Retail Investors Face First Major Market Decline

India’s stock market has suffered a massive $1.2 trillion loss, causing concern among retail investors. These investors had been a strong force in supporting the market, even as foreign funds were flowing out. However, their confidence is now being tested as they experience their first prolonged downturn.

Mutual Fund Investments Drop by 30%

One of the key signs of investor hesitation is the decline in mutual fund inflows. Investments in equity mutual fund schemes fell to Rs 293 billion ($3.4 billion) last month, marking the lowest level since April 2024. This represents a 30% drop from October’s record high, according to data from the Association of Mutual Funds in India (AMFI).

Slowdown in New Investor Participation

Another indicator of weakening investor sentiment is the drop in new trading account openings. In February, only 2.3 million new accounts were added, significantly lower than the 4.5 million recorded in July, as per data from Motilal Oswal Financial Services Ltd.

What This Means for the Market

Retail investors were a major driving force behind India’s post-pandemic stock market boom. Their reduced participation suggests a shift in market dynamics, raising concerns about how long this downturn might last. If this trend continues, the stock market could face even more pressure in the coming months.

Retail Investors Boost Market Activity, But Big Players Stay Cautious

On Thursday, the total trading value in the stock market’s cash segment crossed ₹1.1 trillion, marking the highest level in more than a month—except for the day the Union Budget was presented.

Stockbrokers say this rise indicates that retail investors are gaining confidence. However, larger investors remain cautious. Data from the NSE reveals that margin trading, where investors borrow funds to trade, is still around ₹680 billion. This suggests that wealthy traders are holding back, waiting for clearer signals before making bigger moves in the ongoing market surge.

Retail Trading Slows Across India, Jaipur and Ahmedabad See Biggest Drop

In January 2025, retail trading activity dropped across India’s main stock market hubs. Despite the decline, Mumbai led with a turnover of ₹1.7 lakh crore (11.4% share), followed by Delhi at ₹1.5 lakh crore (10.1%). Bengaluru and Ahmedabad recorded ₹0.6 lakh crore (3.8%) and ₹0.5 lakh crore (3.5%), respectively. All major cities saw a dip, with Jaipur (-19.4%) and Ahmedabad (-12.3%) experiencing the biggest drops.

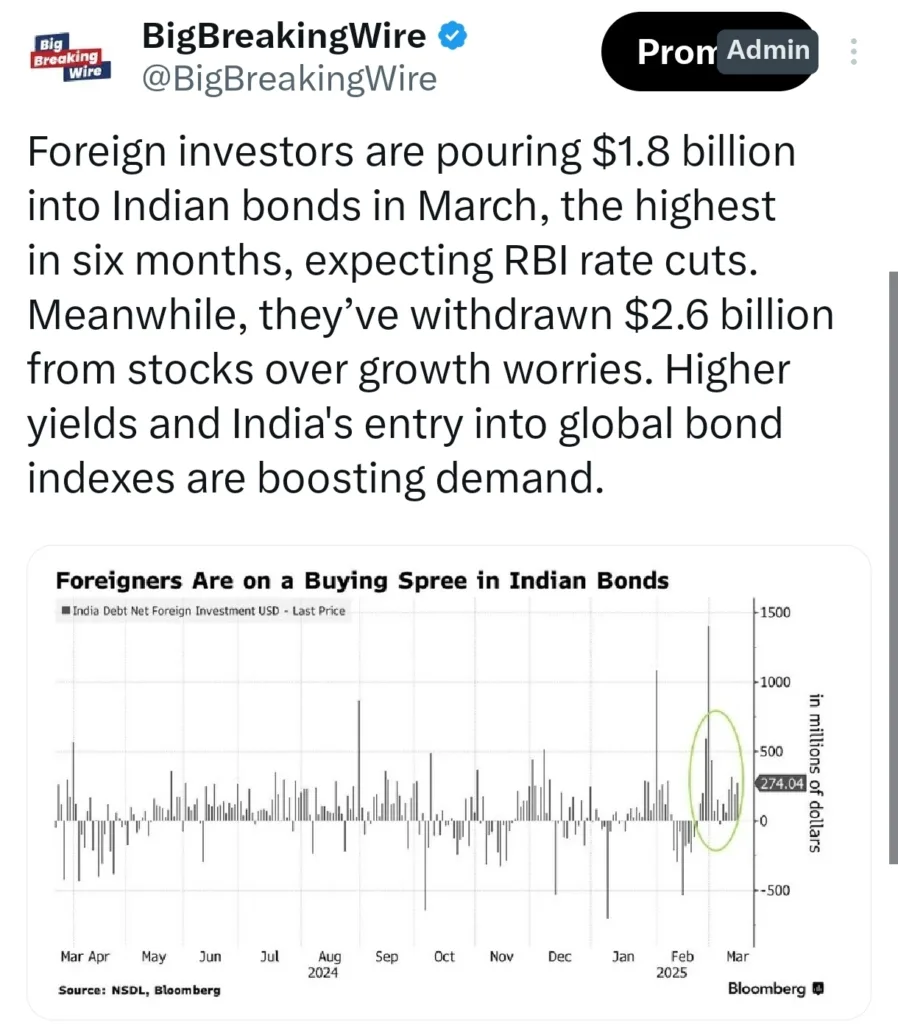

Foreign Investors Shift to Indian Bonds, Pull $2.6B from Stocks

Foreign investors have invested $1.8 billion in Indian bonds in March, the highest in six months, driven by expectations of RBI rate cuts. Higher yields and India’s inclusion in global bond indexes have further boosted demand for Indian debt.At the same time, foreign investors have withdrawn $2.6 billion from Indian stocks due to growth concerns and market uncertainty. This shift highlights a preference for fixed-income securities over equities as investors seek stability amid economic uncertainties.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment