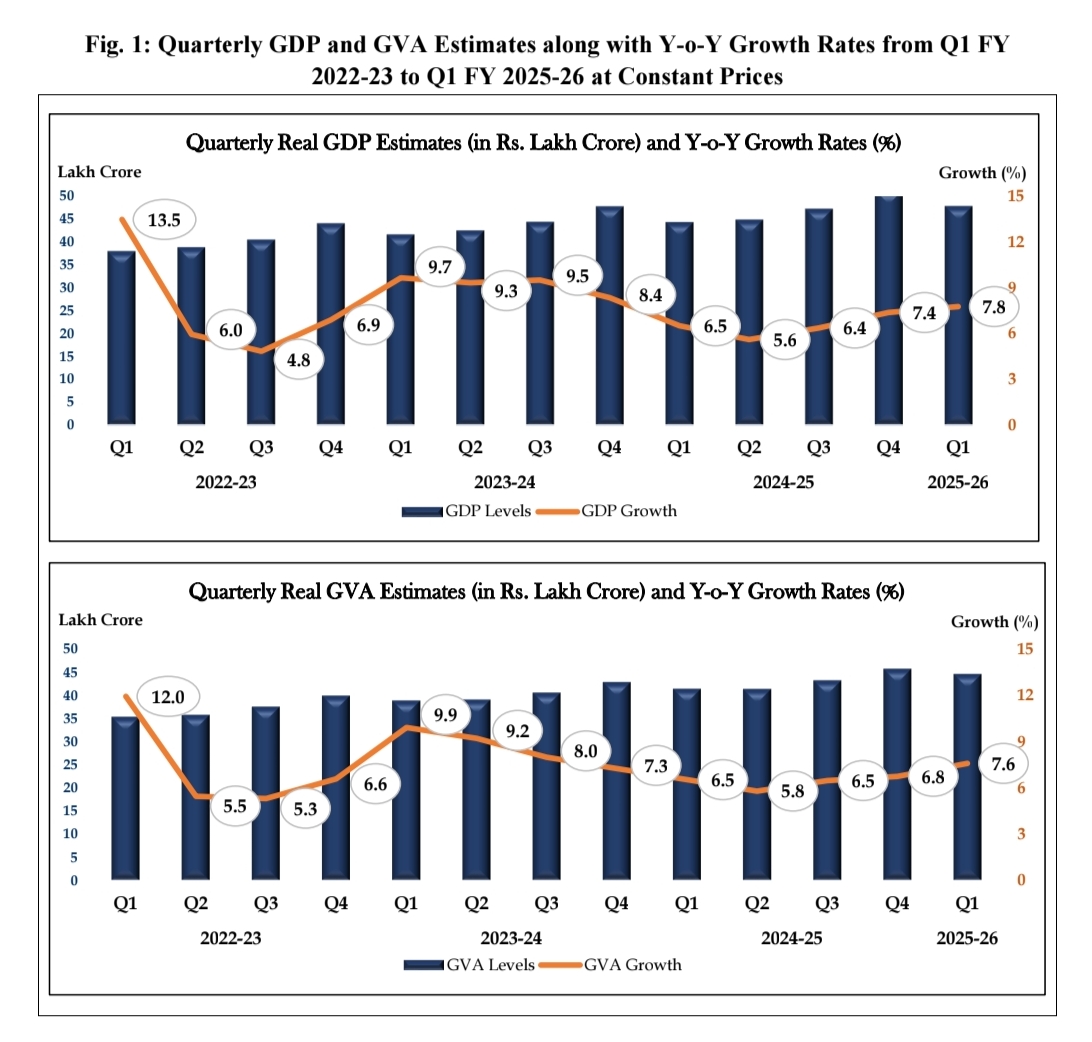

India’s economy witnessed a strong performance in the first quarter (Q1) of FY 2025-26, with a solid 7.8% year-on-year GDP growth, beating expectations of 6.6% and surpassing the previous quarter’s 7.4%. This growth is the highest recorded in the last five quarters, driven by multiple key sectors.

GDP and GVA Growth in Rs

The real GDP at constant prices stood at Rs 47.89 lakh crore in Q1 FY 2025-26, up from Rs 44.42 lakh crore in the same quarter last year. The nominal GDP or GDP at current prices rose to Rs 86.05 lakh crore, an 8.8% increase compared to Rs 79.08 lakh crore a year ago.

Real Gross Value Added (GVA) was Rs 44.64 lakh crore, growing 7.6% from Rs 41.47 lakh crore last year. The nominal GVA reached Rs 78.25 lakh crore, up 8.8% from Rs 71.95 lakh crore.

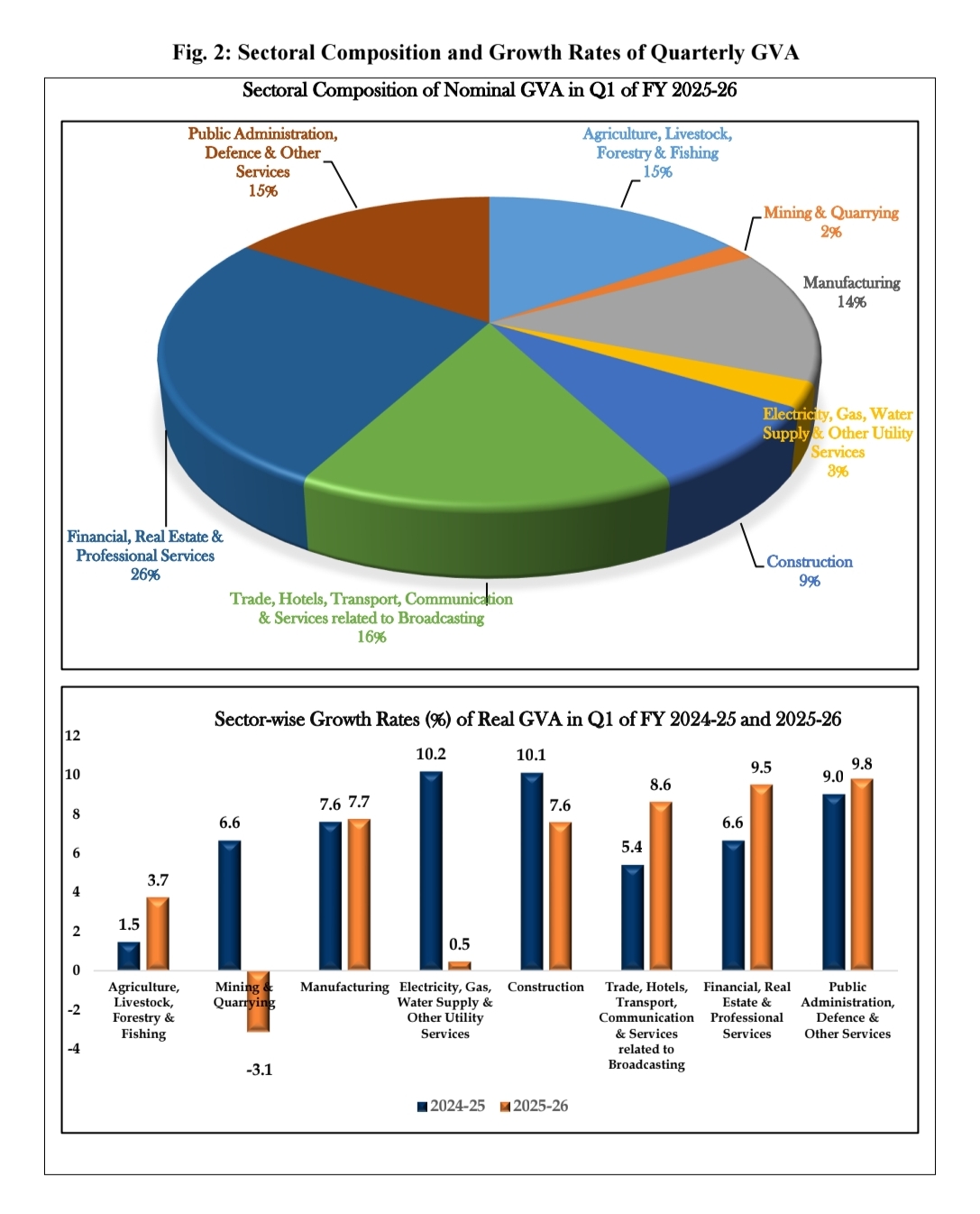

Sector-Wise Growth (Real GVA)

- Services Sector: Led expansion with a 9.3% growth, up from 6.8% the previous year.

- Manufacturing: Increased by 7.7%, slightly higher than last year’s 7.6%.

- Construction: Registered 7.6%, compared to 10.1% last year, showing ongoing strength.

- Agriculture and Allied: Rose to 3.7% from 1.5%, reflecting a good monsoon and recovery.

- Mining & Quarrying: Declined by 3.1%, compared to a 6.6% growth in the previous year.

- Electricity, Gas, Water & Utilities: Grew marginally by 0.5%.

Consumption and Investment

Private Final Consumption Expenditure grew by 7.0%, slightly lower than 8.3% last year, signaling cautious household spending.

Government Final Consumption Expenditure bounced back strongly with a 7.4% increase in real terms, reversing the previous year’s contraction.

Gross Fixed Capital Formation, an indicator of investment, also improved to 7.8%, up from 6.7%, reflecting growing confidence in fixed asset investments.

Key Implications

The growth boost in Q1 was supported by a weak inflation deflator, increased government spending on infrastructure, and robust services sector performance. However, the recently imposed 50% tariff on certain US imports may impact exports and demand in the coming quarters. Continued GST relief and softer prices are expected to support growth into 2026.

Conclusion

At Rs 47.89 lakh crore real GDP and Rs 86.05 lakh crore nominal GDP, India’s economy began FY 2025-26 on a strong footing. With broad-based sector growth and rising investments, India remains among the fastest growing large economies globally.

India CEA on Economic Risks from U.S. Tariffs

India’s Chief Economic Adviser (CEA) has highlighted that near-term economic activity faces risks due to uncertainties surrounding U.S. tariffs. Ongoing discussions with the U.S. aim to resolve these tariff issues. The CEA also cautioned that manufacturing growth could face a negative shock in the July–September quarter if the tariff situation persists. However, the CEA added that any additional tariff imposed by the U.S. on India could be short-lived.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

One Comment