The Reserve Bank of India (RBI) released the latest balance of payments (BoP) data for the first quarter of FY26 (April–June 2025). The report shows that India’s current account balance slipped into a deficit of $2.4 billion, equal to 0.2% of GDP. This marks a reversal from the surplus seen in the previous quarter.

Quarterly Comparison

- Q1 FY26 (April–June 2025): $2.4 billion deficit (0.2% of GDP)

- Q4 FY25 (January–March 2025): $13.5 billion surplus (1.3% of GDP)

- Q1 FY25 (April–June 2024): $8.6 billion deficit (0.9% of GDP)

For the full financial year FY25, India posted a current account deficit of $23.3 billion (0.6% of GDP). This was an improvement from the $26 billion deficit (0.7% of GDP) in FY24, mainly due to strong services exports.

Merchandise Trade Performance

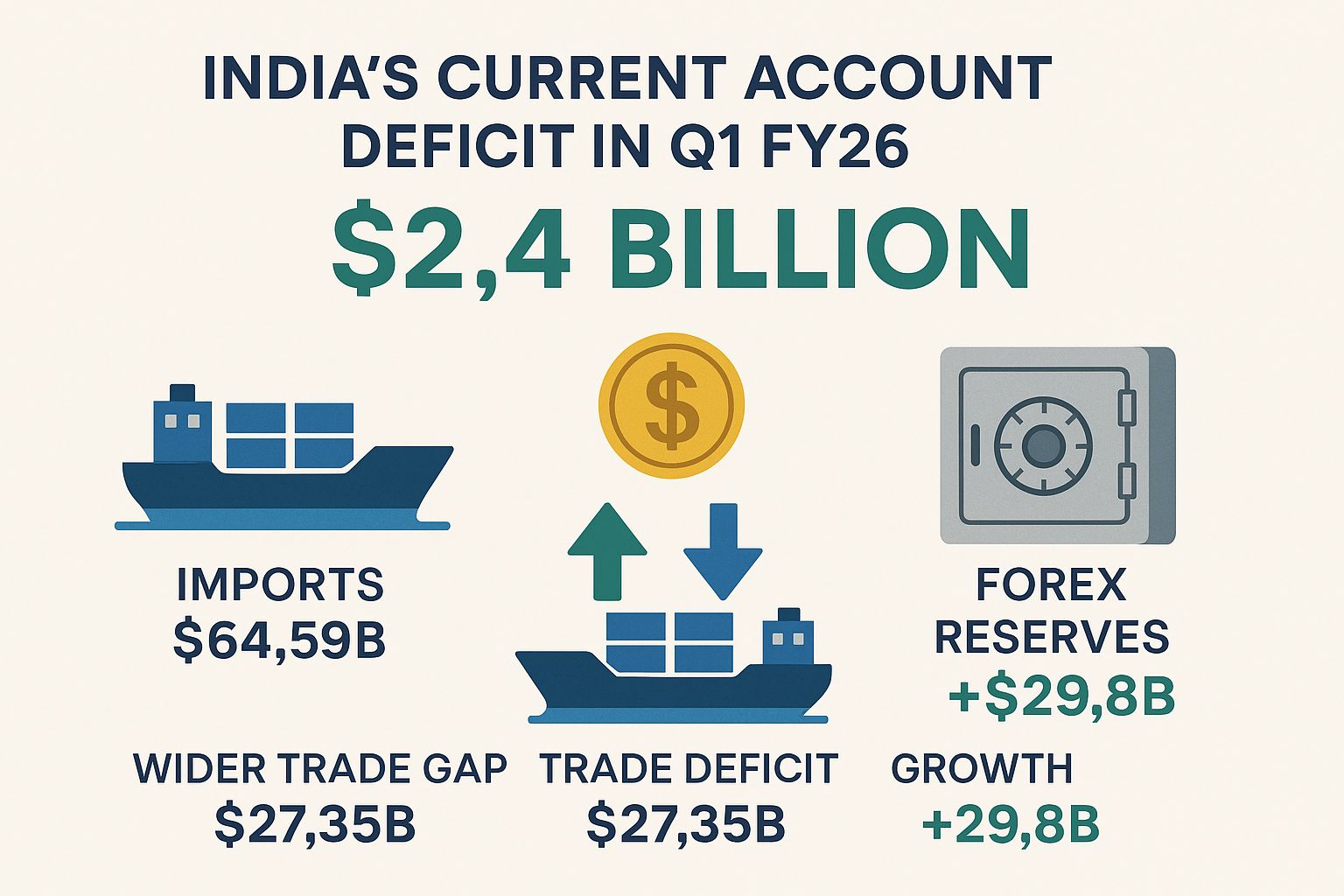

The main reason for the deficit was the wider merchandise trade gap. India’s trade deficit widened to $27.35 billion in July 2025, higher than both $20.35 billion expected by economists and $18.78 billion in June 2025.

The gap was driven by:

- Imports: Rose 8.6% to $64.59 billion

- Exports: Increased 7.3% to $37.24 billion

Capital Flows Support

Despite the current account deficit, capital inflows remained supportive.

According to RBI’s data:

- Foreign Direct Investment (FDI): $5.7 billion (down from $6.2 billion a year ago)

- Portfolio Investment: $1.6 billion (up from $0.9 billion a year ago)

Foreign Exchange Reserves

RBI also reported that foreign exchange reserves increased by $4.5 billion during April–June 2025 on a balance of payments basis. Including valuation effects, reserves grew by a much higher $29.8 billion,

reflecting currency movements and gold price changes.

Key Takeaways

- India moved from a surplus in Jan–Mar 2025 to a deficit in Apr–Jun 2025.

- The merchandise trade deficit remains the biggest challenge.

- Strong services exports and steady capital inflows provided some cushion.

- Foreign exchange reserves continue to rise, aided by valuation gains.

Conclusion

India’s current account deficit in Q1 FY26 highlights the pressure of a widening trade gap even as services exports and capital flows remain resilient. The RBI data shows that while the deficit has narrowed compared to last year, external balances will continue to depend on global trade dynamics, commodity prices, and investment flows.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment