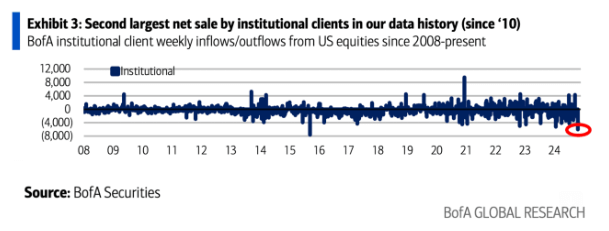

Institutional investors just pulled around $6 billion out of U.S. stocks, making it the biggest sell-off since 2015 and the second-largest in the past 15 years, according to Bank of America. When major investors pull this much money out, it usually means they’re feeling a bit cautious.

This recent $6 billion pullback is about 50% bigger than the $4 billion of fresh money that flowed in just a few weeks ago. That big inflow showed real confidence, but the quick switch from buying to selling suggests that these big players might now feel it’s a good time to take their profits and step back.

One reason for this could be the market’s impressive performance this year. The S&P 500, which tracks major U.S. stocks, is up about 20% this year and around 40% over the last 12 months, which is four times the usual annual return. With gains this strong, investors might be locking in profits, uncertain if the market can keep climbing at such a rapid pace.

In short, after a big year, professional investors seem to be cashing in, possibly to prepare for market ups and downs or just to play it safe. This cautious move from big investors could have an impact on the market in the months ahead.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment