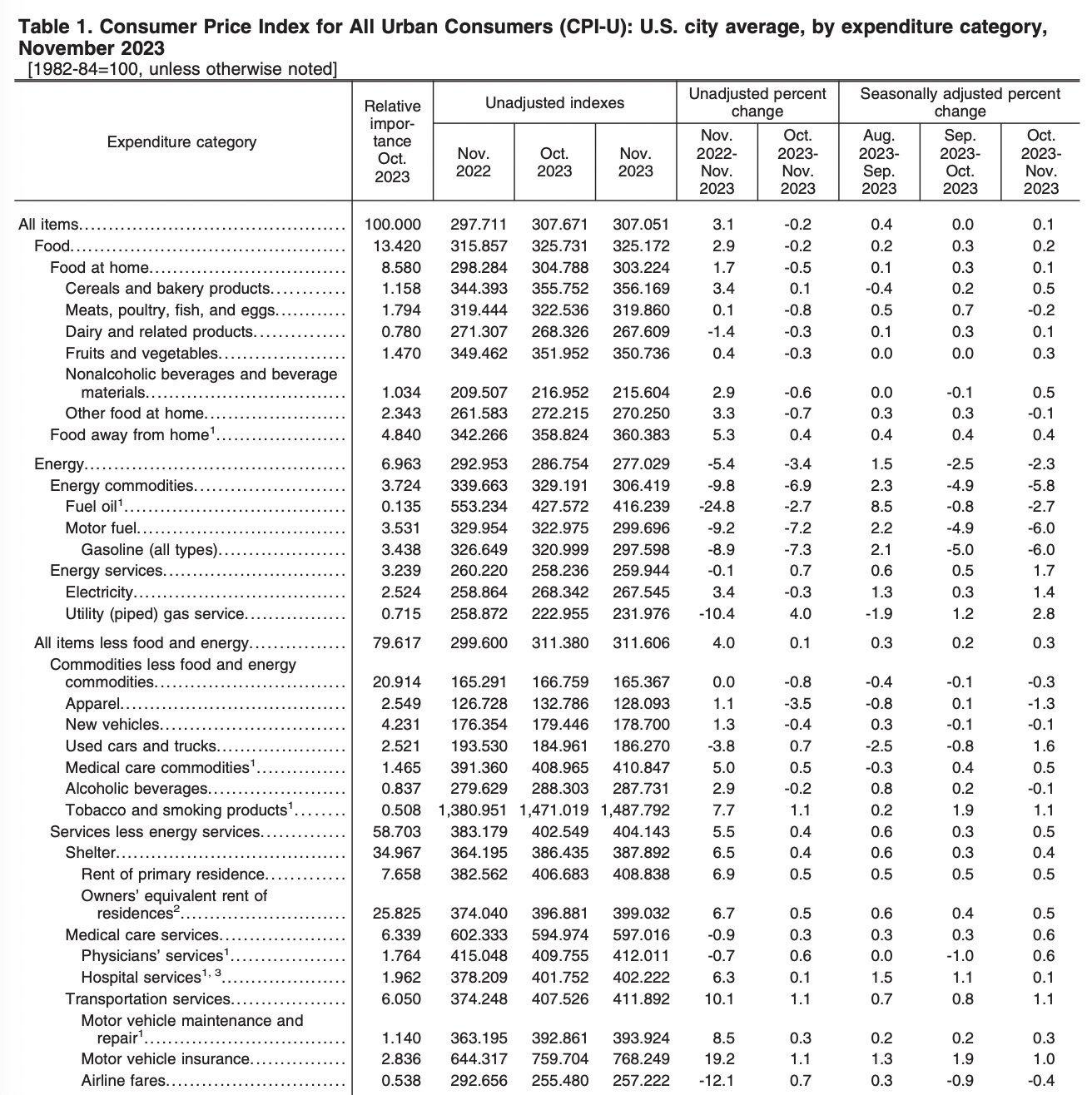

The latest U.S. Consumer Price Index (CPI) report for November revealed a 0.1% increase in prices, surpassing expectations for a flat 0.0% reading. On an annual basis, the headline CPI rose by 3.1%, a slight slowdown from October’s 3.2%. This brings the yearly CPI rate to its lowest level since June.

Breaking it down further, the U.S. core CPI, which excludes volatile food and energy prices, rose by 0.3% on a monthly basis, meeting predictions. The annual rate for headline core CPI remained steady at 4.0%, mirroring October’s figure. Notably, sticky core CPI prices, which represent less volatile elements, may lend support to the Federal Reserve’s commitment to maintaining higher interest rates for an extended period.

Examining inflation by category, rent experienced a substantial 6.9% year-on-year increase, followed by restaurants at 5.3% and personal care at 5.2%. All items considered in the CPI saw a 3.1% uptick annually. On the flip side, certain categories saw a decrease in prices, with used vehicles leading the decline at -3.8%, followed by gas at -8.9% and airline fares at -12.1%.

Following the release of the CPI report, futures tied to short-term U.S. interest rates have seen an increase. However, the impact on U.S. stock futures has been mixed, with S&P 500 futures showing a 0.05% decline, Nasdaq futures slightly rising by 0.04%, and Dow futures edging up by 0.07%.

Despite the overall CPI inflation being at 3.1%, specific essential expenses show significantly higher increases:

1. Car Insurance Inflation: 19.2%

2. Transportation Inflation: 10.1%

3. Car Repair Inflation: 8.5%

4. Rent Inflation: 6.9%

5. Homeowner Inflation: 6.7%

6. Food Away From Home Inflation: 5.3%

7. Electricity Inflation: 3.4%

Used car and truck prices rose by +1.6% in November, marking the first monthly increase since May 2023. It’s important to note that while the overall inflation rate has decreased, prices are still on the rise, and we are experiencing disinflation rather than deflation.

Yellen, the US Treasury Secretary, states that the US economy is headed for a soft landing and expresses confidence that inflation will align with the Federal Reserve’s target.

In summary, although the inflation rate is on a downward trend, it remains uncertain whether it will reach the Federal Reserve’s target of 2% in the near future. Despite the slowdown, the challenge of managing inflation persists for the Fed, particularly with the resilience of sticky core prices, indicating that the battle to stabilize prices is ongoing.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment