• Moody’s Investors Service recently downgraded the long-term issuer rating of New York Community Bancorp (NYCB) to B3 and also downgraded Flagstar Bancorp’s subordinated debt rating to B3 from BA2. This decision by Moody’s was prompted by concerns regarding heightened risks to the creditworthiness of these banks. These concerns stem from the recent financial filings made by the banks, indicating potential challenges in meeting their financial obligations. Additionally, there are worries about increased provisions for credit losses and higher funding costs due to persistent elevated interest rates.

• The impact of this downgrade on NYCB has been substantial, with the bank’s market value plummeting by more than 50% over several trading sessions following a surprising fourth-quarter loss. In response to these challenges, NYCB has taken decisive steps to stabilize its operations. One such measure is the promotion of Alessandro DiNello to the position of executive chairman, effective immediately. DiNello, who previously served as the CEO of Flagstar Bank, was brought onboard NYCB following the acquisition of Flagstar Bank in late 2022.

• Moody’s downgrade has reignited concerns within the financial sector, particularly regarding the vulnerability of small and medium-sized banks to declining profitability and potential losses on real estate assets. However, NYCB’s proactive approach in addressing management concerns emerging from its recent earnings report may help alleviate some of these apprehensions.

• In conclusion, Moody’s downgrade of NYCB’s long-term issuer rating and Flagstar Bancorp’s subordinated debt rating reflects apprehensions regarding the heightened risks to their creditworthiness. The concerns include the possibility of increased credit loss provisions and higher funding costs due to persistent high-interest rates. Nevertheless, NYCB’s efforts to stabilize operations and address management concerns could offer some reassurance and mitigate future risks.

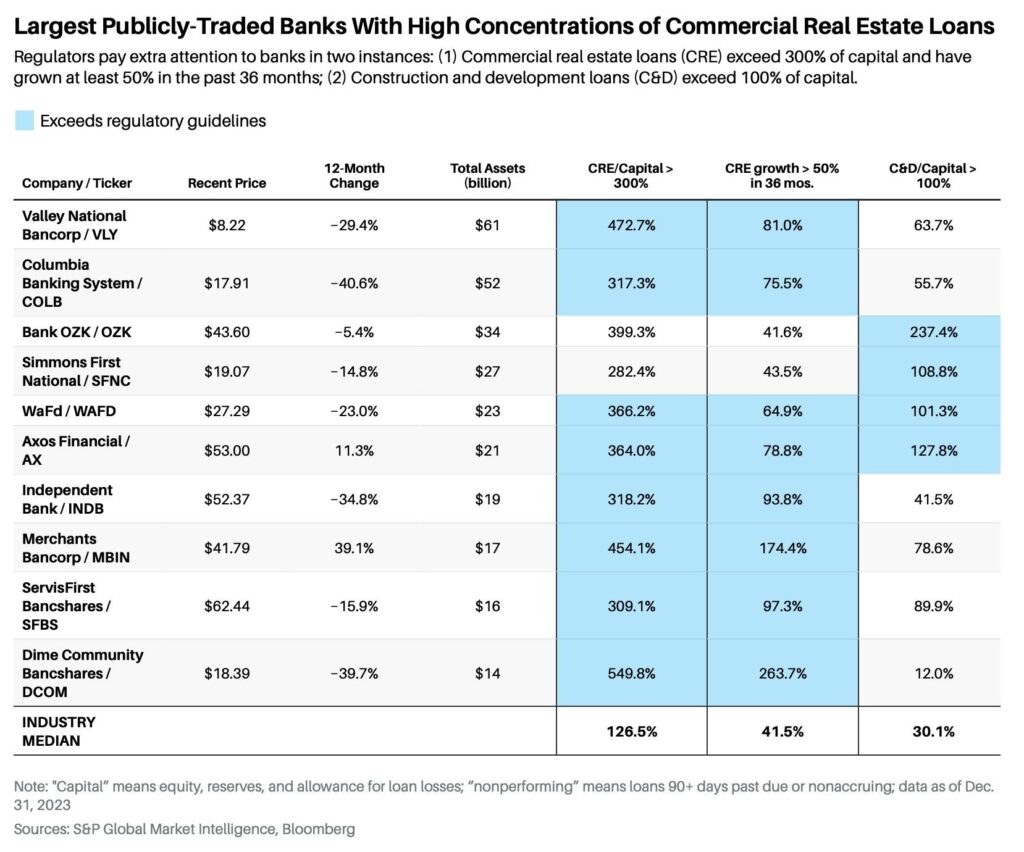

However, Barrons and Bloomberg highlight 10 banks that face exposure in the event of a Commercial Real Estate Market downturn.: $VLY, $COLB, $OZK, $SFNC, $WAFD, $AX, $INDB, $MBIN, $SFBS, $DCOM.

Jamie Dimon issues a warning about the impact of rising rates during a recession on real estate.

According to the Mortgage Bankers Association, $929 billion out of the $4.7 trillion outstanding commercial mortgages will mature this year.

Commercial real estate has experienced a significant decline of over 40%.

The average reserves at major banks including JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs, and Morgan Stanley have decreased from $1.60 to 90 cents for every dollar of commercial real estate debt for borrowers at least 30 days late, reports FT.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment