India’s real Gross Domestic Product (GDP) is expected to grow at a four-year low pace of 6.4% in the financial year 2024-25, down from 8.2% in 2023-24, according to the National Statistics Office (NSO). The first advance estimates suggest a challenging economic landscape, with key sectors witnessing significant slowdowns.

The economy, which grew 6% in the first half of the financial year, is expected to rebound to 6.8% growth in the second half. However, this recovery may not be enough to bring the GDP growth back to the 7%-plus levels recorded in previous years.

Sectoral Performance and Investment Concerns

The manufacturing sector’s Gross Value Added (GVA) growth is expected to nearly halve, dropping from 9.9% in 2023-24 to 5.3% in FY25. Similarly, the mining and quarrying sector is projected to grow at just 2.9%, a sharp decline from the 7.1% growth recorded last year.

One of the key concerns is the slowdown in gross fixed capital formation (GFCF), an indicator of fresh investments in the economy. GFCF is estimated to grow at 6.4% this year, down from 9% in 2023-24, raising worries about long-term economic momentum.

The real GVA for the overall economy is expected to rise by 6.4%, compared to 7.2% in the previous year. Of the eight major economic sectors, only two are expected to show improved growth:

– Agriculture: Projected to grow by 3.8%, recovering from last year’s 1.4%.

– Public Administration, Defence, and Other Services: Expected to grow by 9.1%, up from 7.8% in 2023-24.

Economic Indicators

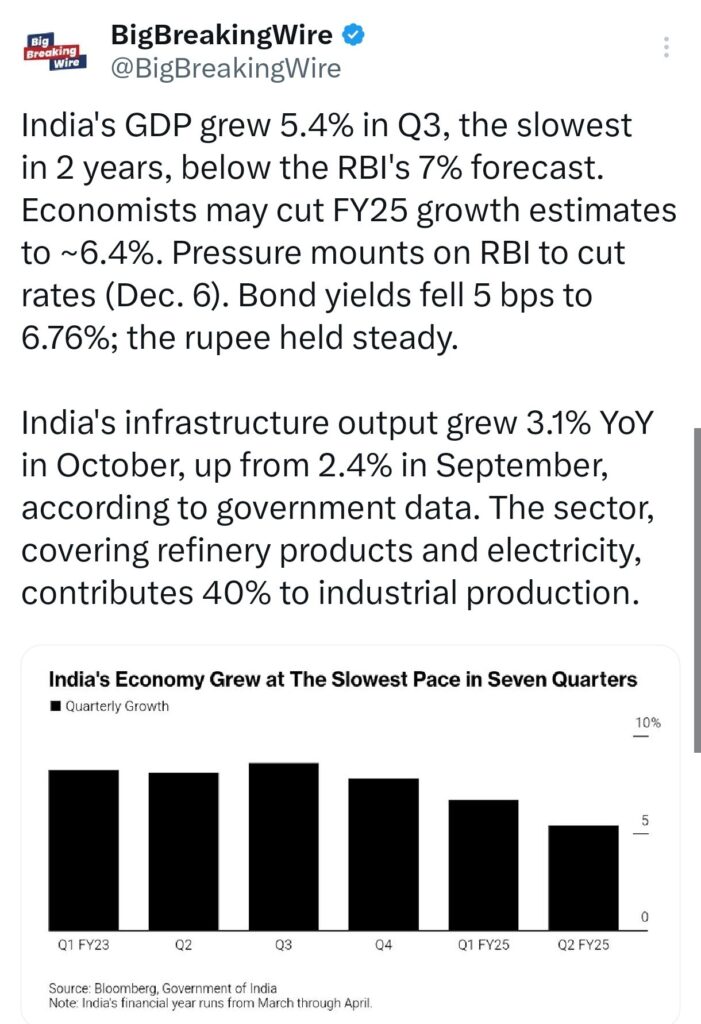

The NSO estimates that the real GDP, or GDP at constant prices, will reach ₹184.88 lakh crore in FY25, up from ₹173.82 lakh crore in FY24. However, the growth trajectory remains uneven, with GDP growth hitting a seven-quarter low of 5.4% in the July-September 2024 quarter.

In response, the Reserve Bank of India revised its full-year growth projection from 7.2% to 6.6%, while the Finance Ministry adjusted its expectation to around 6.5%.

Policy Challenges Ahead

The NSO’s GDP estimates are crucial for framing the Union Budget for 2025-26, set to be presented on February 1. The primary challenge will be reviving the economy’s growth engines to achieve the 7%-plus growth seen in preceding years.

To address this, policymakers may need to focus on:

1. Stimulating Investments: Measures to boost private and public sector investments.

2. Strengthening Consumer Demand: Addressing inflationary pressures to restore household spending.

3. Sectoral Support: Providing targeted support for lagging sectors like manufacturing and mining.

India’s Q3 GDP Growth Slows, Pressure on RBI

India’s GDP grew by 5.4% in Q3, marking the slowest pace in two years and falling short of the Reserve Bank of India’s (RBI) 7% forecast. As a result, economists are likely to revise their FY25 growth projections down to around 6.4%. The slowdown has increased pressure on the RBI to consider cutting interest rates, with the bond yields falling by 5 basis points to 6.76% and the rupee remaining steady. In October, India’s infrastructure output rose 3.1% year-on-year, up from 2.4% in September. The sector, which includes refinery products and electricity, accounts for 40% of industrial production.

The Road Forward

India’s economic narrative for FY25 underscores the need for strategic planning and policy interventions. While growth has slowed, the economy is expected to stabilize in the latter half of the fiscal year. The upcoming Union Budget will play a critical role in setting the tone for recovery and addressing the challenges posed by slower growth.

Despite the hurdles, India’s economy retains its resilience, and with the right measures, it can navigate the current challenges and move toward sustained growth in the coming years.

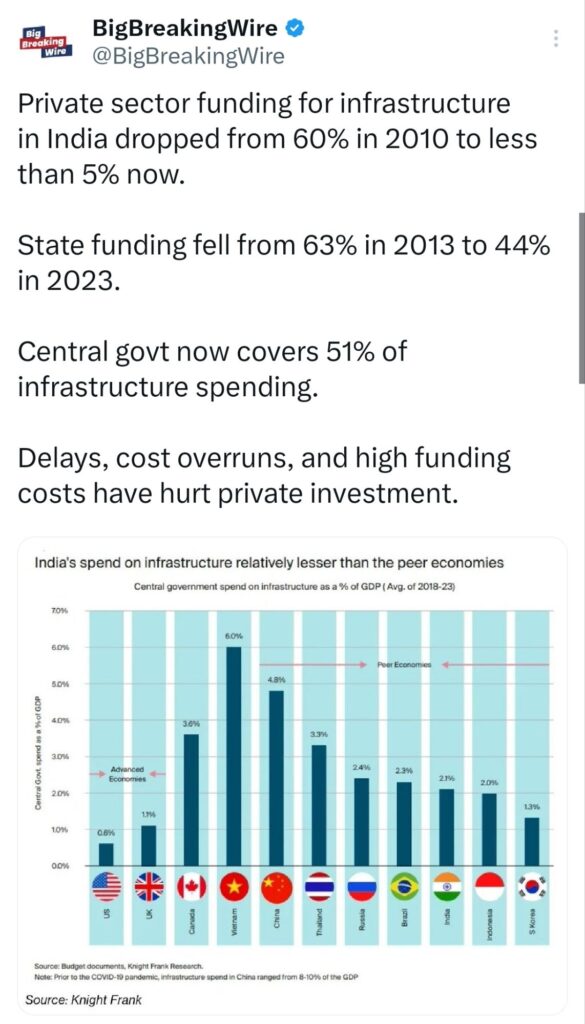

India’s Infrastructure Funding Shifts Dramatically

Private sector funding for infrastructure in India has significantly declined, dropping from 60% in 2010 to less than 5% in recent years. Similarly, state government contributions have decreased from 63% in 2013 to 44% by 2023. In contrast, the central government now shoulders the majority of infrastructure spending, accounting for 51% of the total. This shift is largely attributed to delays, cost overruns, and high funding costs, which have discouraged private investment in the sector.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment