Volatility index, $VIX, experienced a significant surge of 23% this week. This marks the largest weekly jump since September 2023, showcasing heightened market volatility. Additionally, the $VIX reached its highest weekly close since November 2023, indicating increased uncertainty and risk in the market.

On the other hand, the Dow Jones Industrial Average faced its most challenging week in 2024 thus far, reflecting the broader market’s struggles.

As we look ahead, the upcoming week holds critical inflation data releases, including the Consumer Price Index (CPI) and the Producer Price Index (PPI). If the CPI inflation rate rises for a third consecutive month, it would signal a continued upward trend in inflation, potentially impacting both the market’s performance and the Federal Reserve’s monetary policy decisions.

Bond Market

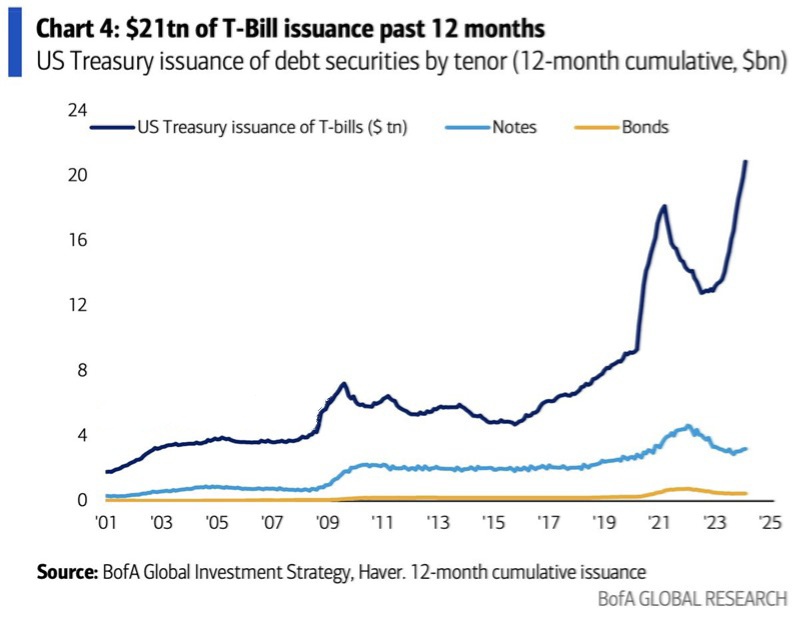

Over the last 12 months, the US Treasury issued an unprecedented $21 trillion in Treasury Bills (T-Bills).

In 2023, the government set a new record by selling $23 trillion worth of Treasury securities.

The Treasury market has expanded by over 60% since the end of 2019, reaching a total value of $27 trillion.

Compared to its size before the 2008 financial crisis, the Treasury market is now approximately six times larger.

The US national debt is currently growing at a rate of $1 trillion every 100 days.

Interest Rates

US financial conditions have returned to levels experienced before the implementation of rate hikes.

Despite the absence of rate cuts, financial conditions have loosened considerably in recent months.

The easing of financial conditions accelerated following the Fed’s pivot in December.

The resurgence of inflation data, including CPI, PPI, and PCE, can be partially attributed to the easing of financial conditions.

The trend indicates a potential shift towards higher interest rates for an extended period.

Update

The two-year U.S. Treasury yield climbs to 4.761%, marking its highest level in four months. The spread between the two-year and ten-year Treasury yields tightens to 350 basis points, with a target of 4.5% for the ten-year yield.

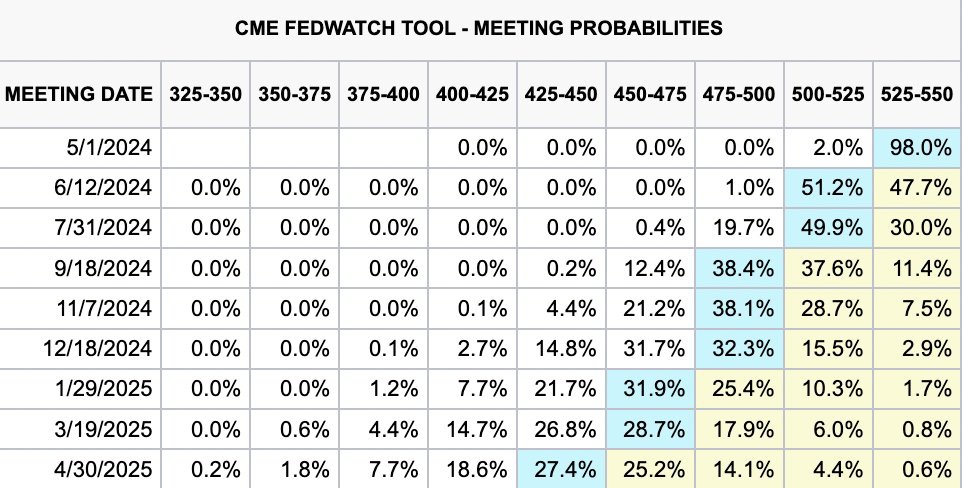

As per the latest data from CME FedWatch, there is a 2.9% likelihood that Jerome Powell and the US Federal Reserve will not implement any rate cuts this year.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment